- India

- /

- Real Estate

- /

- NSEI:SOBHA

Sobha Limited (NSE:SOBHA) Stock's 29% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Sobha Limited (NSE:SOBHA) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 18% share price drop.

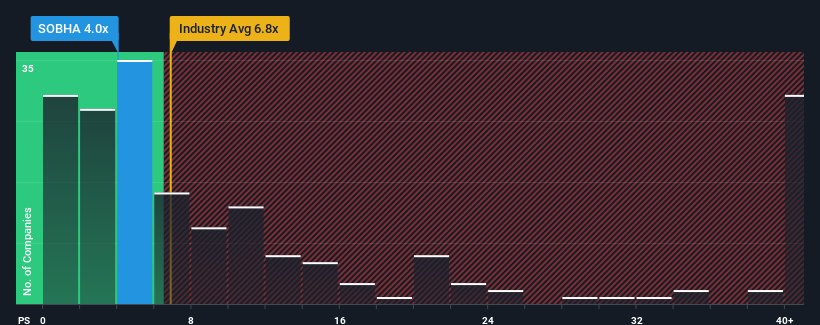

In spite of the heavy fall in price, Sobha may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 4x, since almost half of all companies in the Real Estate industry in India have P/S ratios greater than 6.7x and even P/S higher than 22x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Sobha

How Sobha Has Been Performing

While the industry has experienced revenue growth lately, Sobha's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Sobha will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Sobha?

The only time you'd be truly comfortable seeing a P/S as low as Sobha's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 18% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 54% over the next year. With the industry only predicted to deliver 38%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Sobha's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Sobha's P/S?

The southerly movements of Sobha's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems Sobha currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Sobha that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SOBHA

Sobha

Engages in the construction, development, sale, management, and operation of residential and commercial real estate under the Sobha brand primarily in India.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives