- India

- /

- Real Estate

- /

- NSEI:PARSVNATH

Investors ignore increasing losses at Parsvnath Developers (NSE:PARSVNATH) as stock jumps 12% this past week

Long term investing can be life changing when you buy and hold the truly great businesses. And highest quality companies can see their share prices grow by huge amounts. To wit, the Parsvnath Developers Limited (NSE:PARSVNATH) share price has soared 921% over five years. And this is just one example of the epic gains achieved by some long term investors. Also pleasing for shareholders was the 14% gain in the last three months. It really delights us to see such great share price performance for investors.

The past week has proven to be lucrative for Parsvnath Developers investors, so let's see if fundamentals drove the company's five-year performance.

View our latest analysis for Parsvnath Developers

Parsvnath Developers isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Parsvnath Developers saw its revenue shrink by 16% per year. This is in stark contrast to the strong share price growth of 59%, compound, per year. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

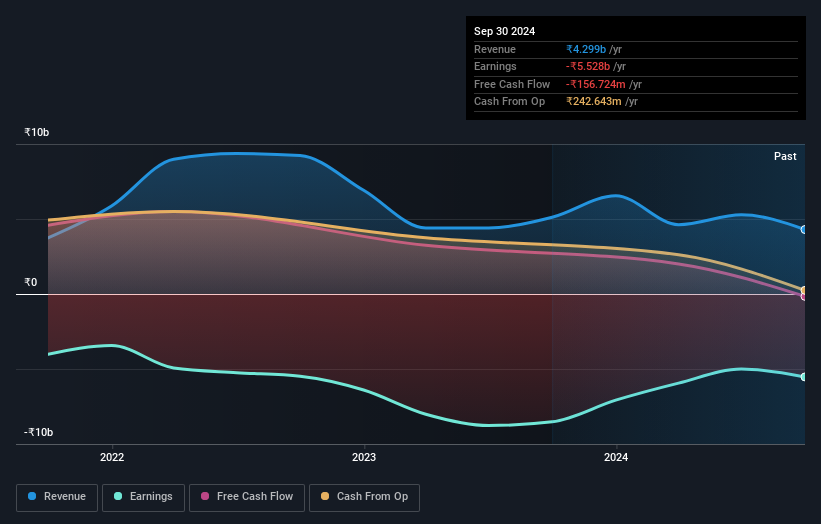

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Parsvnath Developers stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Parsvnath Developers shareholders have received a total shareholder return of 69% over one year. That gain is better than the annual TSR over five years, which is 59%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Parsvnath Developers has 2 warning signs we think you should be aware of.

But note: Parsvnath Developers may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PARSVNATH

Parsvnath Developers

Engages in the real estate development business in India.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion