As global markets navigate the pressures of rising U.S. Treasury yields and tepid economic growth, small-cap stocks have faced particular challenges, with indices like the Russell 2000 showing notable declines. In this environment, identifying promising investment opportunities requires a focus on companies that demonstrate resilience and potential for growth despite broader market headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 7.75% | 1.96% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★★★★

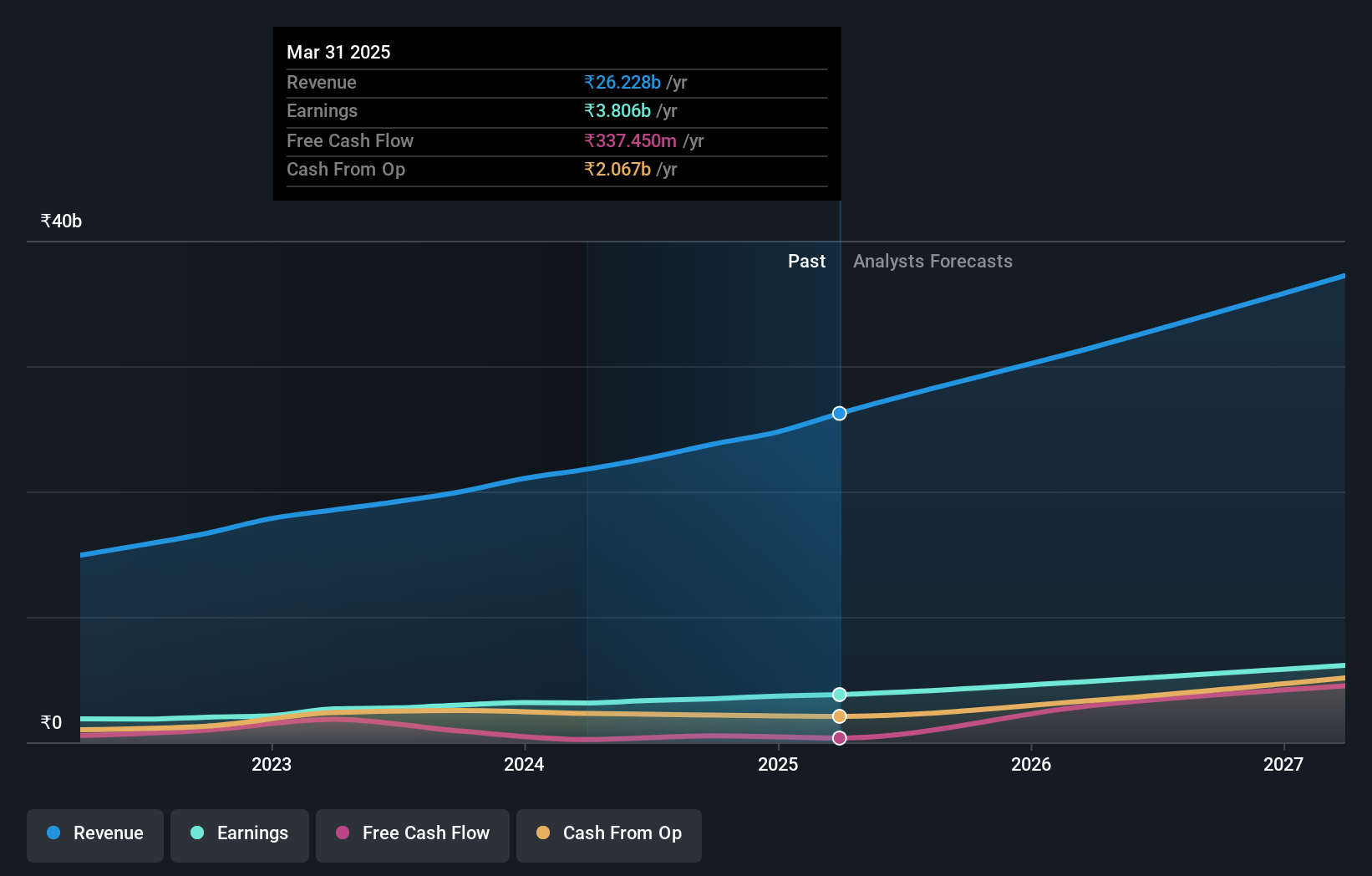

Overview: Marksans Pharma Limited, along with its subsidiaries, is involved in the research, manufacturing, marketing, and sale of pharmaceutical formulations across various international markets including the United States and Europe, with a market cap of ₹126.34 billion.

Operations: Marksans Pharma generates revenue primarily from its pharmaceutical segment, amounting to ₹22.68 billion.

Marksans Pharma, a dynamic player in the pharmaceutical industry, has showcased robust earnings growth of 21.7% over the past year, outpacing the sector's 19.1%. The company's debt to equity ratio improved significantly from 19.9% to 11.7% over five years, highlighting prudent financial management. With interest payments well covered by EBIT at a ratio of 32x, Marksans exhibits strong financial health. Recently, it declared a dividend of INR 0.60 per share and received positive feedback from USFDA inspections at its Goa facility, signaling operational strength and potential for continued expansion into European markets through M&A activities.

Jianshe Industry Group (Yunnan) (SZSE:002265)

Simply Wall St Value Rating: ★★★★★☆

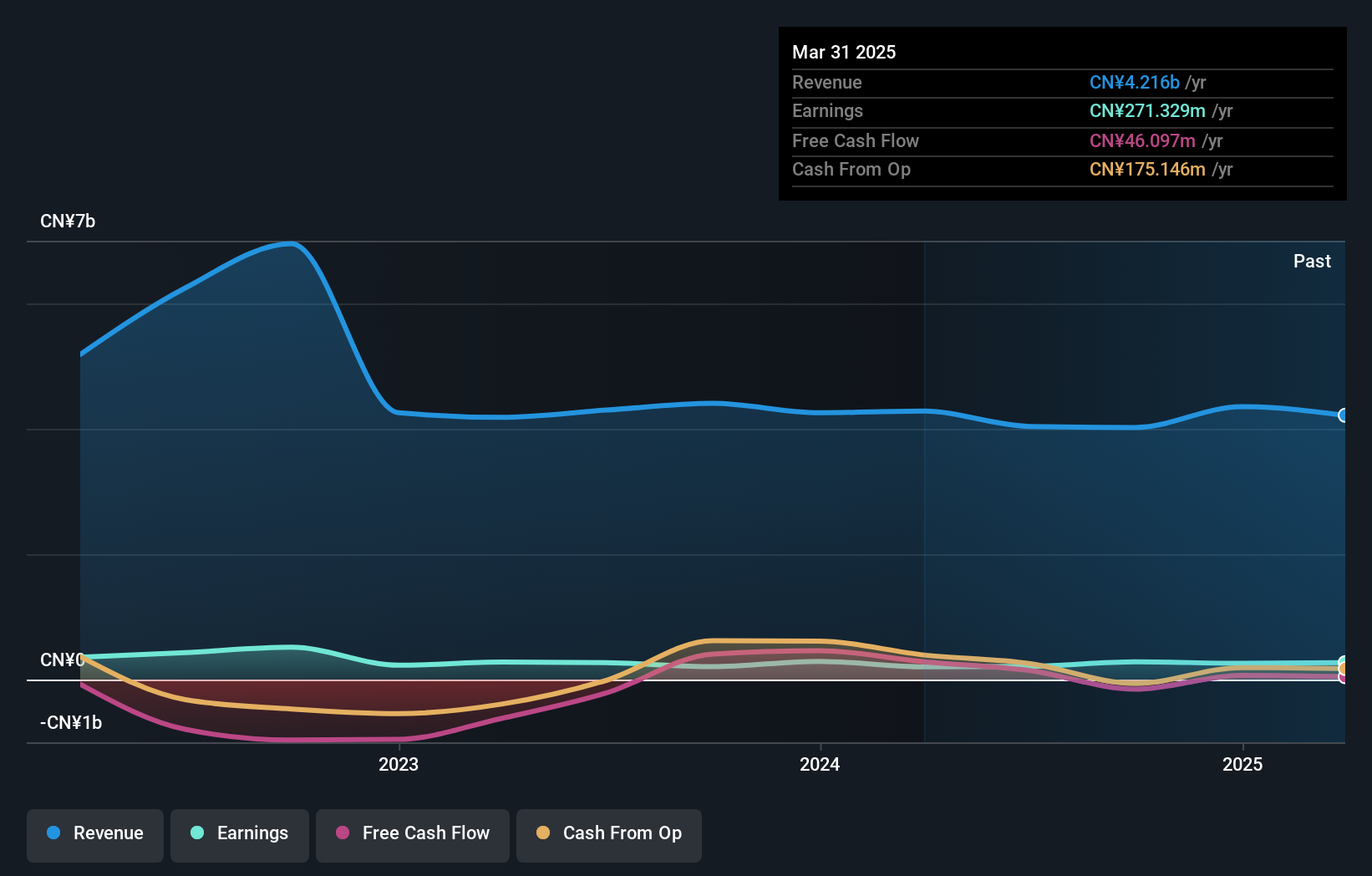

Overview: Jianshe Industry Group (Yunnan) Co., Ltd. is engaged in manufacturing operations and has a market capitalization of approximately CN¥11.66 billion.

Operations: The company generates revenue primarily from its manufacturing segment, totaling approximately CN¥4.02 billion.

Jianshe Industry Group, a relatively small player in the industry, has shown notable earnings growth of 37.7% over the past year, outpacing the Auto Components sector's 12.2%. Despite this impressive growth, recent financials reveal some challenges; sales for the nine months ending September 2024 were CNY 2.93 billion compared to CNY 3.16 billion a year prior, with net income slightly down to CNY 183 million from CNY 191 million. The company seems well-positioned financially as it has more cash than total debt and reduced its debt-to-equity ratio from 22.3% to 13.2% over five years, suggesting prudent financial management amidst fluctuating revenues.

Sumitomo Riko (TSE:5191)

Simply Wall St Value Rating: ★★★★★★

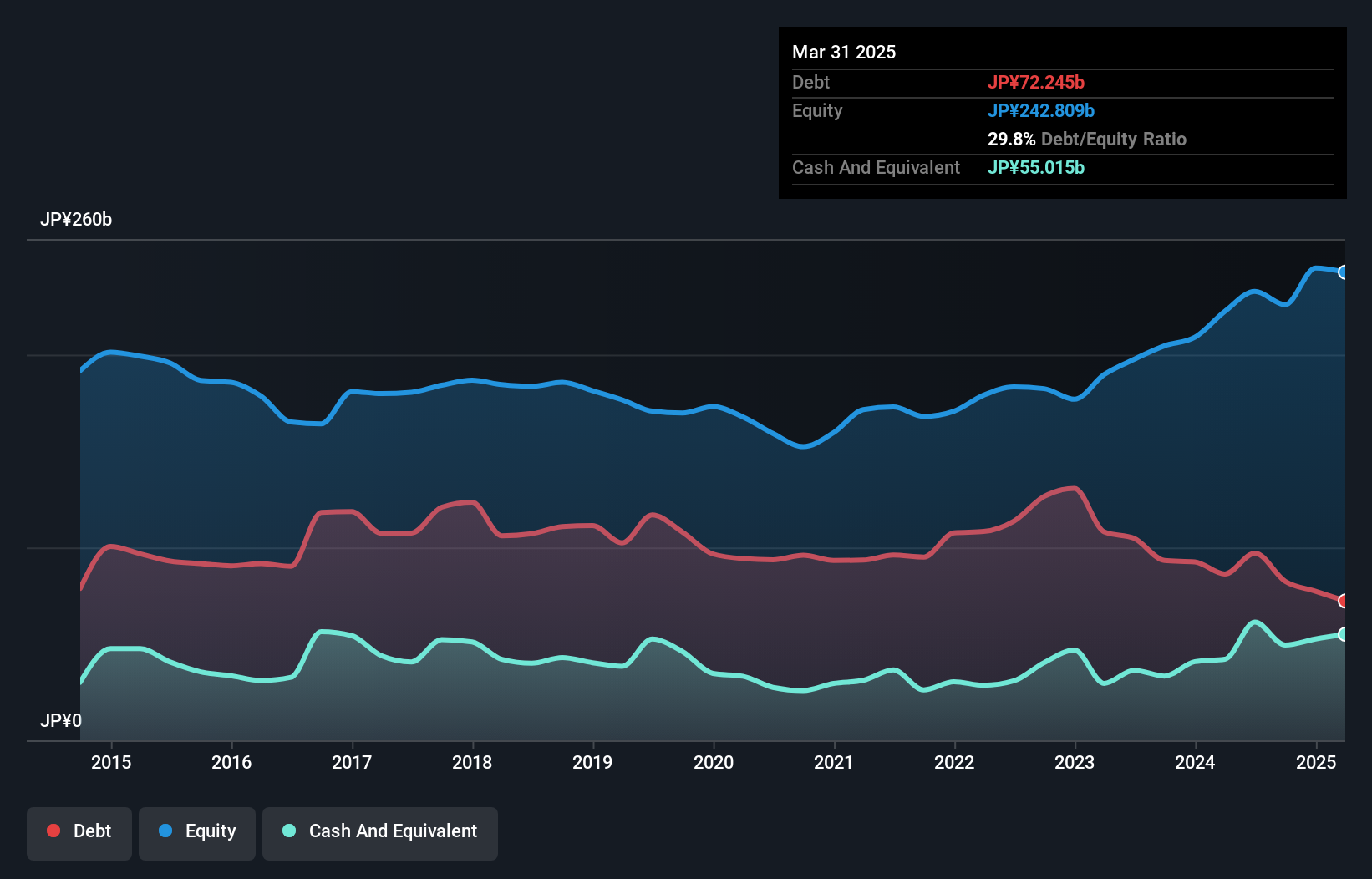

Overview: Sumitomo Riko Company Limited specializes in the manufacture and sale of automotive parts, with a market capitalization of ¥154.49 billion.

Operations: The company generates revenue primarily from automobile supplies, contributing ¥572.89 billion, and general industrial supplies at ¥74.47 billion.

Sumitomo Riko, a promising player in the auto components sector, has seen its earnings soar by 68.8% over the past year, significantly outpacing the industry's 17.1% growth rate. This company showcases a robust financial health with a debt to equity ratio dropping from 68.5% to 41.7% over five years and an impressive EBIT coverage of interest payments at 33.8 times. The price-to-earnings ratio stands attractively at 7.7x compared to Japan's market average of 13.3x, suggesting potential undervaluation in this space and highlighting its appeal for those seeking value opportunities within niche markets like auto components.

- Delve into the full analysis health report here for a deeper understanding of Sumitomo Riko.

Examine Sumitomo Riko's past performance report to understand how it has performed in the past.

Make It Happen

- Click this link to deep-dive into the 4734 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MARKSANS

Marksans Pharma

Engages in the research, manufacturing, marketing, and sale of pharmaceutical formulations in the United States, North America, Europe, the United Kingdom, Australia, New Zealand, and internationally.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives