Volatility 101: Should Eris Lifesciences (NSE:ERIS) Shares Have Dropped 40%?

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Unfortunately the Eris Lifesciences Limited (NSE:ERIS) share price slid 40% over twelve months. That contrasts poorly with the market return of -14%. Eris Lifesciences may have better days ahead, of course; we've only looked at a one year period. The falls have accelerated recently, with the share price down 26% in the last three months. However, one could argue that the price has been influenced by the general market, which is down 11% in the same timeframe.

See our latest analysis for Eris Lifesciences

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

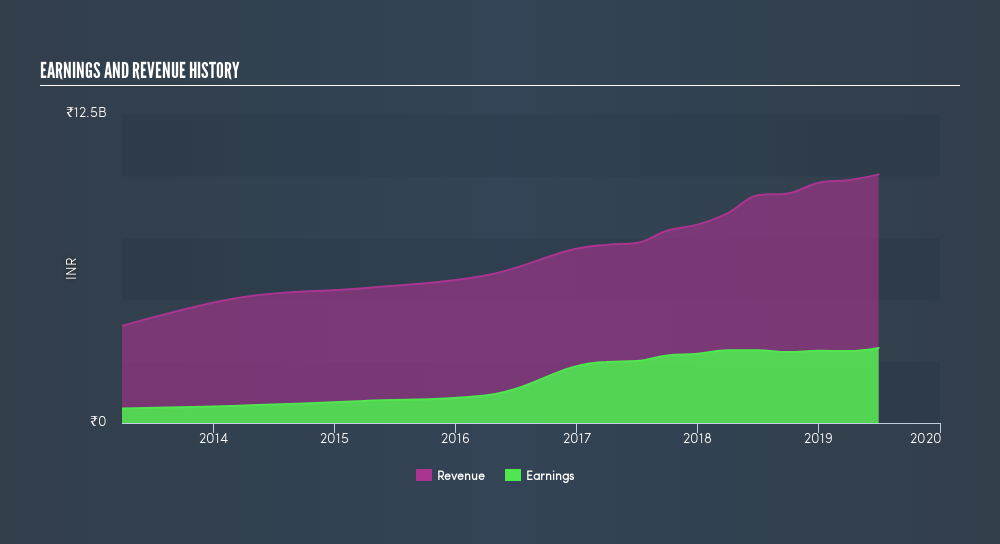

Even though the Eris Lifesciences share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth. It seems quite likely that the market was expecting higher growth from the stock. But other metrics might shed some light on why the share price is down.

Eris Lifesciences's revenue is actually up 9.2% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Eris Lifesciences shareholders are down 40% for the year, even worse than the market loss of 14%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 26%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Eris Lifesciences by clicking this link.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:ERIS

Eris Lifesciences

Provides domestic branded formulations for chronic and sub-chronic therapies in India and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives