Exploring Three Undervalued Small Caps With Insider Action In The Region

Reviewed by Simply Wall St

As global markets display mixed reactions with a notable pivot towards small-cap and value shares, investors are keenly observing these segments for potential opportunities. In such an environment, identifying undervalued small-cap stocks with significant insider action can offer intriguing prospects for discerning investors looking to capitalize on market shifts and underlying economic signals.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Dundee Precious Metals | 8.8x | 3.0x | 45.84% | ★★★★★★ |

| Hanover Bancorp | 9.0x | 2.0x | 45.60% | ★★★★★☆ |

| Thryv Holdings | NA | 0.7x | 26.07% | ★★★★★☆ |

| CVS Group | 21.6x | 1.2x | 40.01% | ★★★★☆☆ |

| Franklin Financial Services | 9.8x | 2.0x | 31.19% | ★★★★☆☆ |

| PCB Bancorp | 10.5x | 2.8x | 35.07% | ★★★★☆☆ |

| Chatham Lodging Trust | NA | 1.4x | 12.53% | ★★★★☆☆ |

| Russel Metals | 9.4x | 0.5x | -10.77% | ★★★☆☆☆ |

| PowerCell Sweden | NA | 4.5x | 40.55% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Marksans Pharma is a pharmaceutical company with operations focused on the manufacturing and marketing of formulation products, holding a market capitalization of approximately ₹21.77 billion.

Operations: The pharmaceuticals segment generated ₹21.77 billion in revenue, with a gross profit margin of 52.32% as of the latest reporting period, reflecting significant operational efficiency in managing costs relative to sales.

PE: 29.6x

Recently, Marksans Pharma showcased a notable financial performance with a year-on-year revenue increase to INR 22.28 billion for FY 2024, up from INR 19.11 billion. Their net income also rose to INR 3.14 billion, reflecting a robust growth trajectory. Insider confidence is evident as they recommended increasing the dividend to INR 0.60 per share, signaling strong future prospects and financial health. This move aligns with their earnings growth forecast of 21.63% annually, underscoring their potential as an undervalued entity in the pharmaceutical sector.

- Navigate through the intricacies of Marksans Pharma with our comprehensive valuation report here.

Gain insights into Marksans Pharma's past trends and performance with our Past report.

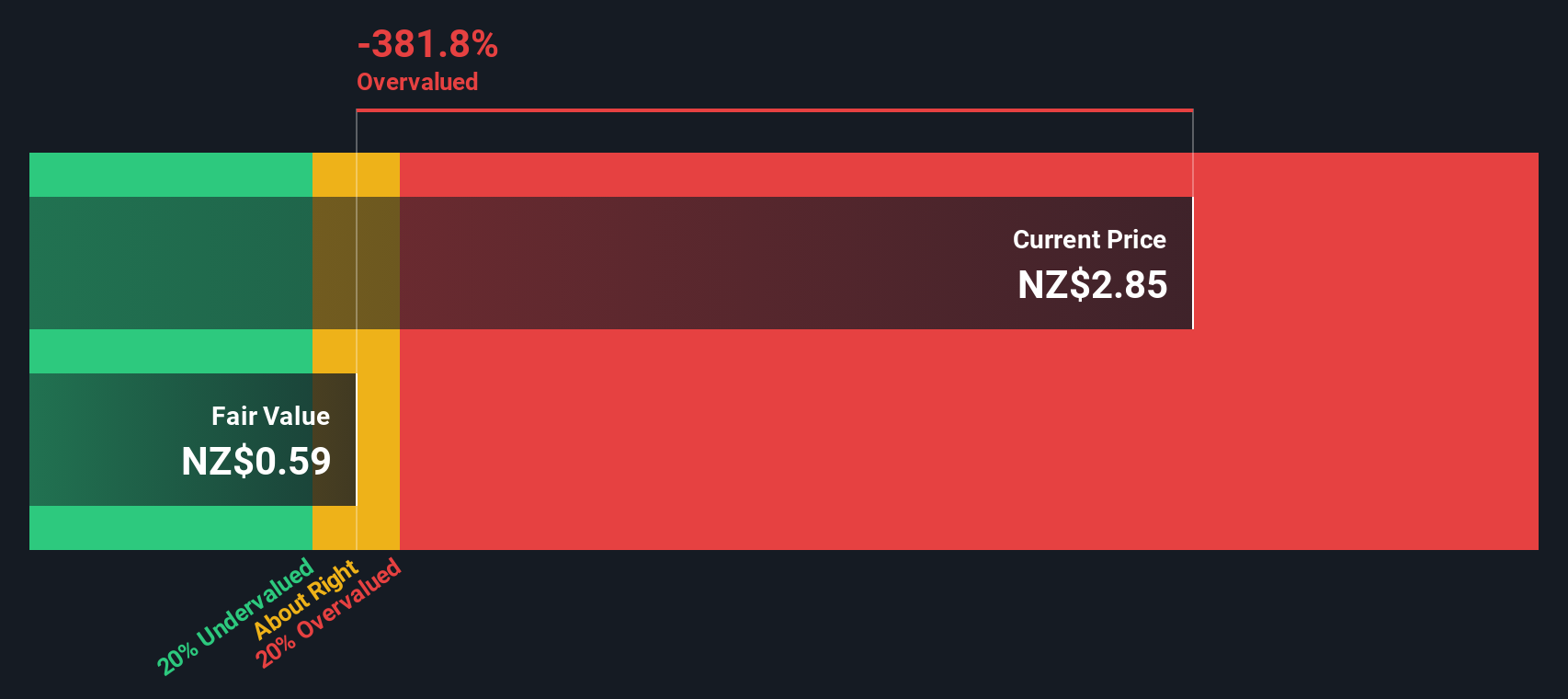

Ryman Healthcare (NZSE:RYM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Ryman Healthcare operates integrated retirement villages for older people, with a market capitalization of approximately NZ$5.72 billion.

Operations: The entity generates NZ$687.56 million from its integrated retirement villages, with a gross profit margin recently reported at 5.19%. Notably, the net income margin has seen fluctuations, currently standing at approximately 0.69%.

PE: 651.4x

Ryman Healthcare, despite a challenging fiscal year with net income dropping to NZ$4.78 million from NZ$257.84 million, shows potential underpinned by a revenue increase to NZ$689.89 million and insider confidence, as evidenced by recent share purchases by executives. This strategic buying hints at internal optimism about the company's future prospects amidst its current financial recalibration and high debt levels. With earnings expected to grow 22.19% annually, Ryman's adjustment of auditors to PwC could further align its strategic goals for robust governance and financial management.

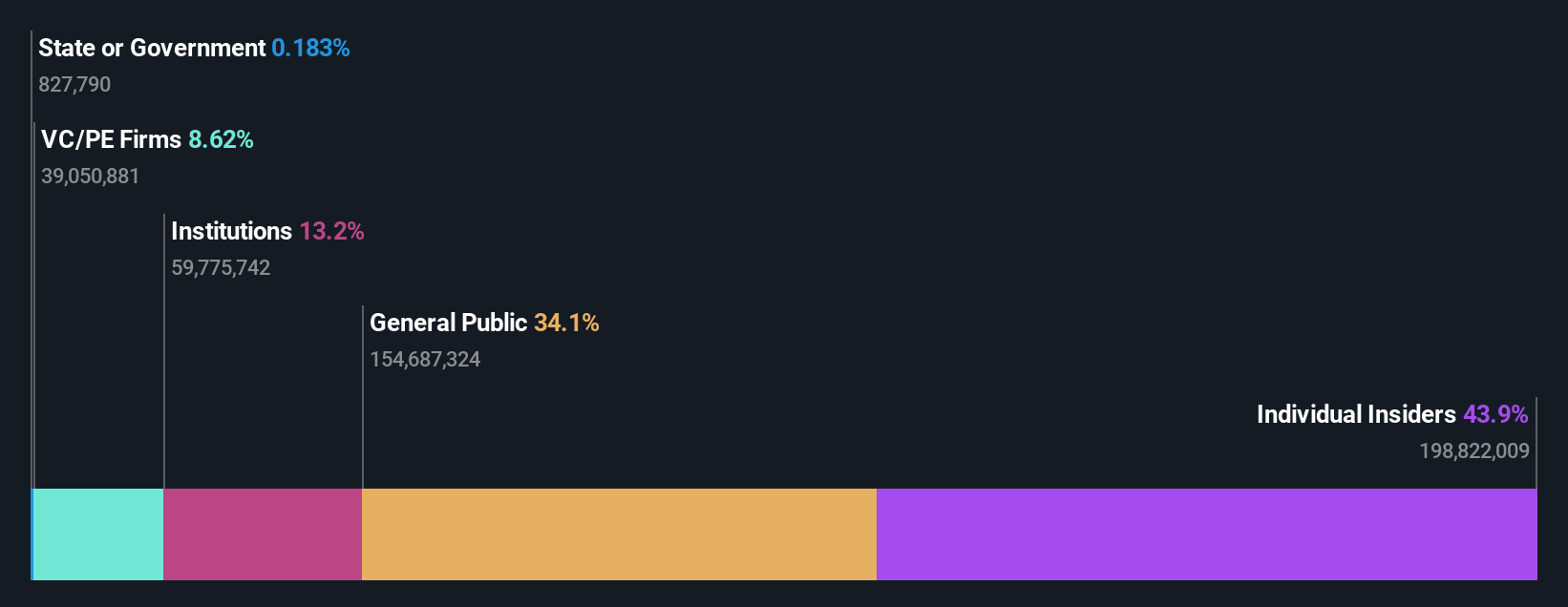

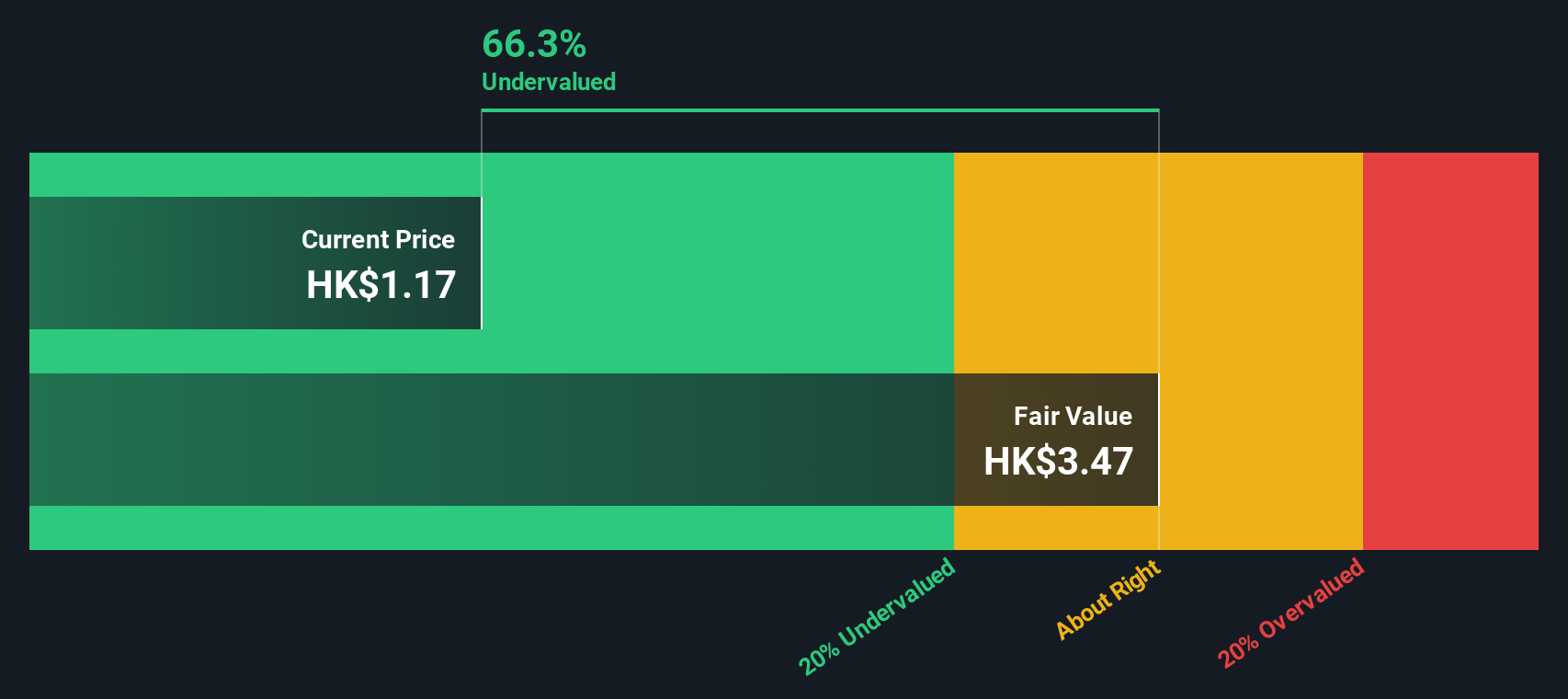

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kinetic Development Group is a company involved in various business sectors, with a market capitalization of approximately CN¥2.07 billion.

Operations: The company's gross profit margin has seen a significant increase from 9.05% in September 2013 to 59.07% in December 2024, reflecting improved efficiency or pricing strategies over the period. In contrast, net income has fluctuated, turning positive since June 2014 and growing to CN¥2.08 billion by December 2024, indicating varying profitability amidst operational adjustments and market conditions.

PE: 4.0x

Kinetic Development Group, reflecting a strategic pivot in its governance, recently overhauled its corporate bylaws on May 7, 2024, signaling a streamlined operational approach. Despite a modest dividend cut to HK$0.05 per share announced the same day, insider confidence remains robust with recent purchases underscoring belief in the company's prospects. This aligns with their financial strategy reliant solely on external borrowing—a higher risk yet potentially rewarding approach given the firm's market positioning and growth trajectory.

Summing It All Up

- Investigate our full lineup of 214 Undervalued Small Caps With Insider Buying right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MARKSANS

Marksans Pharma

Engages in the research, manufacturing, marketing, and sale of pharmaceutical formulations in the United States, North America, Europe, the United Kingdom, Australia, New Zealand, and internationally.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives