Why We're Not Concerned About Eris Lifesciences Limited's (NSE:ERIS) Share Price

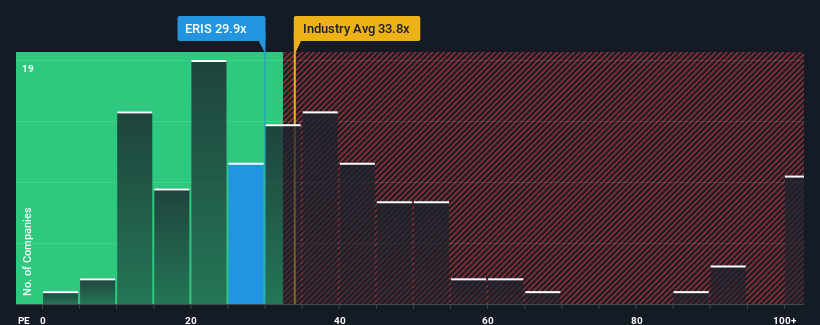

With a median price-to-earnings (or "P/E") ratio of close to 31x in India, you could be forgiven for feeling indifferent about Eris Lifesciences Limited's (NSE:ERIS) P/E ratio of 29.9x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Eris Lifesciences could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Eris Lifesciences

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Eris Lifesciences' to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 2.7%. Regardless, EPS has managed to lift by a handy 12% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 19% each year over the next three years. With the market predicted to deliver 20% growth each year, the company is positioned for a comparable earnings result.

With this information, we can see why Eris Lifesciences is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Eris Lifesciences maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Eris Lifesciences you should know about.

Of course, you might also be able to find a better stock than Eris Lifesciences. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Eris Lifesciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ERIS

Eris Lifesciences

Provides domestic branded formulations for chronic and sub-chronic therapies in India and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives