- India

- /

- Life Sciences

- /

- NSEI:DIVISLAB

Revenues Not Telling The Story For Divi's Laboratories Limited (NSE:DIVISLAB)

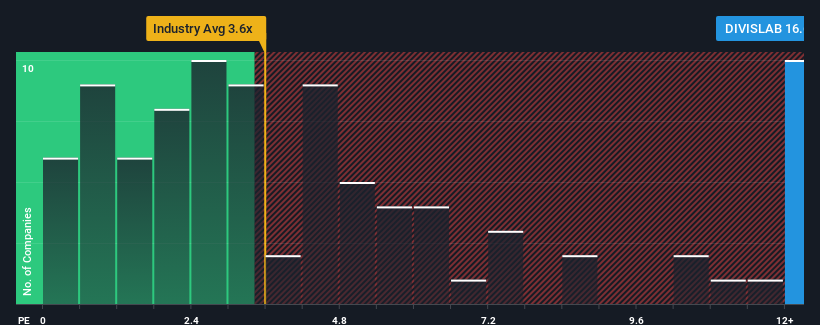

When close to half the companies in the Life Sciences industry in India have price-to-sales ratios (or "P/S") below 3.7x, you may consider Divi's Laboratories Limited (NSE:DIVISLAB) as a stock to avoid entirely with its 16.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Divi's Laboratories

How Has Divi's Laboratories Performed Recently?

Recent revenue growth for Divi's Laboratories has been in line with the industry. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Divi's Laboratories will help you uncover what's on the horizon.How Is Divi's Laboratories' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Divi's Laboratories' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. The solid recent performance means it was also able to grow revenue by 14% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 16% during the coming year according to the analysts following the company. That's shaping up to be similar to the 16% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Divi's Laboratories' P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Divi's Laboratories' P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Analysts are forecasting Divi's Laboratories' revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

You always need to take note of risks, for example - Divi's Laboratories has 2 warning signs we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DIVISLAB

Divi's Laboratories

Engages in the manufacture and sale of generic active pharmaceutical ingredients (APIs), intermediates, and nutraceuticals in India, North America, Asia, Europe, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives