- India

- /

- Semiconductors

- /

- NSEI:WEBELSOLAR

Websol Energy System Limited's (NSE:WEBELSOLAR) 30% Share Price Surge Not Quite Adding Up

Websol Energy System Limited (NSE:WEBELSOLAR) shares have continued their recent momentum with a 30% gain in the last month alone. The last 30 days were the cherry on top of the stock's 604% gain in the last year, which is nothing short of spectacular.

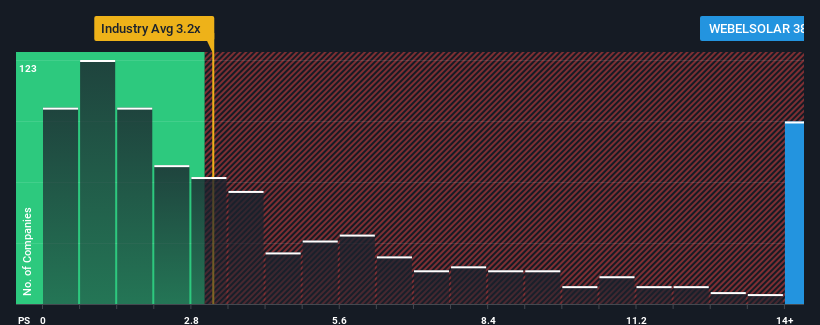

Following the firm bounce in price, Websol Energy System may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 38.7x, when you consider almost half of the companies in the Semiconductor industry in India have P/S ratios under 11.2x and even P/S lower than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Websol Energy System

What Does Websol Energy System's Recent Performance Look Like?

Websol Energy System certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Websol Energy System will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Websol Energy System?

The only time you'd be truly comfortable seeing a P/S as steep as Websol Energy System's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 23% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 31% shows it's an unpleasant look.

With this in mind, we find it worrying that Websol Energy System's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Websol Energy System's P/S

The strong share price surge has lead to Websol Energy System's P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Websol Energy System currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Websol Energy System (1 can't be ignored!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Websol Energy System might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:WEBELSOLAR

Websol Energy System

Manufactures and sells solar photovoltaic (PV) cells and modules in India.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives