Discovering Jai And 2 Hidden Indian Small Caps with Strong Financials

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has remained flat, with notable gains of 3.5% in the Utilities sector. Despite this short-term stability, the market is up an impressive 44% over the past year and earnings are forecast to grow by 17% annually. In such a dynamic environment, identifying stocks with strong financials and growth potential can be particularly rewarding. This article explores Jai and two other hidden Indian small caps that stand out for their robust financial health and promising prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shree Digvijay Cement | 0.01% | 13.97% | 16.37% | ★★★★★★ |

| All E Technologies | NA | 40.78% | 31.63% | ★★★★★★ |

| Aeroflex Industries | 0.04% | 14.69% | 33.38% | ★★★★★★ |

| AGI Infra | 61.29% | 29.16% | 33.44% | ★★★★★★ |

| Pearl Global Industries | 72.24% | 19.89% | 41.91% | ★★★★★☆ |

| Om Infra | 13.99% | 43.36% | 27.66% | ★★★★★☆ |

| Network People Services Technologies | 0.24% | 81.82% | 86.35% | ★★★★★☆ |

| Piccadily Agro Industries | 50.57% | 13.86% | 42.85% | ★★★★★☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

| Rir Power Electronics | 54.23% | 16.42% | 34.78% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Jai (NSEI:JAICORPLTD)

Simply Wall St Value Rating: ★★★★★★

Overview: Jai Corp Limited primarily engages in the plastic processing business in India and internationally, with a market cap of ₹71.54 billion.

Operations: Jai Corp Limited generates revenue from three primary segments: Plastic Processing (₹4.65 billion), Real Estate (₹35.68 million), and Steel (₹3.21 million).

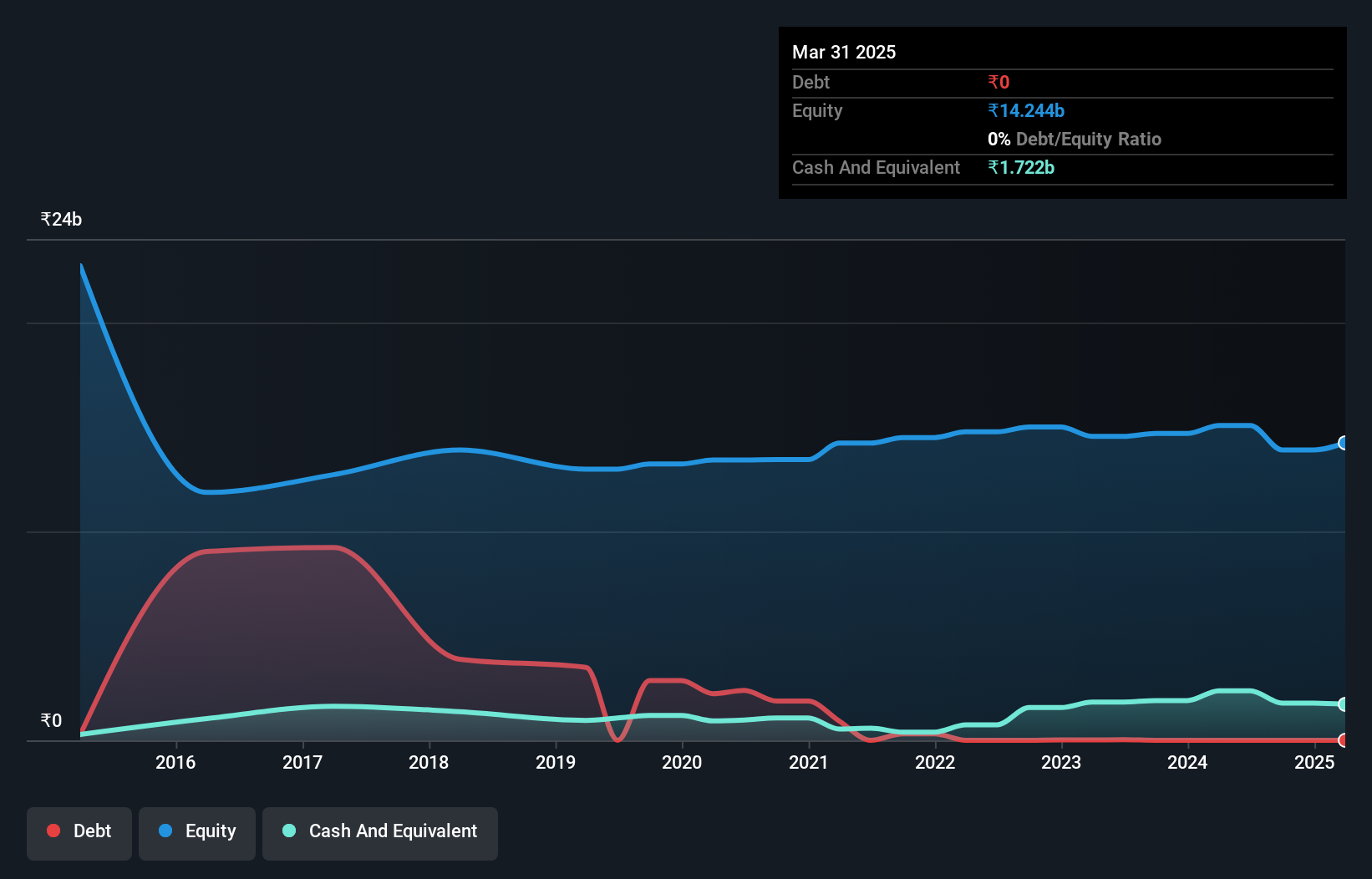

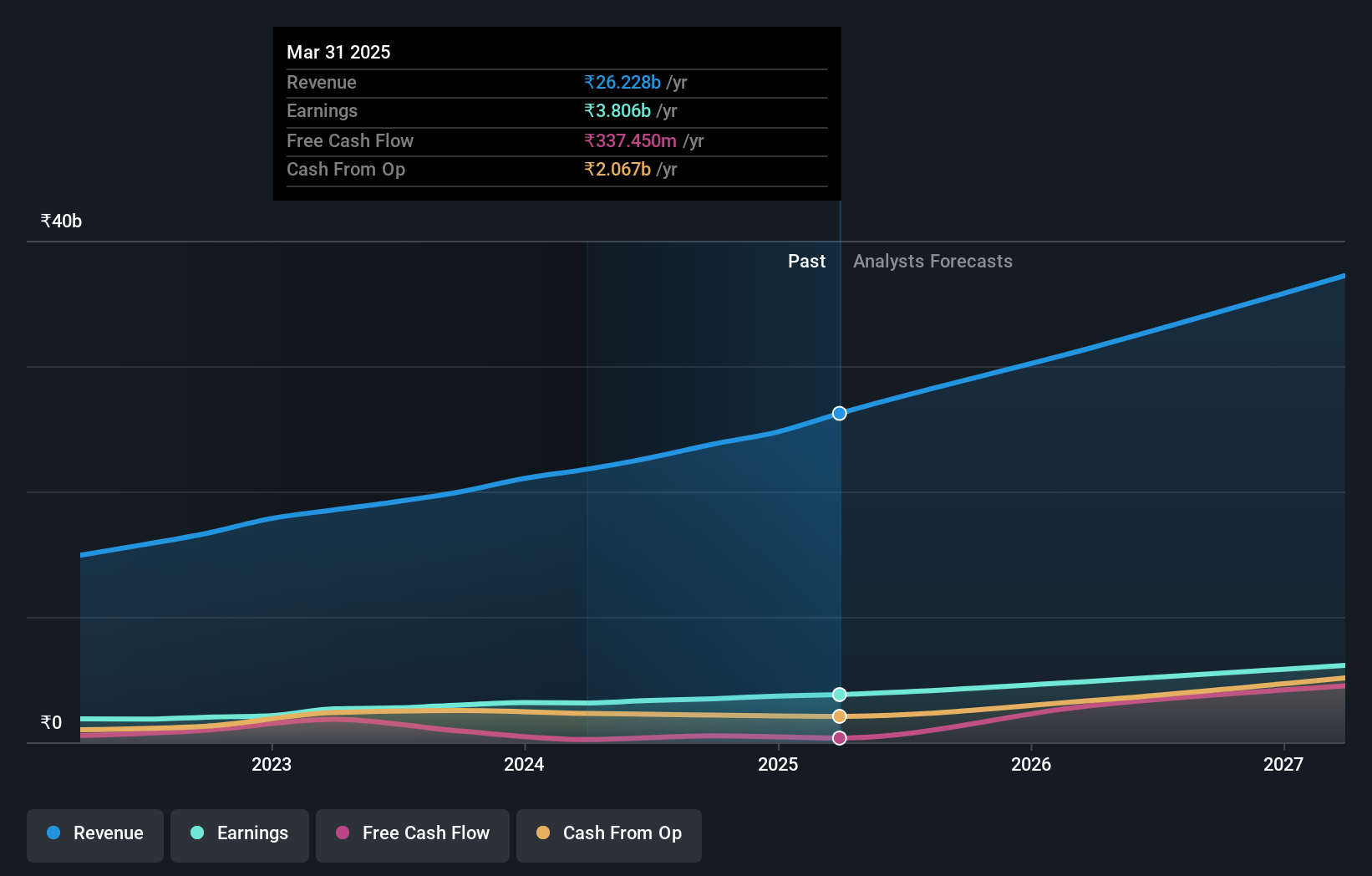

Jai Corp Limited, a promising player in the Indian market, has shown impressive financial health with no debt and high-quality earnings. The company reported net income of INR 137.3 million for Q1 2024, up from INR 55.3 million a year ago, reflecting its robust performance. Additionally, Jai Corp's recent buyback program aims to repurchase up to 2.94 million shares for INR 1,177.77 million by September 20, enhancing shareholder value and return on equity.

- Unlock comprehensive insights into our analysis of Jai stock in this health report.

Gain insights into Jai's historical performance by reviewing our past performance report.

Maharashtra Scooters (NSEI:MAHSCOOTER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Maharashtra Scooters Ltd. manufactures and sells pressure die casting dies, jigs, fixtures, and die casting components primarily for the two and three-wheeler industry in India with a market cap of ₹139.28 billion.

Operations: Maharashtra Scooters Ltd. generates revenue primarily from investments (₹2.14 billion) and manufacturing (₹108.10 million). The company operates within the two and three-wheeler industry in India, focusing on die casting components.

Maharashtra Scooters, an intriguing small-cap opportunity, has seen its earnings grow 19.3% annually over the past five years. Despite a modest 6.6% growth last year, it trails behind the broader Capital Markets industry’s impressive 63.2%. The company is debt-free and boasts high-quality earnings, with recent levered free cash flow reaching INR 2254.62 million as of September 2023. Additionally, Maharashtra Scooters declared an interim dividend of INR 110 per share for FY25 on September 12, signaling robust shareholder returns.

- Dive into the specifics of Maharashtra Scooters here with our thorough health report.

Understand Maharashtra Scooters' track record by examining our Past report.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★★★★

Overview: Marksans Pharma Limited, along with its subsidiaries, focuses on the research, manufacturing, marketing, and sale of pharmaceutical formulations across various international markets including the United States, North America, Europe, the United Kingdom, Australia, and New Zealand with a market cap of ₹142.54 billion.

Operations: Marksans Pharma generates revenue primarily from its pharmaceutical segment, totaling ₹22.68 billion. The company's market cap stands at ₹142.54 billion.

Marksans Pharma has shown robust performance, with earnings growing 21.7% over the past year, surpassing the industry average of 19.2%. The company's debt to equity ratio improved from 19.9% to 11.7% over five years, indicating better financial health. Recent Q1 results reported revenue at INR 6.06 billion and net income at INR 887 million, reflecting solid growth compared to last year’s figures. Additionally, their interest payments are well-covered by EBIT (32x).

- Take a closer look at Marksans Pharma's potential here in our health report.

Explore historical data to track Marksans Pharma's performance over time in our Past section.

Taking Advantage

- Access the full spectrum of 480 Indian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JAICORPLTD

Jai

Primarily engages in the plastic processing business in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives