- India

- /

- Real Estate

- /

- NSEI:PARSVNATH

Investors might be losing patience for Parsvnath Developers' (NSE:PARSVNATH) increasing losses, as stock sheds 11% over the past week

It's been a soft week for Parsvnath Developers Limited (NSE:PARSVNATH) shares, which are down 11%. But that doesn't change the fact that the returns over the last year have been spectacular. Few could complain about the impressive 319% rise, throughout the period. So it is not that surprising to see the stock retrace a little. The real question is whether the fundamental business performance can justify the strong increase over the long term.

Although Parsvnath Developers has shed ₹849m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

Check out our latest analysis for Parsvnath Developers

Parsvnath Developers wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Parsvnath Developers saw its revenue shrink by 67%. This is in stark contrast to the splendorous stock price, which has rocketed 319% since this time a year ago. It's pretty clear the market isn't basing its valuation on fundamental metrics like revenue. To us, a gain like this looks like speculation, but there might be historical trends to back it up.

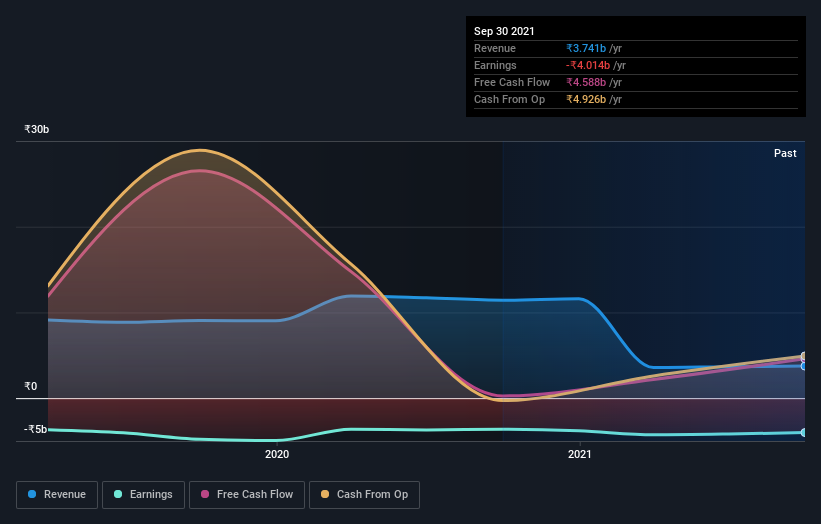

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's good to see that Parsvnath Developers has rewarded shareholders with a total shareholder return of 319% in the last twelve months. That gain is better than the annual TSR over five years, which is 5%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Parsvnath Developers better, we need to consider many other factors. Take risks, for example - Parsvnath Developers has 3 warning signs (and 1 which is concerning) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PARSVNATH

Parsvnath Developers

Engages in the real estate development business in India.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026