- India

- /

- Real Estate

- /

- NSEI:ARKADE

Uncovering Hidden Gems In India This September 2024

Reviewed by Simply Wall St

The Indian market has been experiencing a unique rally, driven primarily by large-cap stocks, while mid-and small-cap stocks have shown a negative bias. Despite this trend, the influx of foreign institutional investor (FII) liquidity is providing some momentum to domestic markets. In such an environment, identifying good stocks involves looking for companies with strong fundamentals and growth potential that can thrive even when broader market conditions are challenging.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| 3B Blackbio Dx | 0.38% | -0.88% | -1.47% | ★★★★★★ |

| Aeroflex Industries | 0.04% | 14.69% | 33.38% | ★★★★★★ |

| AGI Infra | 61.29% | 29.16% | 33.44% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 42.61% | 42.95% | ★★★★★★ |

| Voith Paper Fabrics India | 0.07% | 10.95% | 9.70% | ★★★★★☆ |

| Gallantt Ispat | 18.85% | 37.56% | 37.26% | ★★★★★☆ |

| Indo Tech Transformers | 2.30% | 22.05% | 60.31% | ★★★★★☆ |

| Ingersoll-Rand (India) | 1.05% | 14.88% | 27.54% | ★★★★★☆ |

| Macpower CNC Machines | 0.40% | 22.04% | 31.09% | ★★★★★☆ |

| Share India Securities | 24.23% | 37.59% | 48.98% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Arkade Developers (NSEI:ARKADE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Arkade Developers Limited operates as a real estate development company in India with a market cap of ₹28.89 billion.

Operations: Arkade Developers generates revenue primarily from real estate development, amounting to ₹6.35 billion.

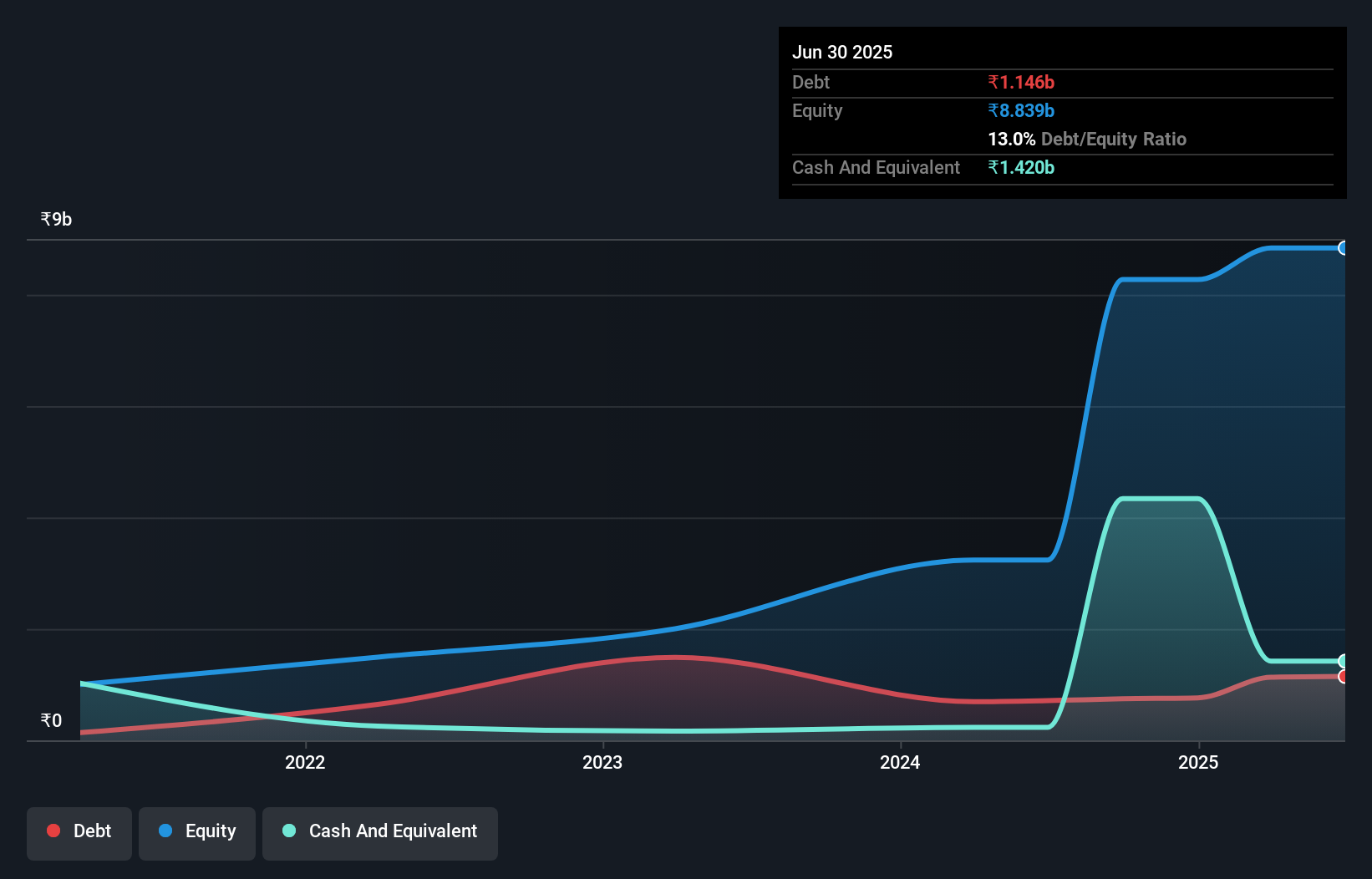

Earnings for Arkade Developers surged by 141.9% over the past year, outpacing the Real Estate industry's 24.1%. Their net debt to equity ratio stands at a satisfactory 14.2%, with EBIT covering interest payments 12.2 times over. Recently, Arkade completed an IPO raising INR 4.1 billion and reported annual sales of INR 6,347 million compared to INR 2,202 million last year, with net income climbing to INR 1,228 million from INR 508 million previously.

- Take a closer look at Arkade Developers' potential here in our health report.

Evaluate Arkade Developers' historical performance by accessing our past performance report.

Godawari Power & Ispat (NSEI:GPIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Godawari Power & Ispat Limited, along with its subsidiaries, is involved in iron ore mining in India and has a market cap of ₹136.48 billion.

Operations: GPIL's primary revenue streams are derived from iron ore mining activities in India. The company's cost structure includes expenses related to mining operations and associated logistics. Notably, GPIL's net profit margin has shown variability over recent periods, reflecting fluctuations in operational efficiency and market conditions.

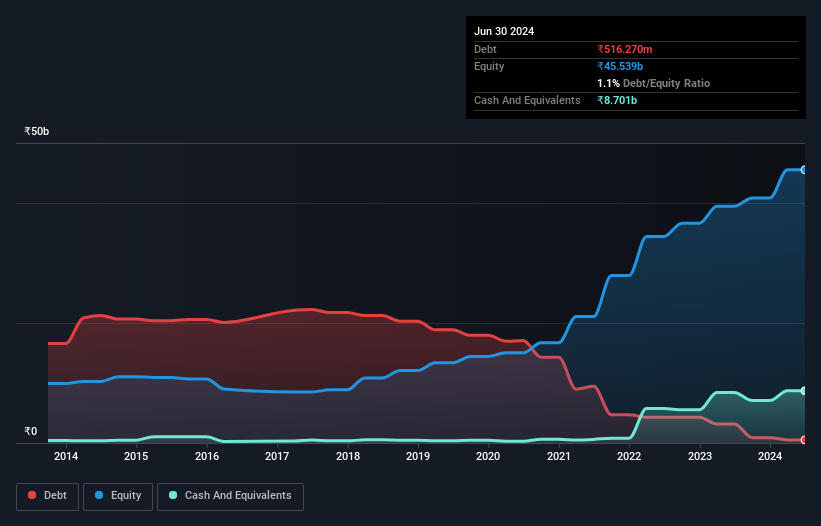

Godawari Power & Ispat (GPIL) has demonstrated strong performance with earnings growth of 42.1% over the past year, outpacing the Metals and Mining industry’s 19.3%. The company’s debt to equity ratio has significantly improved from 141.1% to 1.1% in five years, showing robust financial health. Additionally, GPIL trades at a favorable P/E ratio of 13.8x compared to the Indian market's 34.1x, indicating good value for investors seeking opportunities in this sector.

- Unlock comprehensive insights into our analysis of Godawari Power & Ispat stock in this health report.

Gain insights into Godawari Power & Ispat's past trends and performance with our Past report.

JSW Holdings (NSEI:JSWHL)

Simply Wall St Value Rating: ★★★★★☆

Overview: JSW Holdings Limited, a non-banking financial company, primarily engages in investing and financing activities in India with a market cap of ₹97.93 billion.

Operations: JSW Holdings generates revenue primarily from its investing and financing activities, amounting to ₹1.71 billion.

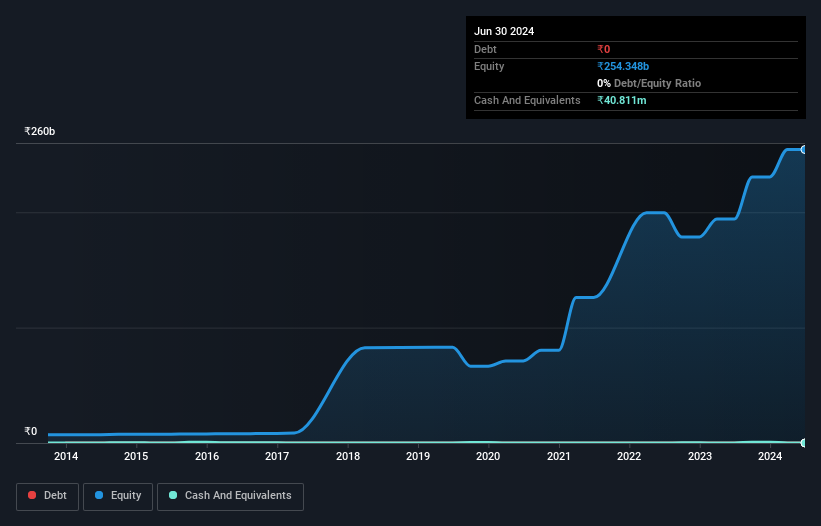

JSW Holdings, despite its small cap nature, has shown resilience with a net income of INR 525.81 million in Q1 2024, compared to INR 243.57 million the previous year. The company is debt-free and reported high-quality earnings. It was recently added to the S&P Global BMI Index on September 23, 2024. Basic earnings per share from continuing operations surged to INR 47.38 from INR 21.95 a year ago, indicating robust profitability improvements.

- Navigate through the intricacies of JSW Holdings with our comprehensive health report here.

Examine JSW Holdings' past performance report to understand how it has performed in the past.

Make It Happen

- Dive into all 475 of the Indian Undiscovered Gems With Strong Fundamentals we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ARKADE

Arkade Developers

Operates as a real estate development company in India.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion