Lyka Labs (NSE:LYKALABS) shareholder returns have been enviable, earning 527% in 5 years

For many, the main point of investing in the stock market is to achieve spectacular returns. While the best companies are hard to find, but they can generate massive returns over long periods. For example, the Lyka Labs Limited (NSE:LYKALABS) share price is up a whopping 527% in the last half decade, a handsome return for long term holders. This just goes to show the value creation that some businesses can achieve. It's also good to see the share price up 27% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 21% in 90 days). We love happy stories like this one. The company should be really proud of that performance!

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for Lyka Labs

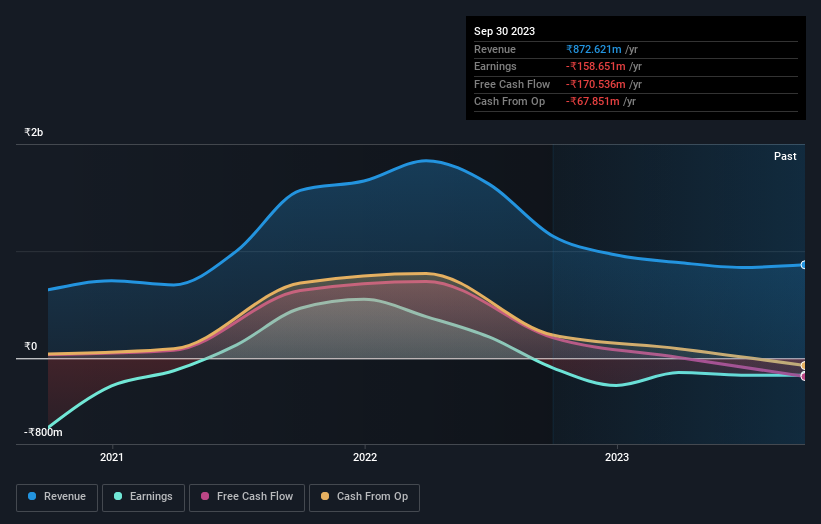

Given that Lyka Labs didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Lyka Labs' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Lyka Labs shareholders gained a total return of 14% during the year. Unfortunately this falls short of the market return. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 44% over five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Lyka Labs (1 is significant!) that you should be aware of before investing here.

But note: Lyka Labs may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LYKALABS

Lyka Labs

A pharmaceutical company, develops, manufactures, and markets pharmaceutical formulations and active pharmaceutical ingredients in India.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives