Ind-Swift Laboratories Limited's (NSE:INDSWFTLAB) Revenues Are Not Doing Enough For Some Investors

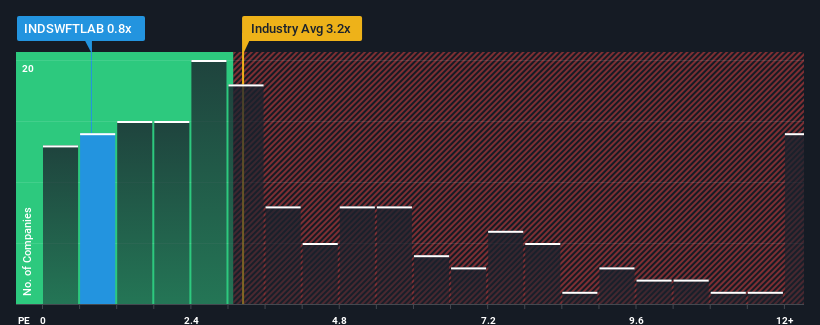

With a price-to-sales (or "P/S") ratio of 0.8x Ind-Swift Laboratories Limited (NSE:INDSWFTLAB) may be sending very bullish signals at the moment, given that almost half of all the Pharmaceuticals companies in India have P/S ratios greater than 3.2x and even P/S higher than 6x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Ind-Swift Laboratories

How Ind-Swift Laboratories Has Been Performing

For instance, Ind-Swift Laboratories' receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Ind-Swift Laboratories will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Ind-Swift Laboratories' earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Ind-Swift Laboratories would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 5.3% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 13% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Ind-Swift Laboratories' P/S sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Ind-Swift Laboratories' P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

In line with expectations, Ind-Swift Laboratories maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Ind-Swift Laboratories is showing 4 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of Ind-Swift Laboratories' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INDSWFTLAB

Ind-Swift Laboratories

Develops, manufactures, and sells active pharmaceutical ingredients (APIs), intermediates, and formulations in India and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives