CyberTech Systems and Software (NSE:CYBERTECH) Has Affirmed Its Dividend Of ₹2.00

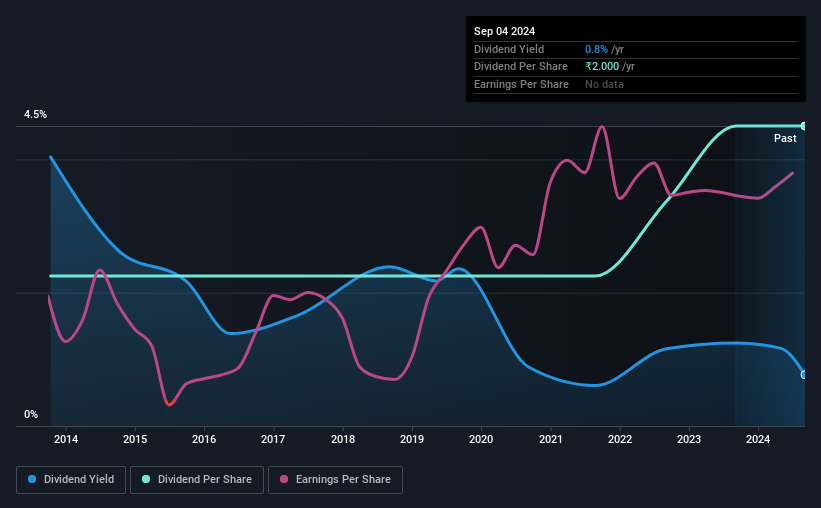

CyberTech Systems and Software Limited's (NSE:CYBERTECH) investors are due to receive a payment of ₹2.00 per share on 21st of October. Including this payment, the dividend yield on the stock will be 0.8%, which is a modest boost for shareholders' returns.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that CyberTech Systems and Software's stock price has increased by 81% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

See our latest analysis for CyberTech Systems and Software

CyberTech Systems and Software's Payment Has Solid Earnings Coverage

Even a low dividend yield can be attractive if it is sustained for years on end. Before making this announcement, CyberTech Systems and Software was easily earning enough to cover the dividend. This means that most of its earnings are being retained to grow the business.

Over the next year, EPS could expand by 11.3% if recent trends continue. If the dividend continues on this path, the payout ratio could be 24% by next year, which we think can be pretty sustainable going forward.

CyberTech Systems and Software Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. The annual payment during the last 10 years was ₹1.00 in 2014, and the most recent fiscal year payment was ₹2.00. This works out to be a compound annual growth rate (CAGR) of approximately 7.2% a year over that time. Dividends have grown at a reasonable rate over this period, and without any major cuts in the payment over time, we think this is an attractive combination as it provides a nice boost to shareholder returns.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. CyberTech Systems and Software has seen EPS rising for the last five years, at 11% per annum. CyberTech Systems and Software definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio.

We Really Like CyberTech Systems and Software's Dividend

In summary, it is good to see that the dividend is staying consistent, and we don't think there is any reason to suspect this might change over the medium term. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All of these factors considered, we think this has solid potential as a dividend stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 4 warning signs for CyberTech Systems and Software that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CYBERTECH

CyberTech Systems and Software

Provides geospatial, networking, and enterprise information technology solutions in India and the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

The Green Consolidator

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion