Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Sobha Limited (NSE:SOBHA) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Sobha's Debt?

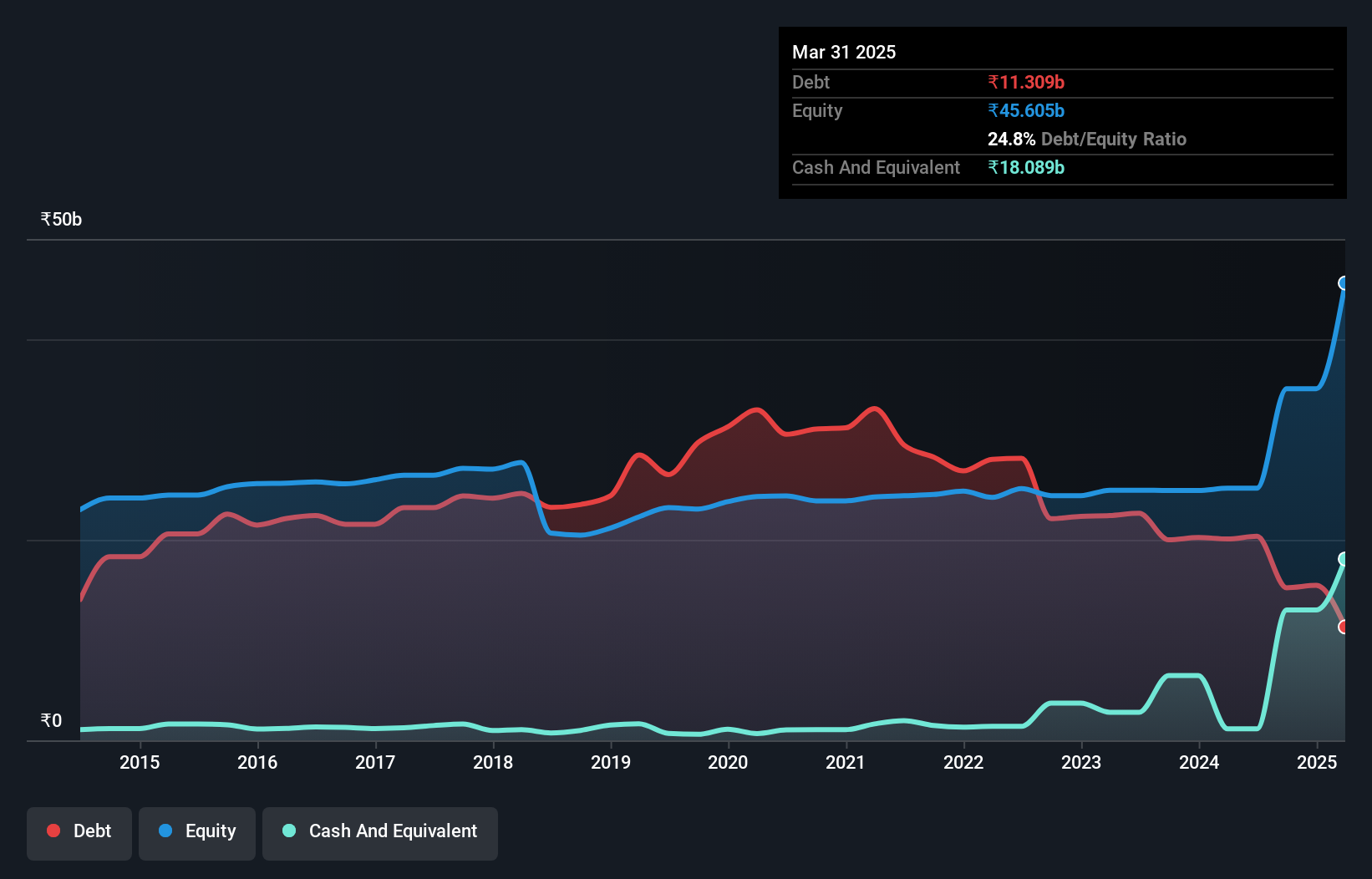

The image below, which you can click on for greater detail, shows that Sobha had debt of ₹11.3b at the end of March 2025, a reduction from ₹20.1b over a year. However, its balance sheet shows it holds ₹18.1b in cash, so it actually has ₹6.78b net cash.

A Look At Sobha's Liabilities

According to the last reported balance sheet, Sobha had liabilities of ₹117.1b due within 12 months, and liabilities of ₹9.51b due beyond 12 months. Offsetting these obligations, it had cash of ₹18.1b as well as receivables valued at ₹1.86b due within 12 months. So it has liabilities totalling ₹106.7b more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of ₹151.6b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. While it does have liabilities worth noting, Sobha also has more cash than debt, so we're pretty confident it can manage its debt safely.

Check out our latest analysis for Sobha

Importantly Sobha's EBIT was essentially flat over the last twelve months. We would prefer to see some earnings growth, because that always helps diminish debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Sobha can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Sobha has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Sobha actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing Up

Although Sobha's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of ₹6.78b. The cherry on top was that in converted 227% of that EBIT to free cash flow, bringing in ₹687m. So we are not troubled with Sobha's debt use. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Sobha insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SOBHA

Sobha

Engages in the construction, development, sale, management, and operation of residential and commercial real estate under the Sobha brand primarily in India.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026