- India

- /

- Specialty Stores

- /

- NSEI:ARVINDFASN

Exploring Three Indian Exchange Growth Companies With Significant Insider Stakes

Reviewed by Simply Wall St

The Indian market has shown robust growth, climbing 3.7% in the past week and an impressive 45% over the last year, with earnings expected to increase by 16% annually. In this thriving environment, stocks with high insider ownership can be particularly appealing as they often indicate a strong alignment between company management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 33.4% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 37.8% | 22.9% |

| Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 27.7% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 33.1% |

| Aether Industries (NSEI:AETHER) | 31.1% | 39.8% |

Here's a peek at a few of the choices from the screener.

Arvind Fashions (NSEI:ARVINDFASN)

Simply Wall St Growth Rating: ★★★★☆☆

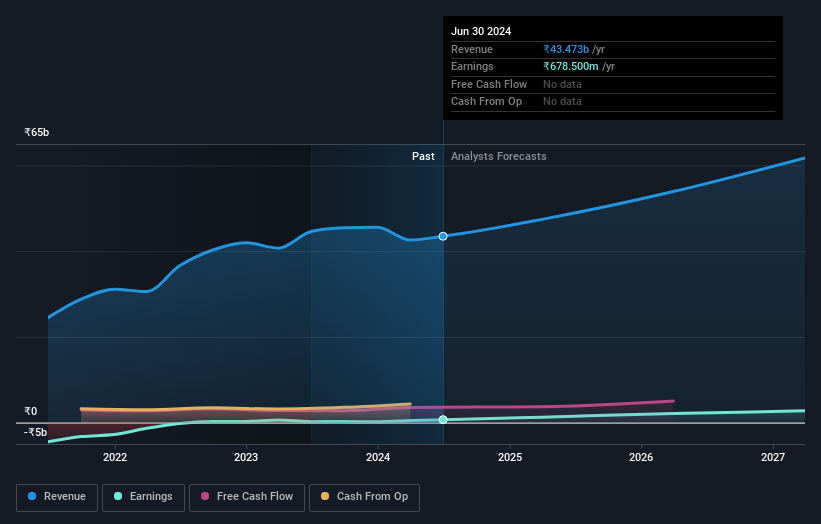

Overview: Arvind Fashions Limited operates in India, specializing in the retail of garments, cosmetics, and accessories, with a market capitalization of approximately ₹62.60 billion.

Operations: The company generates revenue primarily from branded apparel, including garments and accessories, totaling approximately ₹42.59 billion.

Insider Ownership: 13.5%

Arvind Fashions, a prominent Indian apparel retailer, exhibits strong growth potential with its earnings expected to surge by 60.8% annually. Despite limited insider buying in the past three months, the company's revenue growth outpaces the broader Indian market at an anticipated 12% yearly rate. However, challenges such as a low forecasted return on equity of 15.8% in three years and moderate insider transactions could temper investor enthusiasm. Recent moves include proposing a final dividend of INR 1.25 per share for FY2024.

- Get an in-depth perspective on Arvind Fashions' performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Arvind Fashions' shares may be trading at a premium.

Mrs. Bectors Food Specialities (NSEI:BECTORFOOD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mrs. Bectors Food Specialities Limited is an Indian company engaged in the manufacturing and distribution of a variety of food products, with a market capitalization of ₹83.20 billion.

Operations: The company generates ₹16.24 billion from its food products segment.

Insider Ownership: 36.2%

Mrs. Bectors Food Specialities Limited, a key player in the Indian food industry, reported robust financial performance with substantial year-over-year growth in sales and net income for Q4 2024 and FY2024. The company's earnings are expected to grow by 16.49% annually, outpacing the Indian market's average. Despite slower revenue growth projections compared to some peers, Mrs. Bectors maintains a high forecasted Return on Equity at 22.1%. Additionally, the board recommended a final dividend of INR 2 per share for FY2023-2024.

- Take a closer look at Mrs. Bectors Food Specialities' potential here in our earnings growth report.

- The valuation report we've compiled suggests that Mrs. Bectors Food Specialities' current price could be inflated.

