- India

- /

- Real Estate

- /

- NSEI:GODREJPROP

Exploring Three Indian Exchange Stocks With Intrinsic Value Discounts Ranging From 14.7% To 39.9%

Reviewed by Simply Wall St

The Indian stock market has shown robust growth, rising 1.1% over the past week and achieving a remarkable 45% increase over the last year, with earnings expected to continue growing at an annual rate of 16%. In this thriving market environment, identifying stocks that are trading below their intrinsic value could present attractive opportunities for investors seeking potential gains.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HEG (NSEI:HEG) | ₹2096.15 | ₹3284.02 | 36.2% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹417.60 | ₹636.71 | 34.4% |

| Updater Services (NSEI:UDS) | ₹324.25 | ₹538.89 | 39.8% |

| Vedanta (NSEI:VEDL) | ₹455.50 | ₹744.79 | 38.8% |

| Rajesh Exports (NSEI:RAJESHEXPO) | ₹309.50 | ₹507.53 | 39% |

| Strides Pharma Science (NSEI:STAR) | ₹942.55 | ₹1664.05 | 43.4% |

| Mahindra Logistics (NSEI:MAHLOG) | ₹534.50 | ₹906.03 | 41% |

| Delhivery (NSEI:DELHIVERY) | ₹382.70 | ₹741.32 | 48.4% |

| PVR INOX (NSEI:PVRINOX) | ₹1438.30 | ₹2546.10 | 43.5% |

| Godrej Properties (NSEI:GODREJPROP) | ₹3381.40 | ₹5621.73 | 39.9% |

Here's a peek at a few of the choices from the screener.

Godrej Properties (NSEI:GODREJPROP)

Overview: Godrej Properties Limited operates in real estate construction and development across India, with a market capitalization of approximately ₹939.83 billion.

Operations: The company generates revenue primarily from real estate construction and development, totaling approximately ₹29.95 billion, with a smaller segment in hospitality bringing in around ₹0.41 billion.

Estimated Discount To Fair Value: 39.9%

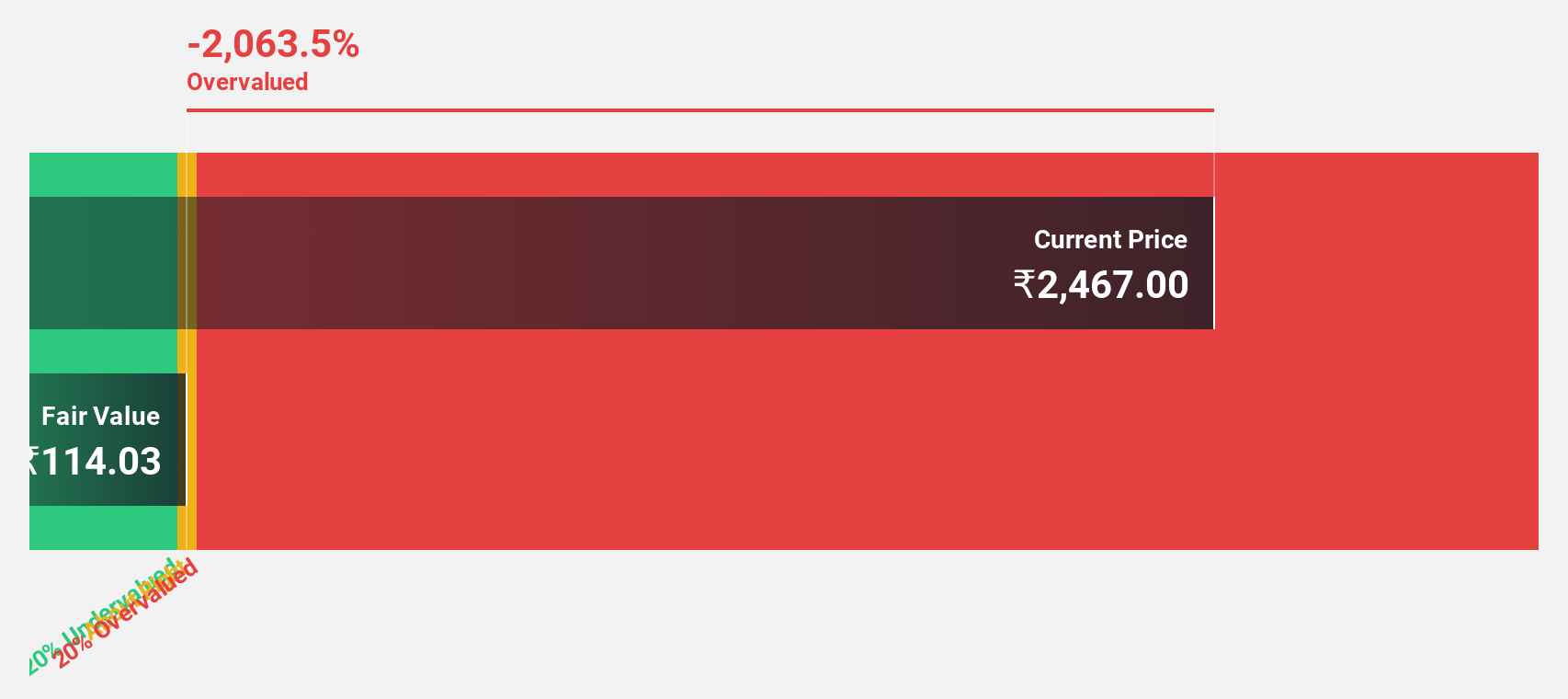

Godrej Properties, priced at ₹3381.4, is significantly undervalued by 39.9%, with a fair value estimated at ₹5621.73. Recent acquisitions in Bengaluru and Pune highlight aggressive expansion, enhancing future revenue potentials to approximately INR 30 billion. Despite earnings growing by 28.7% annually over the past five years, debt concerns persist as it's poorly covered by operating cash flow. However, robust forecasted annual earnings growth of 36.2% and revenue growth projections outpacing the market suggest promising upside potential.

- Our comprehensive growth report raises the possibility that Godrej Properties is poised for substantial financial growth.

- Dive into the specifics of Godrej Properties here with our thorough financial health report.

Quess (NSEI:QUESS)

Overview: Quess Corp Limited is a business services provider operating in India, South East Asia, the Middle East, and North America with a market capitalization of approximately ₹92.81 billion.

Operations: The company's revenue is generated from Workforce Management (₹134.42 billion), Operating Asset Management (₹28.01 billion), and Global Technology Solutions excluding Product Led Business (₹23.40 billion).

Estimated Discount To Fair Value: 14.7%

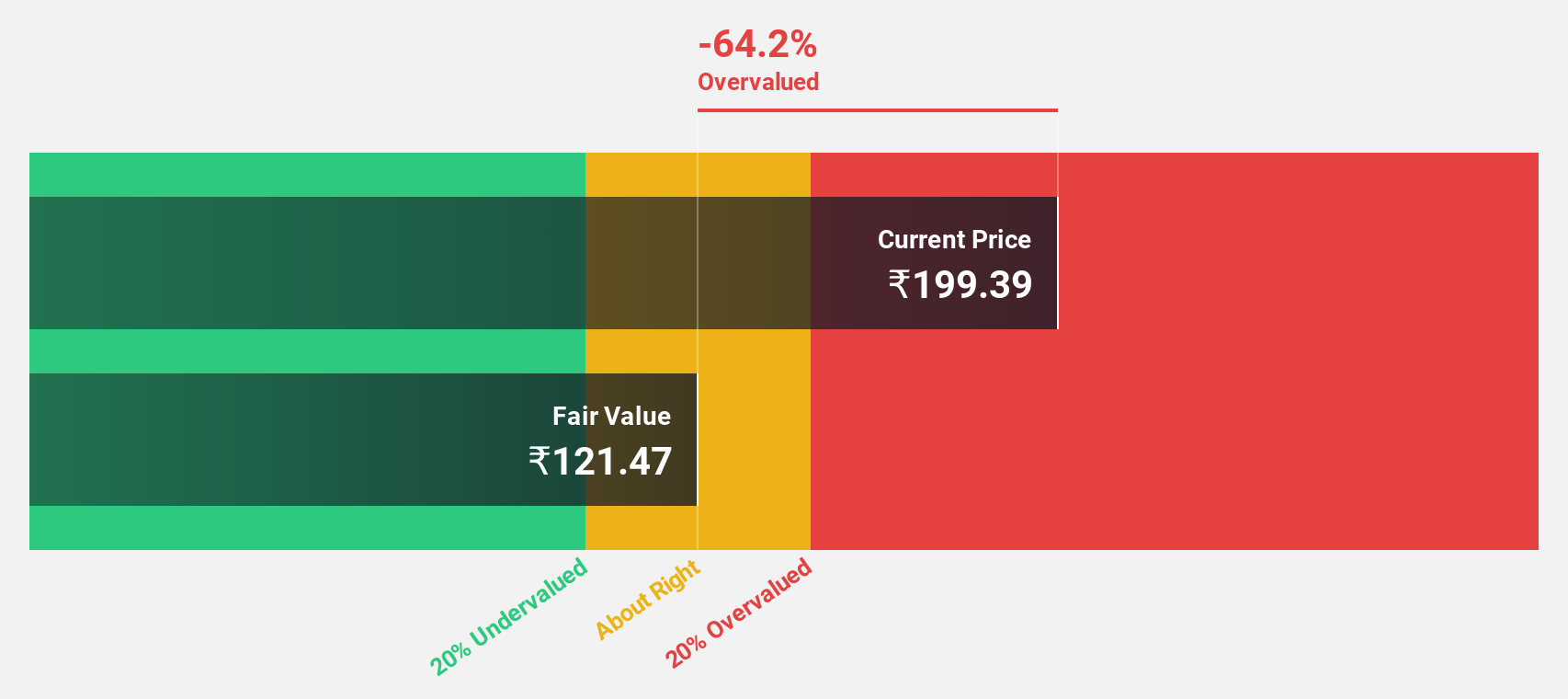

Quess Corp, trading at ₹625.6, is below its estimated fair value of ₹733.22, reflecting a potential undervaluation in the market. Despite a challenging dividend history and significant insider selling recently, Quess's earnings have grown by 23.8% over the past year with forecasts suggesting a robust annual growth of 27.61%. The recent strategic appointment of Mr. Gurmeet Chahal as CEO of Quess Global Technology Solutions could enhance its focus on lucrative sectors like healthcare and financial services through advanced technologies such as AI and analytics.

- According our earnings growth report, there's an indication that Quess might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Quess.

Rajesh Exports (NSEI:RAJESHEXPO)

Overview: Rajesh Exports Limited operates in India, engaging in the refining, manufacturing, wholesale, and retail of gold and diamond jewelry and various gold products, with a market capitalization of approximately ₹91.74 billion.

Operations: The company generates ₹28.09 billion from its gold products segment.

Estimated Discount To Fair Value: 39%

Rajesh Exports, priced at ₹309.5, is assessed to be 39% below its fair value of ₹507.53, suggesting a significant undervaluation based on cash flows. Despite a modest return on equity forecast at 8.2%, the company's earnings are expected to rise by 31.7% annually over the next three years, outpacing the Indian market's growth rate of 15.9%. However, its profit margins have declined from last year's 0.4% to just 0.1%, indicating potential efficiency challenges ahead.

- In light of our recent growth report, it seems possible that Rajesh Exports' financial performance will exceed current levels.

- Take a closer look at Rajesh Exports' balance sheet health here in our report.

Summing It All Up

- Click this link to deep-dive into the 20 companies within our Undervalued Indian Stocks Based On Cash Flows screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:GODREJPROP

Godrej Properties

Engages primarily in the business of real estate construction, development, hospitality, and other related activities in India.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives