- India

- /

- Semiconductors

- /

- NSEI:PREMIERENE

Does Premier Energies (NSE:PREMIERENE) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Premier Energies (NSE:PREMIERENE). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Fast Is Premier Energies Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's easy to see why many investors focus in on EPS growth. In impressive fashion, Premier Energies' EPS grew from ₹11.92 to ₹23.11, over the previous 12 months. Year on year growth of 94% is certainly a sight to behold. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Premier Energies shareholders is that EBIT margins have grown from 15% to 21% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

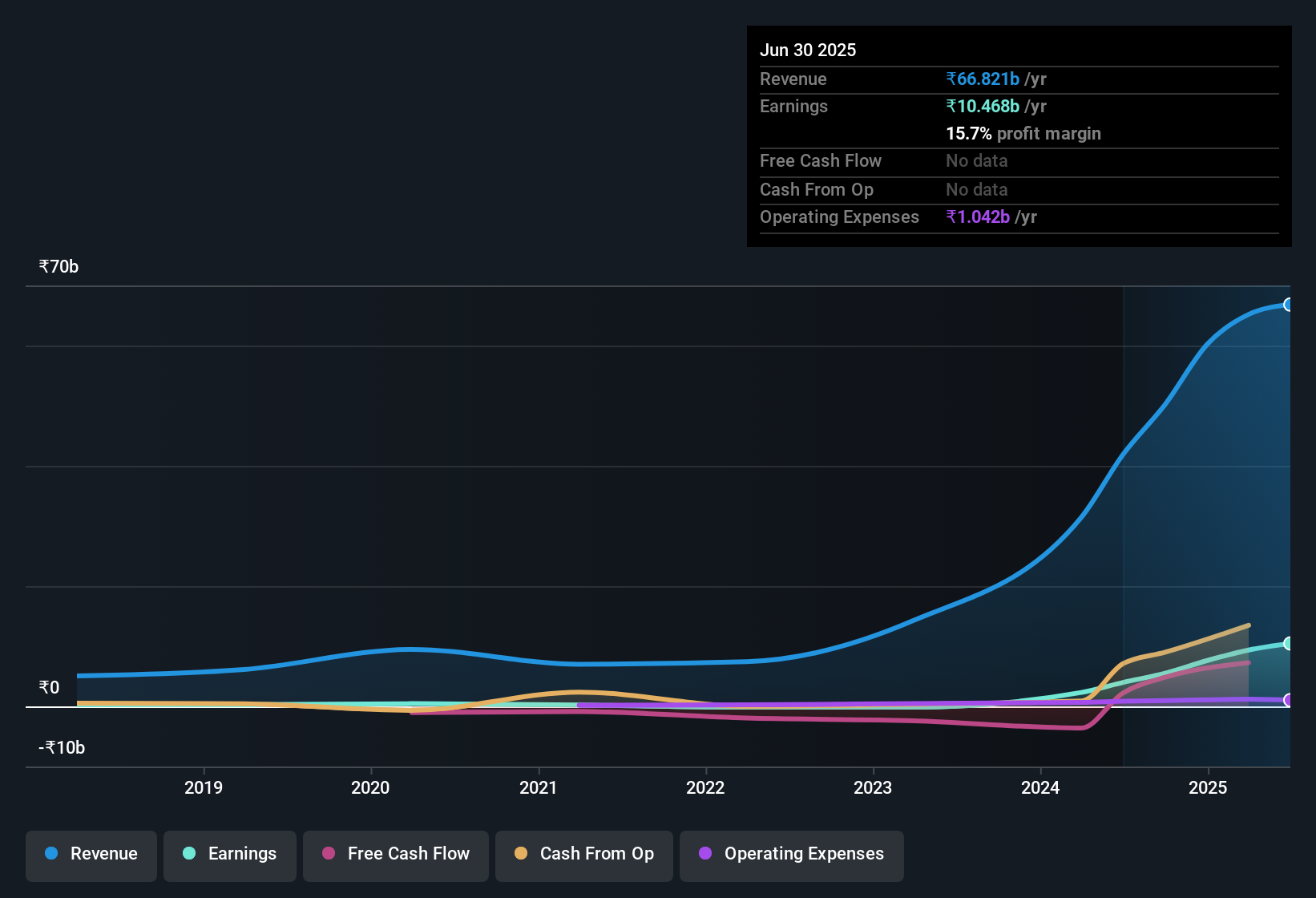

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

View our latest analysis for Premier Energies

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Premier Energies?

Are Premier Energies Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So those who are interested in Premier Energies will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Indeed, with a collective holding of 68%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. This insider holding amounts to This is an incredible endorsement from them.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. A brief analysis of the CEO compensation suggests they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Premier Energies with market caps between ₹353b and ₹1.1t is about ₹75m.

Premier Energies' CEO took home a total compensation package of ₹20m in the year prior to March 2025. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Premier Energies To Your Watchlist?

Premier Energies' earnings have taken off in quite an impressive fashion. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The sharp increase in earnings could signal good business momentum. Premier Energies is certainly doing some things right and is well worth investigating. Of course, just because Premier Energies is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Indian companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PREMIERENE

Premier Energies

Manufactures and sells integrated solar cells and modules in India.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives