- India

- /

- Real Estate

- /

- NSEI:TCIDEVELOP

We Discuss Why TCI Developers Limited's (NSE:TCIDEVELOP) CEO Compensation May Be Closely Reviewed

The results at TCI Developers Limited (NSE:TCIDEVELOP) have been quite disappointing recently and CEO Naresh Baranwal bears some responsibility for this. At the upcoming AGM on 28 July 2021, shareholders can hear from the board including their plans for turning around performance. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. From our analysis, we think CEO compensation may need a review in light of the recent performance.

See our latest analysis for TCI Developers

How Does Total Compensation For Naresh Baranwal Compare With Other Companies In The Industry?

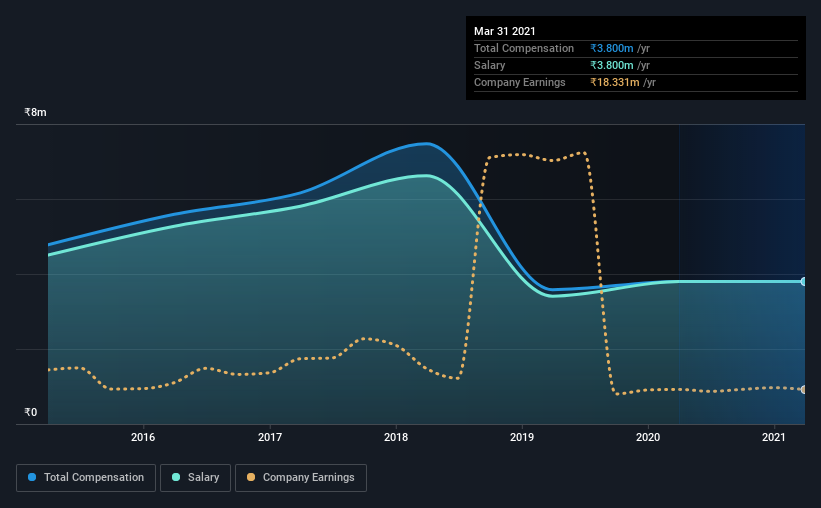

According to our data, TCI Developers Limited has a market capitalization of ₹1.4b, and paid its CEO total annual compensation worth ₹3.8m over the year to March 2021. There was no change in the compensation compared to last year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹3.8m.

In comparison with other companies in the industry with market capitalizations under ₹15b, the reported median total CEO compensation was ₹1.8m. This suggests that Naresh Baranwal is paid more than the median for the industry.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹3.8m | ₹3.8m | 100% |

| Other | - | - | - |

| Total Compensation | ₹3.8m | ₹3.8m | 100% |

Speaking on an industry level, all of total compensation represents salary, while non-salary remuneration is completely ignored. On a company level, TCI Developers prefers to reward its CEO through a salary, opting not to pay Naresh Baranwal through non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at TCI Developers Limited's Growth Numbers

Over the last three years, TCI Developers Limited has shrunk its earnings per share by 15% per year. In the last year, its revenue is up 5.8%.

Few shareholders would be pleased to read that EPS have declined. The fairly low revenue growth fails to impress given that the EPS is down. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has TCI Developers Limited Been A Good Investment?

Since shareholders would have lost about 15% over three years, some TCI Developers Limited investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

TCI Developers rewards its CEO solely through a salary, ignoring non-salary benefits completely. Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 3 warning signs for TCI Developers that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading TCI Developers or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TCI Developers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:TCIDEVELOP

TCI Developers

TCI Developers Limited engages in the real estate and warehousing development businesses in India.

Adequate balance sheet with poor track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026