We Don’t Think Nirman Agri Genetics' (NSE:NIRMAN) Earnings Should Make Shareholders Too Comfortable

Investors appear disappointed with Nirman Agri Genetics Limited's (NSE:NIRMAN) recent earnings, despite the decent statutory profit number. We think that they may be worried about something else, so we did some analysis and found that investors have noticed some soft numbers underlying the profit.

A Closer Look At Nirman Agri Genetics' Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

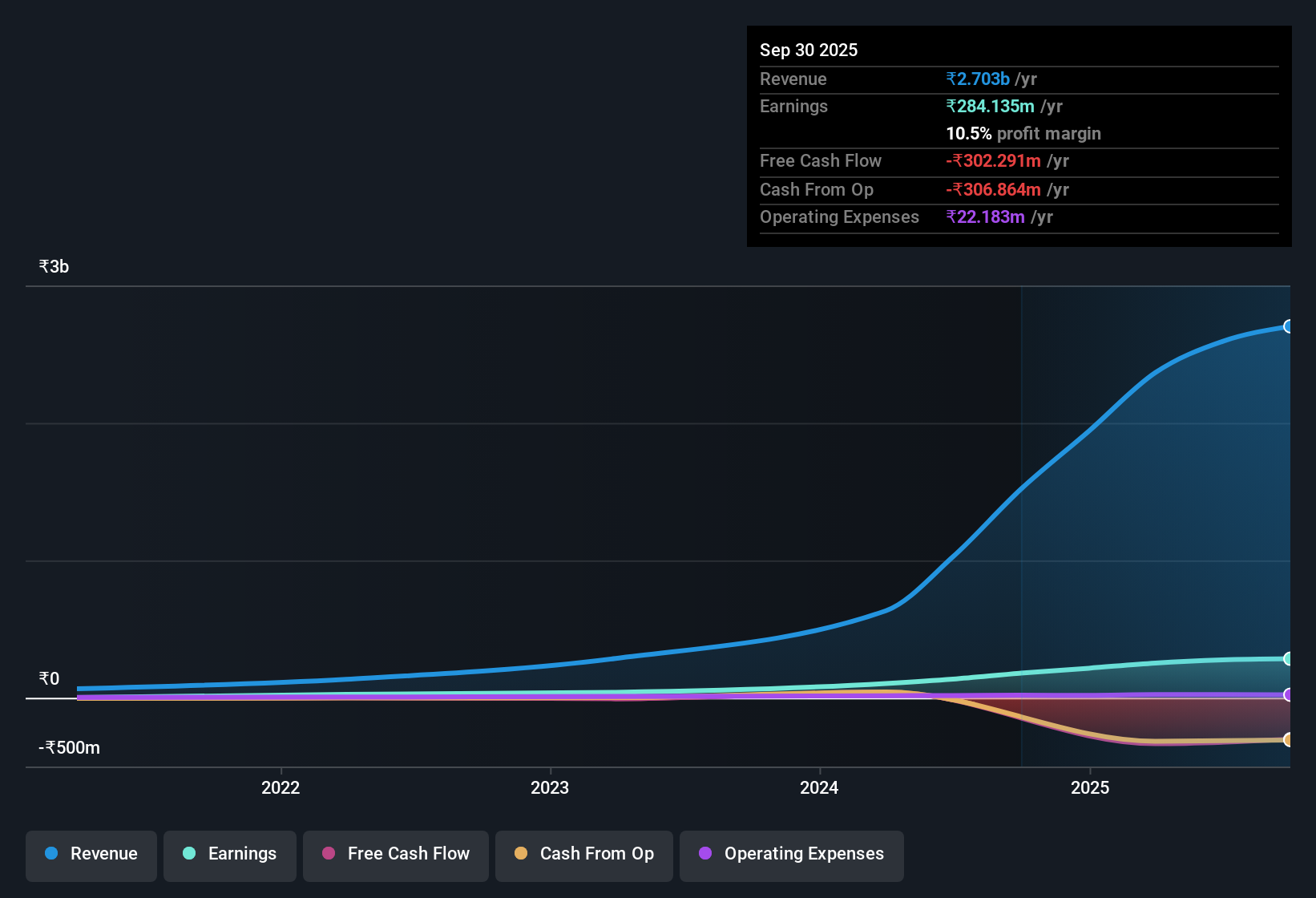

Nirman Agri Genetics has an accrual ratio of 0.57 for the year to September 2025. As a general rule, that bodes poorly for future profitability. To wit, the company did not generate one whit of free cashflow in that time. Over the last year it actually had negative free cash flow of ₹302m, in contrast to the aforementioned profit of ₹284.1m. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of ₹302m, this year, indicates high risk. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Nirman Agri Genetics.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. In fact, Nirman Agri Genetics increased the number of shares on issue by 34% over the last twelve months by issuing new shares. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Nirman Agri Genetics' EPS by clicking here.

A Look At The Impact Of Nirman Agri Genetics' Dilution On Its Earnings Per Share (EPS)

As you can see above, Nirman Agri Genetics has been growing its net income over the last few years, with an annualized gain of 765% over three years. But EPS was only up 324% per year, in the exact same period. And at a glance the 58% gain in profit over the last year impresses. But in comparison, EPS only increased by 38% over the same period. So you can see that the dilution has had a fairly significant impact on shareholders.

In the long term, earnings per share growth should beget share price growth. So it will certainly be a positive for shareholders if Nirman Agri Genetics can grow EPS persistently. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On Nirman Agri Genetics' Profit Performance

As it turns out, Nirman Agri Genetics couldn't match its profit with cashflow and its dilution means that earnings per share growth is lagging net income growth. For the reasons mentioned above, we think that a perfunctory glance at Nirman Agri Genetics' statutory profits might make it look better than it really is on an underlying level. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. When we did our research, we found 5 warning signs for Nirman Agri Genetics (4 are potentially serious!) that we believe deserve your full attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Nirman Agri Genetics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NIRMAN

Moderate risk with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success