Varun Beverages (NSEI:VBL)

Simply Wall St Growth Rating: ★★★★★☆

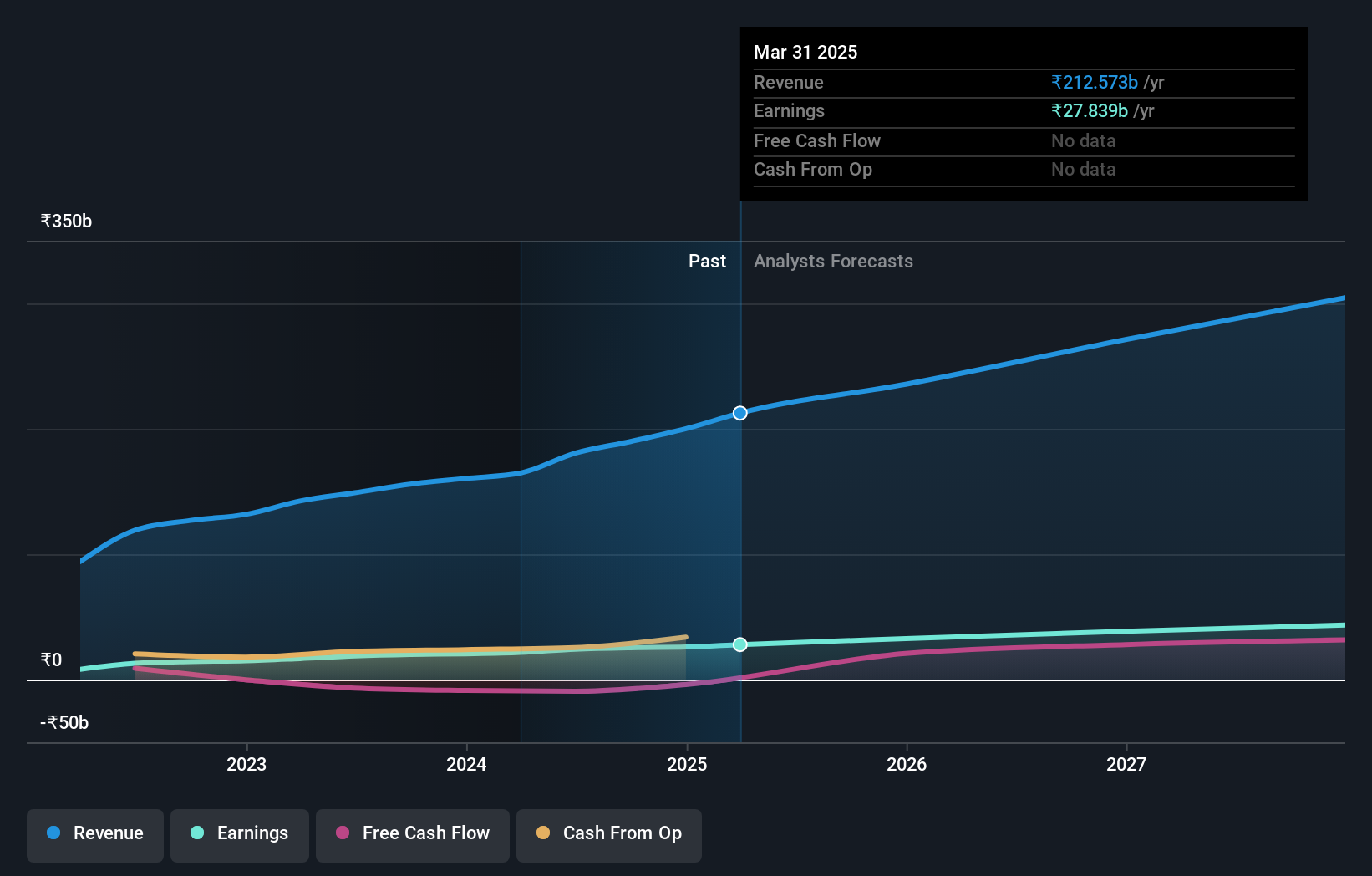

Overview: Varun Beverages Limited operates as a franchisee of PepsiCo, producing and distributing carbonated soft drinks and non-carbonated beverages, with a market capitalization of approximately ₹2.02 trillion.

Operations: The company generates its revenue primarily from the manufacturing and sale of beverages, totaling approximately ₹164.67 billion.

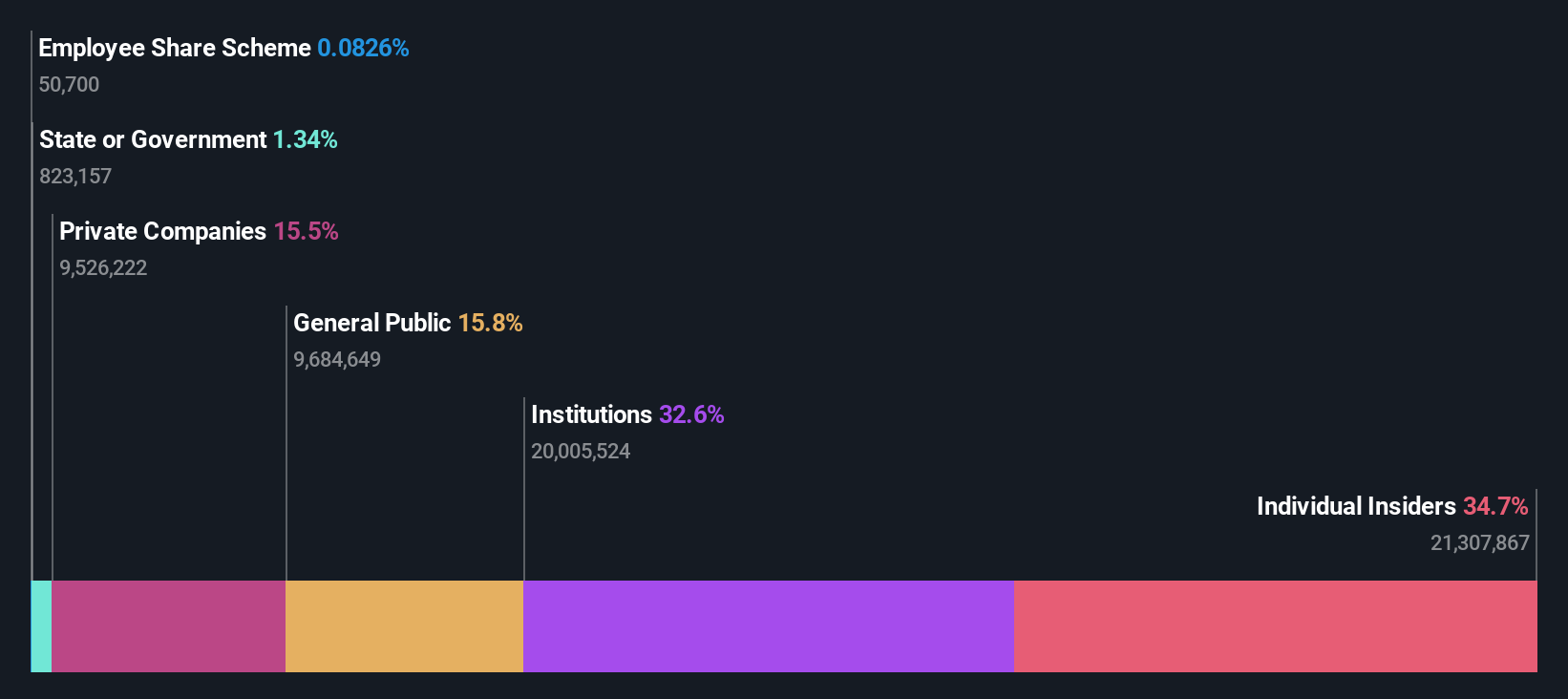

Insider Ownership: 36.4%

Varun Beverages Limited, with high insider ownership, is poised for substantial growth. The company's earnings are expected to increase by 24.38% annually over the next three years, outstripping the Indian market's forecast of 15.9%. Similarly, revenue growth projections stand at 16.6% per year against a market average of 9.5%. Despite these positive indicators, Varun Beverages carries a high level of debt which could impact its financial flexibility. Recent strategic moves include appointing a new CFO and expanding operations into Zimbabwe, signaling ongoing organizational and geographical growth initiatives.

- Delve into the full analysis future growth report here for a deeper understanding of Varun Beverages.

- Our expertly prepared valuation report Varun Beverages implies its share price may be too high.

Key Takeaways

- Click this link to deep-dive into the 80 companies within our Fast Growing Indian Companies With High Insider Ownership screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ARVINDFASN

Arvind Fashions

Engages in the wholesale and retail trading of garments and accessories in India and internationally.

Solid track record with reasonable growth potential.