- India

- /

- Real Estate

- /

- NSEI:SHRADHA

A Piece Of The Puzzle Missing From Shradha Infraprojects Limited's (NSE:SHRADHA) 30% Share Price Climb

Shradha Infraprojects Limited (NSE:SHRADHA) shares have had a really impressive month, gaining 30% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 69%.

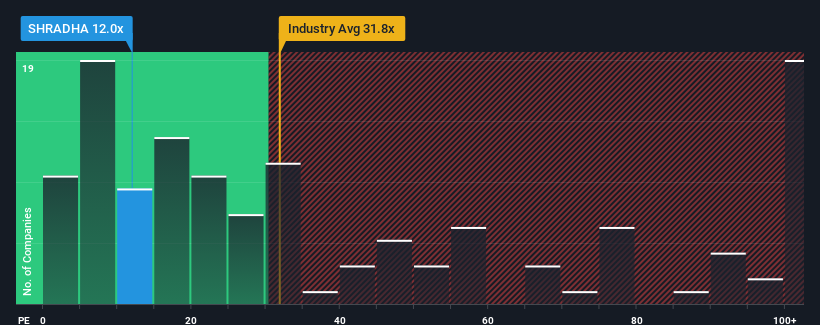

Although its price has surged higher, Shradha Infraprojects may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 12x, since almost half of all companies in India have P/E ratios greater than 32x and even P/E's higher than 60x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Earnings have risen firmly for Shradha Infraprojects recently, which is pleasing to see. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Shradha Infraprojects

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Shradha Infraprojects' is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 22% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 742% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's noticeably more attractive on an annualised basis.

In light of this, it's peculiar that Shradha Infraprojects' P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Shradha Infraprojects' P/E

Shares in Shradha Infraprojects are going to need a lot more upward momentum to get the company's P/E out of its slump. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Shradha Infraprojects revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Having said that, be aware Shradha Infraprojects is showing 6 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of Shradha Infraprojects' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SHRADHA

Shradha Infraprojects

An infrastructure development company, engages in the real estate development business in India.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026