- India

- /

- Diversified Financial

- /

- NSEI:JSWHL

Undiscovered Gems in India to Watch This October 2024

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has remained flat, yet it has impressively risen by 44% over the past 12 months. As earnings are expected to grow by 17% per annum over the next few years, identifying undiscovered gems that align with this growth trajectory can be key to finding promising investment opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| All E Technologies | NA | 40.78% | 31.63% | ★★★★★★ |

| Suraj | 27.47% | 17.95% | 67.29% | ★★★★★★ |

| Aeroflex Industries | 0.04% | 14.69% | 33.38% | ★★★★★★ |

| AGI Infra | 61.29% | 29.16% | 33.44% | ★★★★★★ |

| ELANTAS Beck India | NA | 14.89% | 24.83% | ★★★★★★ |

| Timex Group India | 14.33% | 17.75% | 59.68% | ★★★★★★ |

| Om Infra | 13.99% | 43.36% | 27.66% | ★★★★★☆ |

| Spright Agro | 0.58% | 83.13% | 86.22% | ★★★★★☆ |

| Nibe | 39.26% | 80.75% | 84.69% | ★★★★★☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Arkade Developers (NSEI:ARKADE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Arkade Developers Limited operates as a real estate development company in India with a market cap of ₹28.16 billion.

Operations: Arkade Developers generates revenue primarily from real estate development, amounting to ₹6.35 billion. The company has a market capitalization of ₹28.16 billion.

Arkade Developers has shown impressive growth with earnings jumping 141.9% over the past year, outpacing the Real Estate industry’s 24.1%. Their net debt to equity ratio stands at a satisfactory 14.2%, and interest payments are well covered by EBIT (12.2x). Recently, Arkade completed an IPO raising INR 4.1 billion, which could bolster future projects and expansion plans. Despite high-quality earnings and trading at 55% below estimated fair value, shares remain highly illiquid.

- Navigate through the intricacies of Arkade Developers with our comprehensive health report here.

Assess Arkade Developers' past performance with our detailed historical performance reports.

Godawari Power & Ispat (NSEI:GPIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Godawari Power & Ispat Limited, along with its subsidiaries, operates in the mining of iron ores in India and has a market cap of ₹143.52 billion.

Operations: GPIL generates revenue primarily from the mining of iron ores. The company has a market cap of ₹143.52 billion and its financial performance includes a net profit margin that has shown significant fluctuations over recent periods.

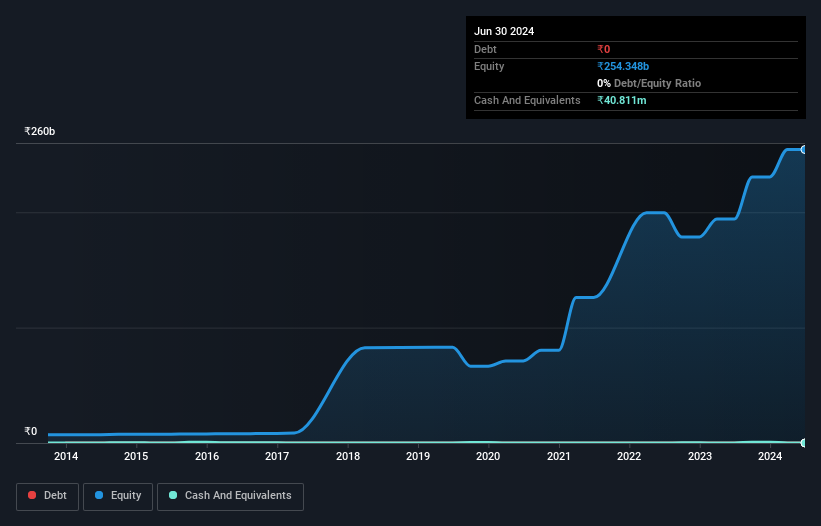

Godawari Power & Ispat (GPIL) has shown impressive financial performance, with earnings growth of 42.1% over the past year, outpacing the Metals and Mining industry average of 19.3%. The company’s debt to equity ratio has significantly improved from 141.1% to 1.1% in five years, reflecting better financial health. GPIL's P/E ratio stands at a favorable 14.5x compared to the Indian market's 34.1x, indicating good value relative to peers and industry standards. Recent developments include a proposed alteration of share capital at their AGM on September 21, alongside a special dividend announcement of INR 1.25 per share for their anniversary celebration. Additionally, Q1 results for FY2025 reported net income rising to INR 2,865 million from INR 2,309 million year-on-year and basic EPS increasing from INR18.51 to INR22.97. The company also completed a significant buyback program repurchasing shares worth INR3 billion between June and July this year which likely signals confidence in its future prospects while maintaining robust cash flows evident by levered free cash flow figures like ₹9 billion as of September end last year

JSW Holdings (NSEI:JSWHL)

Simply Wall St Value Rating: ★★★★★☆

Overview: JSW Holdings Limited, a non-banking financial company, primarily engages in investing and financing activities in India with a market cap of ₹101.04 billion.

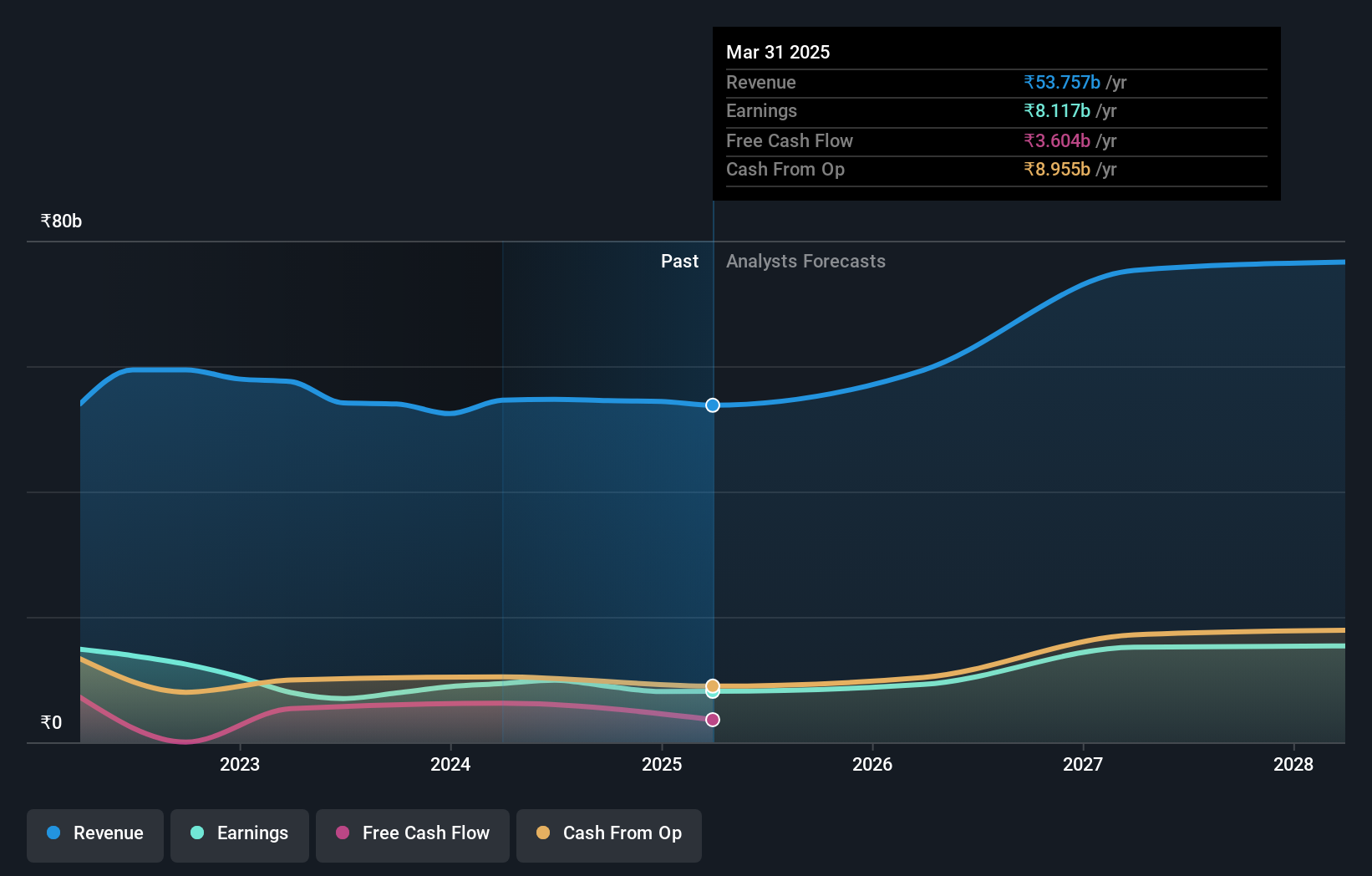

Operations: JSW Holdings generates revenue primarily from its investing and financing activities, amounting to ₹1.71 billion. The net profit margin stands at 97.52%.

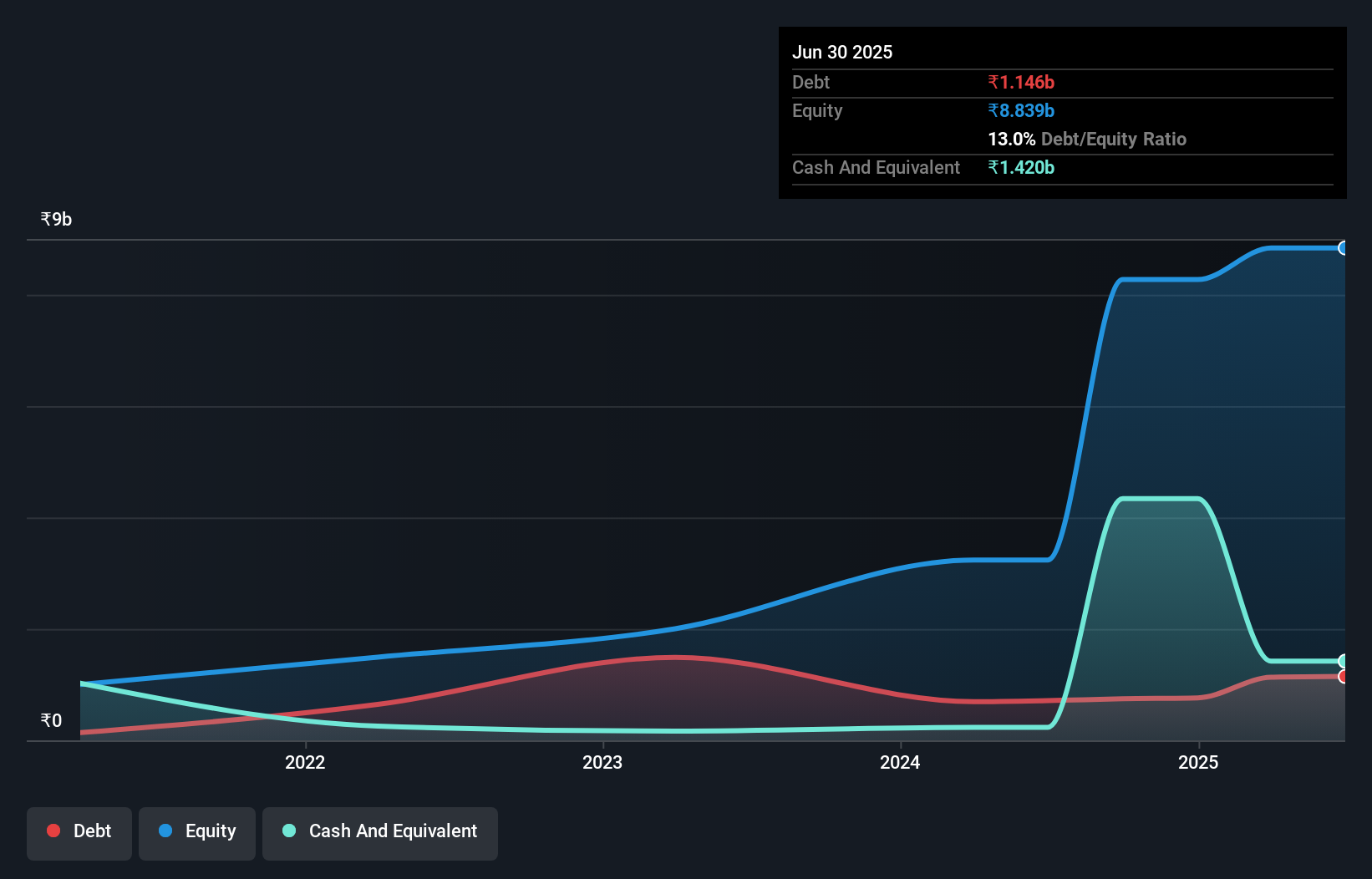

JSW Holdings, a smaller player in the market, recently reported Q1 2024 revenue of INR 272.32 million and net income of INR 525.81 million, showing significant improvement from last year’s figures. The company has no debt and is free cash flow positive, which indicates strong financial health. Notably, it was added to the S&P Global BMI Index on September 23, 2024. Despite negative earnings growth (-47.5%) over the past year compared to industry averages, its high-quality earnings remain a highlight.

- Click to explore a detailed breakdown of our findings in JSW Holdings' health report.

Gain insights into JSW Holdings' past trends and performance with our Past report.

Summing It All Up

- Click this link to deep-dive into the 475 companies within our Indian Undiscovered Gems With Strong Fundamentals screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JSWHL

JSW Holdings

A non-banking financial company, primarily engages in investing and financing activities in India.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives