Even With A 26% Surge, Cautious Investors Are Not Rewarding Solara Active Pharma Sciences Limited's (NSE:SOLARA) Performance Completely

Despite an already strong run, Solara Active Pharma Sciences Limited (NSE:SOLARA) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days bring the annual gain to a very sharp 31%.

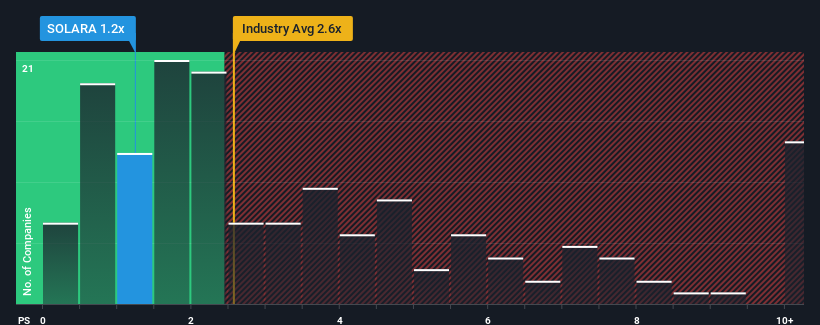

Even after such a large jump in price, Solara Active Pharma Sciences may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.2x, considering almost half of all companies in the Pharmaceuticals industry in India have P/S ratios greater than 2.6x and even P/S higher than 6x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Solara Active Pharma Sciences

What Does Solara Active Pharma Sciences' Recent Performance Look Like?

Solara Active Pharma Sciences hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Solara Active Pharma Sciences will help you uncover what's on the horizon.How Is Solara Active Pharma Sciences' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Solara Active Pharma Sciences' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.2%. This means it has also seen a slide in revenue over the longer-term as revenue is down 4.3% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 18% over the next year. That's shaping up to be materially higher than the 12% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Solara Active Pharma Sciences' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Solara Active Pharma Sciences' P/S?

The latest share price surge wasn't enough to lift Solara Active Pharma Sciences' P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look at Solara Active Pharma Sciences' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Solara Active Pharma Sciences that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SOLARA

Solara Active Pharma Sciences

Manufactures, produces, processes, formulates, sells, imports, exports, merchandises, distributes, trades in, and deals in active pharmaceutical ingredients (API) in India, Asia Pacific, Europe, North America, South America, and internationally.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives