While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is important. We'll use ROE to examine Vimta Labs Limited (NSE:VIMTALABS), by way of a worked example.

Vimta Labs has a ROE of 8.3%, based on the last twelve months. Another way to think of that is that for every ₹1 worth of equity in the company, it was able to earn ₹0.08.

See our latest analysis for Vimta Labs

How Do You Calculate ROE?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

Or for Vimta Labs:

8.3% = ₹140m ÷ ₹1.7b (Based on the trailing twelve months to September 2019.)

It's easy to understand the 'net profit' part of that equation, but 'shareholders' equity' requires further explanation. It is all earnings retained by the company, plus any capital paid in by shareholders. You can calculate shareholders' equity by subtracting the company's total liabilities from its total assets.

What Does Return On Equity Signify?

ROE looks at the amount a company earns relative to the money it has kept within the business. The 'return' is the yearly profit. A higher profit will lead to a higher ROE. So, all else being equal, a high ROE is better than a low one. That means ROE can be used to compare two businesses.

Does Vimta Labs Have A Good ROE?

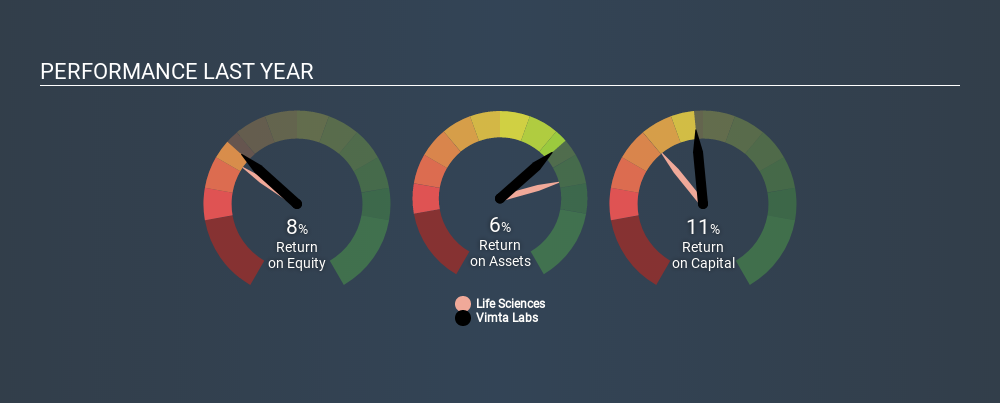

By comparing a company's ROE with its industry average, we can get a quick measure of how good it is. The limitation of this approach is that some companies are quite different from others, even within the same industry classification. The image below shows that Vimta Labs has an ROE that is roughly in line with the Life Sciences industry average (7.0%).

That's not overly surprising. ROE tells us about the quality of the business, but it does not give us much of an idea if the share price is cheap. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

How Does Debt Impact Return On Equity?

Virtually all companies need money to invest in the business, to grow profits. That cash can come from issuing shares, retained earnings, or debt. In the first two cases, the ROE will capture this use of capital to grow. In the latter case, the use of debt will improve the returns, but will not change the equity. That will make the ROE look better than if no debt was used.

Vimta Labs's Debt And Its 8.3% ROE

While Vimta Labs does have some debt, with debt to equity of just 0.12, we wouldn't say debt is excessive. Its ROE is quite low, and the company already has some debt, so surely shareholders are hoping for an improvement. Careful use of debt to boost returns is often very good for shareholders. However, it could reduce the company's ability to take advantage of future opportunities.

The Bottom Line On ROE

Return on equity is one way we can compare the business quality of different companies. A company that can achieve a high return on equity without debt could be considered a high quality business. If two companies have the same ROE, then I would generally prefer the one with less debt.

Having said that, while ROE is a useful indicator of business quality, you'll have to look at a whole range of factors to determine the right price to buy a stock. It is important to consider other factors, such as future profit growth -- and how much investment is required going forward. Check the past profit growth by Vimta Labs by looking at this visualization of past earnings, revenue and cash flow.

Of course Vimta Labs may not be the best stock to buy. So you may wish to see this free collection of other companies that have high ROE and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:VIMTALABS

Vimta Labs

Provides contract research and testing services in India and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion