- India

- /

- Semiconductors

- /

- NSEI:BORORENEW

The 8.5% return this week takes Borosil Renewables' (NSE:BORORENEW) shareholders five-year gains to 511%

For many, the main point of investing in the stock market is to achieve spectacular returns. And highest quality companies can see their share prices grow by huge amounts. To wit, the Borosil Renewables Limited (NSE:BORORENEW) share price has soared 511% over five years. This just goes to show the value creation that some businesses can achieve. Also pleasing for shareholders was the 14% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 15% in 90 days). It really delights us to see such great share price performance for investors.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

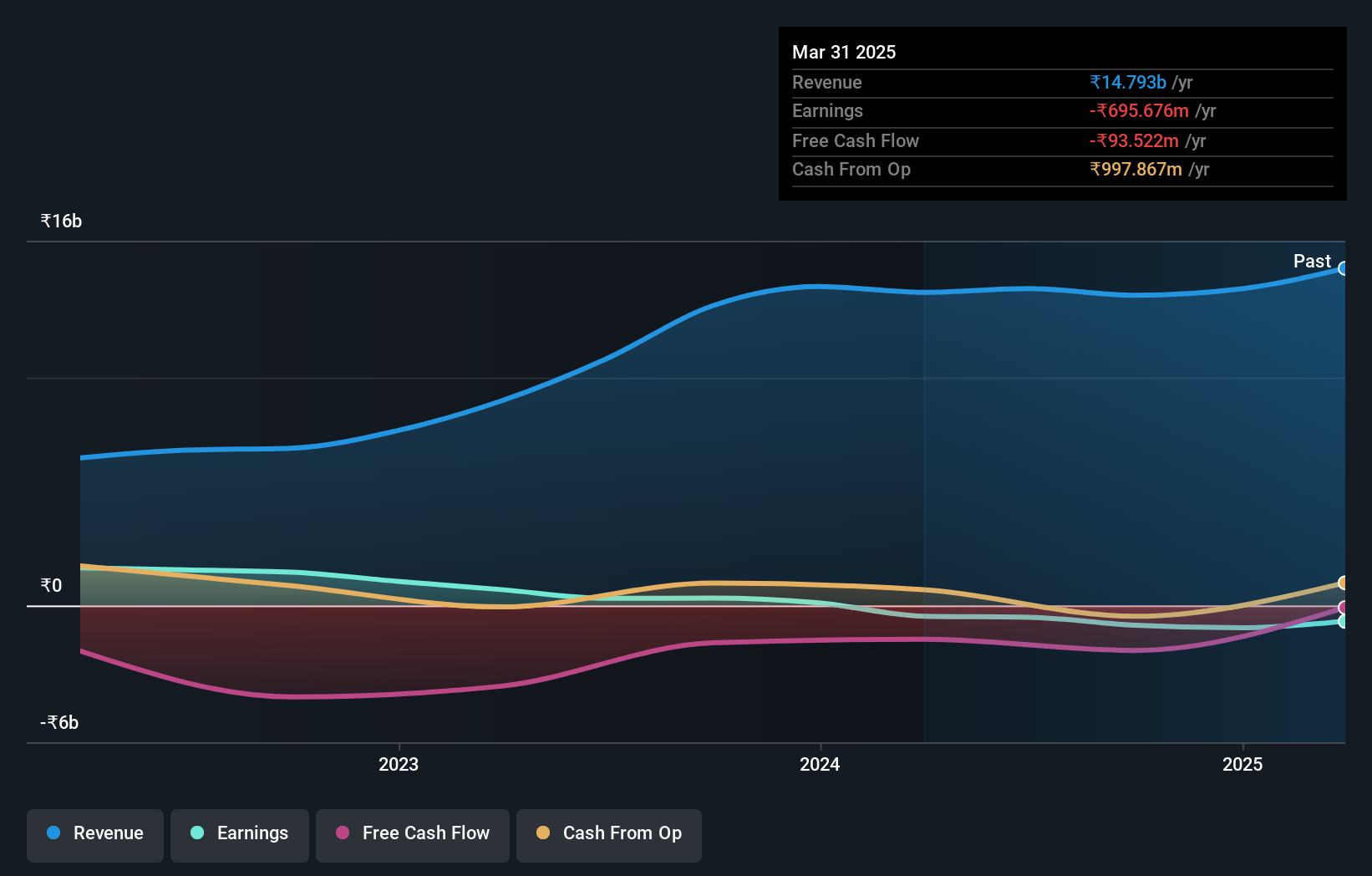

Given that Borosil Renewables didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

For the last half decade, Borosil Renewables can boast revenue growth at a rate of 31% per year. Even measured against other revenue-focussed companies, that's a good result. Fortunately, the market has not missed this, and has pushed the share price up by 44% per year in that time. Despite the strong run, top performers like Borosil Renewables have been known to go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on Borosil Renewables' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Borosil Renewables has rewarded shareholders with a total shareholder return of 20% in the last twelve months. Having said that, the five-year TSR of 44% a year, is even better. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Borosil Renewables .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Borosil Renewables might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BORORENEW

Borosil Renewables

Engages in the manufacture and sale of flat glass products in India and internationally.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives