- India

- /

- Specialty Stores

- /

- NSEI:GOCOLORS

Most Shareholders Will Probably Agree With Go Fashion (India) Limited's (NSE:GOCOLORS) CEO Compensation

Key Insights

- Go Fashion (India) will host its Annual General Meeting on 4th of September

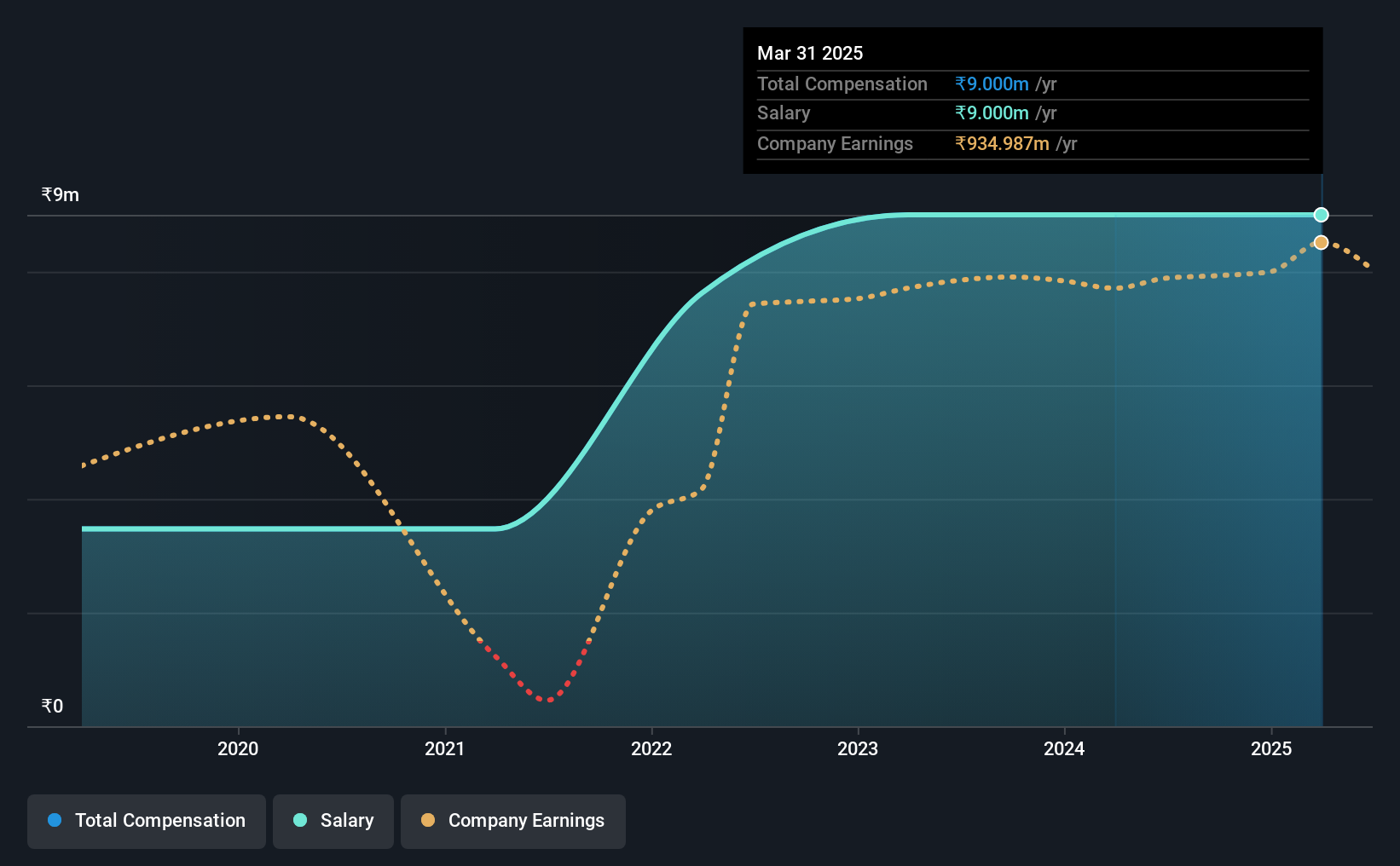

- Total pay for CEO Gautam Saraogi includes ₹9.00m salary

- The total compensation is 36% less than the average for the industry

- Over the past three years, Go Fashion (India)'s EPS grew by 2.8% and over the past three years, the total loss to shareholders 40%

The performance at Go Fashion (India) Limited (NSE:GOCOLORS) has been rather lacklustre of late and shareholders may be wondering what CEO Gautam Saraogi is planning to do about this. At the next AGM coming up on 4th of September, they can influence managerial decision making through voting on resolutions, including executive remuneration. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. In our opinion, CEO compensation does not look excessive and we discuss why.

See our latest analysis for Go Fashion (India)

How Does Total Compensation For Gautam Saraogi Compare With Other Companies In The Industry?

At the time of writing, our data shows that Go Fashion (India) Limited has a market capitalization of ₹38b, and reported total annual CEO compensation of ₹9.0m for the year to March 2025. This was the same as last year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹9.0m.

In comparison with other companies in the Indian Specialty Retail industry with market capitalizations ranging from ₹18b to ₹70b, the reported median CEO total compensation was ₹14m. Accordingly, Go Fashion (India) pays its CEO under the industry median. Furthermore, Gautam Saraogi directly owns ₹10b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | ₹9.0m | ₹9.0m | 100% |

| Other | - | - | - |

| Total Compensation | ₹9.0m | ₹9.0m | 100% |

Talking in terms of the industry, salary represents all of total compensation among the companies we analyzed, while other remuneration is, interestingly, completely ignored. On a company level, Go Fashion (India) prefers to reward its CEO through a salary, opting not to pay Gautam Saraogi through non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Go Fashion (India) Limited's Growth

Over the past three years, Go Fashion (India) Limited has seen its earnings per share (EPS) grow by 2.8% per year. In the last year, its revenue is up 7.3%.

We're not particularly impressed by the revenue growth, but the modest improvement in EPS is good. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Go Fashion (India) Limited Been A Good Investment?

The return of -40% over three years would not have pleased Go Fashion (India) Limited shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Go Fashion (India) rewards its CEO solely through a salary, ignoring non-salary benefits completely. The loss to shareholders over the past three years is certainly concerning. The disappointing performance may have something to do with the flat earnings growth. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Go Fashion (India).

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GOCOLORS

Go Fashion (India)

Engages in designing, developing, sourcing, marketing, and retailing of women’s and girl’s bottom-wear products under the Go Colors brand in India.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives