- India

- /

- Real Estate

- /

- NSEI:ARIHANTSUP

Further Upside For Arihant Superstructures Limited (NSE:ARIHANTSUP) Shares Could Introduce Price Risks After 27% Bounce

Arihant Superstructures Limited (NSE:ARIHANTSUP) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 94% in the last year.

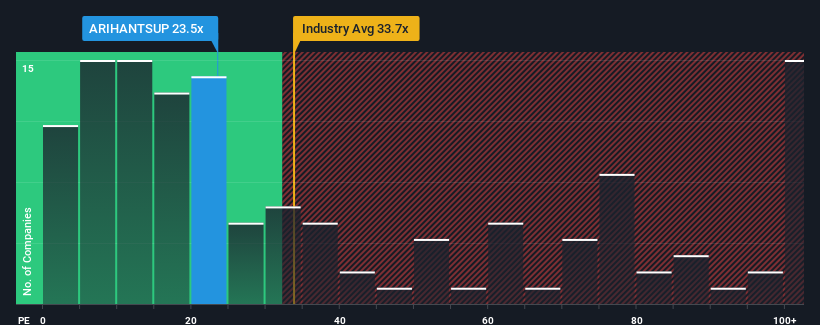

In spite of the firm bounce in price, given about half the companies in India have price-to-earnings ratios (or "P/E's") above 35x, you may still consider Arihant Superstructures as an attractive investment with its 23.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Arihant Superstructures has been doing a decent job lately as it's been growing earnings at a reasonable pace. One possibility is that the P/E is low because investors think this good earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

Check out our latest analysis for Arihant Superstructures

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Arihant Superstructures' is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a decent 5.2% gain to the company's bottom line. Pleasingly, EPS has also lifted 469% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Arihant Superstructures is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Arihant Superstructures' P/E

Arihant Superstructures' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Arihant Superstructures revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

It is also worth noting that we have found 3 warning signs for Arihant Superstructures (2 are concerning!) that you need to take into consideration.

You might be able to find a better investment than Arihant Superstructures. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ARIHANTSUP

Arihant Superstructures

Operates as a real estate development company in India.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026