- India

- /

- Specialty Stores

- /

- NSEI:ARVINDFASN

Three Indian Exchange Stocks Estimated To Be Up To 17.1% Below Intrinsic Value

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has remained flat, yet it boasts an impressive 45% rise over the past year with earnings forecasted to grow by 17% annually. In such a promising environment, identifying undervalued stocks can offer significant opportunities for investors looking to capitalize on intrinsic value discrepancies.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HEG (NSEI:HEG) | ₹2056.90 | ₹3898.80 | 47.2% |

| Shyam Metalics and Energy (NSEI:SHYAMMETL) | ₹696.45 | ₹1126.67 | 38.2% |

| NIIT Learning Systems (NSEI:NIITMTS) | ₹460.00 | ₹702.88 | 34.6% |

| S Chand (NSEI:SCHAND) | ₹220.86 | ₹355.97 | 38% |

| Sudarshan Chemical Industries (BSE:506655) | ₹915.60 | ₹1481.22 | 38.2% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1413.80 | ₹2166.83 | 34.8% |

| Macrotech Developers (NSEI:LODHA) | ₹1175.30 | ₹1944.07 | 39.5% |

| Texmaco Rail & Engineering (NSEI:TEXRAIL) | ₹243.50 | ₹396.45 | 38.6% |

| Piramal Pharma (NSEI:PPLPHARMA) | ₹168.36 | ₹289.56 | 41.9% |

| Strides Pharma Science (NSEI:STAR) | ₹1080.80 | ₹2032.10 | 46.8% |

Underneath we present a selection of stocks filtered out by our screen.

Arvind Fashions (NSEI:ARVINDFASN)

Overview: Arvind Fashions Limited is involved in the wholesale and retail trading of garments and accessories both in India and internationally, with a market cap of ₹64.68 billion.

Operations: The company's revenue segments include Branded Apparel (Garments and Accessories), generating ₹43.47 billion.

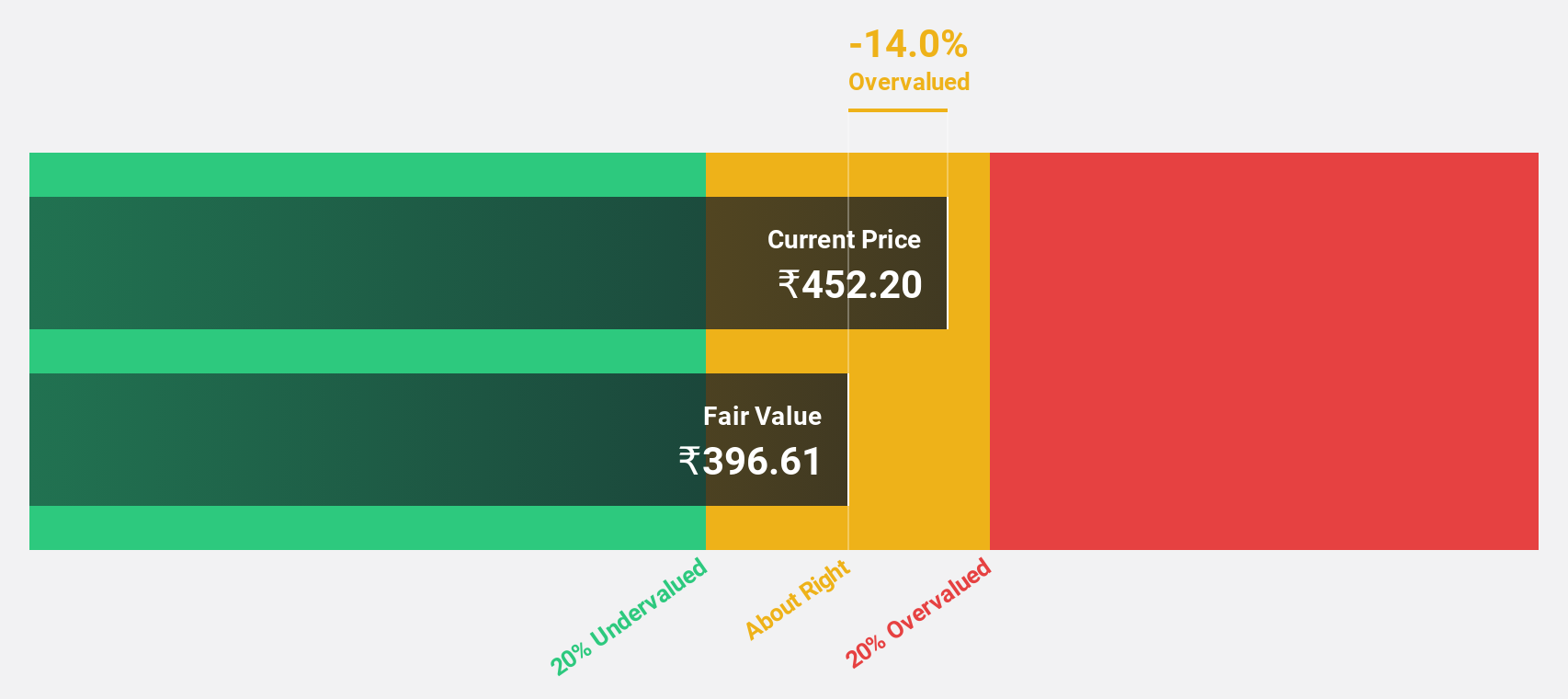

Estimated Discount To Fair Value: 15.7%

Arvind Fashions reported Q1 2025 earnings with a net income of ₹13.2 million, reversing a loss from the previous year. The stock is trading at ₹485.5, below its estimated fair value of ₹575.94 and 15.7% under analyst price targets, indicating it may be undervalued based on cash flows. Despite an unstable dividend track record and low forecasted return on equity (15%), earnings are expected to grow significantly at 46.9% annually over the next three years, outpacing both revenue growth and market expectations.

- Upon reviewing our latest growth report, Arvind Fashions' projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Arvind Fashions.

Eris Lifesciences (NSEI:ERIS)

Overview: Eris Lifesciences Limited, along with its subsidiaries, manufactures, markets, and distributes domestic branded formulations for chronic and sub-chronic therapies in India, with a market cap of ₹146.81 billion.

Operations: The company's revenue segments include Pharmaceuticals, generating ₹22.47 billion.

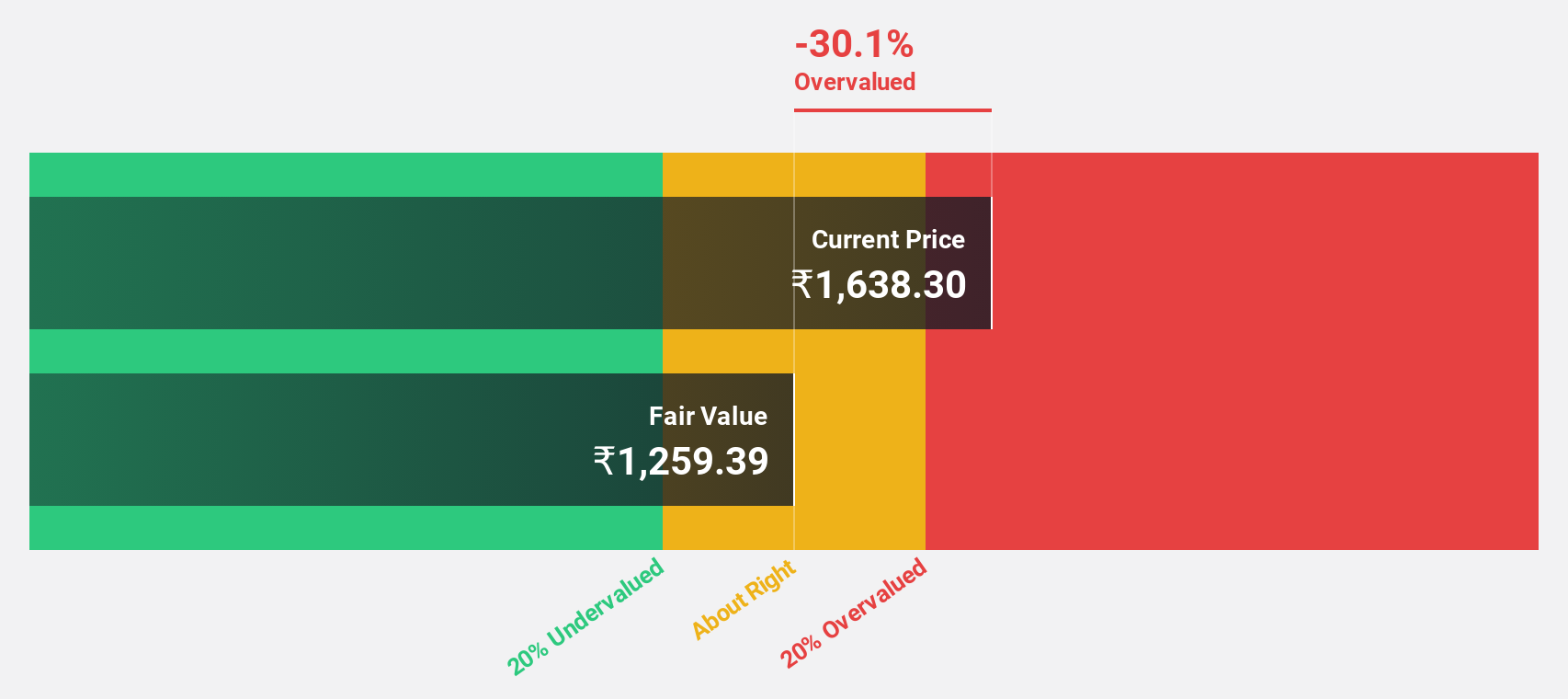

Estimated Discount To Fair Value: 11.5%

Eris Lifesciences is trading at ₹1078.9, below its fair value estimate of ₹1218.48, indicating potential undervaluation based on cash flows. Despite a recent decline in net income to ₹831.8 million for Q1 2024, revenue grew significantly to ₹7,213.6 million from the previous year’s ₹4,676.1 million. The company’s earnings are forecasted to grow at 22.3% annually over the next three years, outpacing the market's growth rate and reflecting strong future performance expectations despite current challenges.

- Our expertly prepared growth report on Eris Lifesciences implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Eris Lifesciences stock in this financial health report.

Quess (NSEI:QUESS)

Overview: Quess Corp Limited is a business services provider operating in India, South East Asia, the Middle East, and North America with a market cap of ₹98.20 billion.

Operations: The company's revenue segments include Product Led Business (₹4.29 billion), Workforce Management (₹138.44 billion), Operating Asset Management (₹28.43 billion), and Global Technology Solutions excluding Product Led Business (₹23.87 billion).

Estimated Discount To Fair Value: 17.1%

Quess Corp, trading at ₹660.7, is undervalued relative to its fair value estimate of ₹797.12 based on discounted cash flows. Despite significant insider selling recently, Quess's earnings grew by 62.5% last year and are forecasted to grow at 23% annually over the next three years, surpassing the market's growth rate of 16.7%. Recent Q1 results show substantial revenue growth to ₹50 billion and net income doubling from a year ago, underscoring robust financial health.

- Our earnings growth report unveils the potential for significant increases in Quess' future results.

- Take a closer look at Quess' balance sheet health here in our report.

Taking Advantage

- Reveal the 28 hidden gems among our Undervalued Indian Stocks Based On Cash Flows screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ARVINDFASN

Arvind Fashions

Engages in the wholesale and retail trading of garments and accessories in India and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives