- India

- /

- Office REITs

- /

- NSEI:BIRET

This Analyst Just Wrote A Brand New Outlook For Brookfield India Real Estate Trust's (NSE:BIRET) Business

Shareholders in Brookfield India Real Estate Trust (NSE:BIRET) may be thrilled to learn that the covering analyst has just delivered a major upgrade to their near-term forecasts. The analyst greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals.

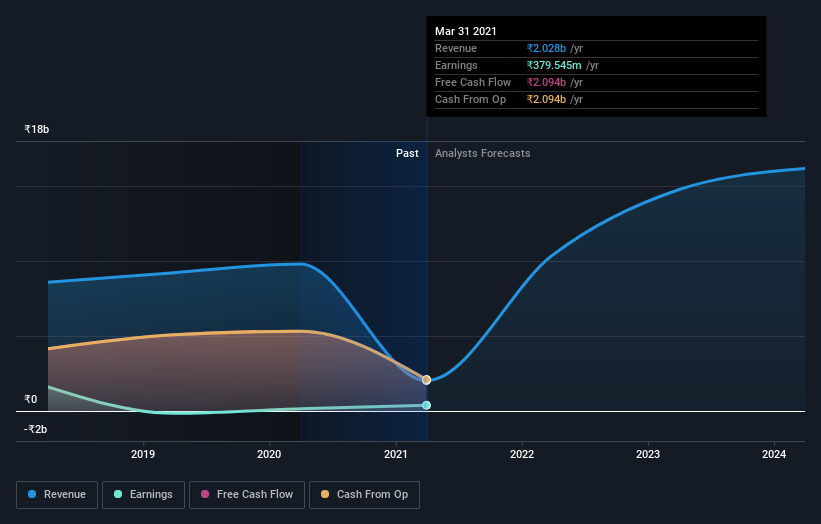

Following the upgrade, the current consensus from Brookfield India Real Estate Trust's solo analyst is for revenues of ₹10b in 2022 which - if met - would reflect a huge 413% increase on its sales over the past 12 months. Per-share earnings are expected to bounce 842% to ₹11.81. Previously, the analyst had been modelling revenues of ₹9.0b and earnings per share (EPS) of ₹9.92 in 2022. There has definitely been an improvement in perception recently, with the analyst substantially increasing both their earnings and revenue estimates.

Check out our latest analysis for Brookfield India Real Estate Trust

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Brookfield India Real Estate Trust's past performance and to peers in the same industry. One thing stands out from these estimates, which is that Brookfield India Real Estate Trust is forecast to grow faster in the future than it has in the past, with revenues expected to display 25x annualised growth until the end of 2022. If achieved, this would be a much better result than the 26% annual decline over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 6.4% per year. So it looks like Brookfield India Real Estate Trust is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The biggest takeaway for us from these new estimates is that the analyst upgraded their earnings per share estimates, with improved earnings power expected for this year. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. With a serious upgrade to expectations, it might be time to take another look at Brookfield India Real Estate Trust.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have analyst estimates for Brookfield India Real Estate Trust going out as far as 2024, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield India Real Estate Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BIRET

Brookfield India Real Estate Trust

The Brookfield India Real Estate Trust is India’s only institutionally managed public commercial real estate vehicle.

Solid track record average dividend payer.

Market Insights

Community Narratives