Here's Why I Think TV18 Broadcast (NSE:TV18BRDCST) Is An Interesting Stock

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like TV18 Broadcast (NSE:TV18BRDCST). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for TV18 Broadcast

How Fast Is TV18 Broadcast Growing Its Earnings Per Share?

Over the last three years, TV18 Broadcast has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like the last firework on New Year's Eve accelerating into the sky, TV18 Broadcast's EPS shot from ₹1.59 to ₹3.62, over the last year. You don't see 127% year-on-year growth like that, very often.

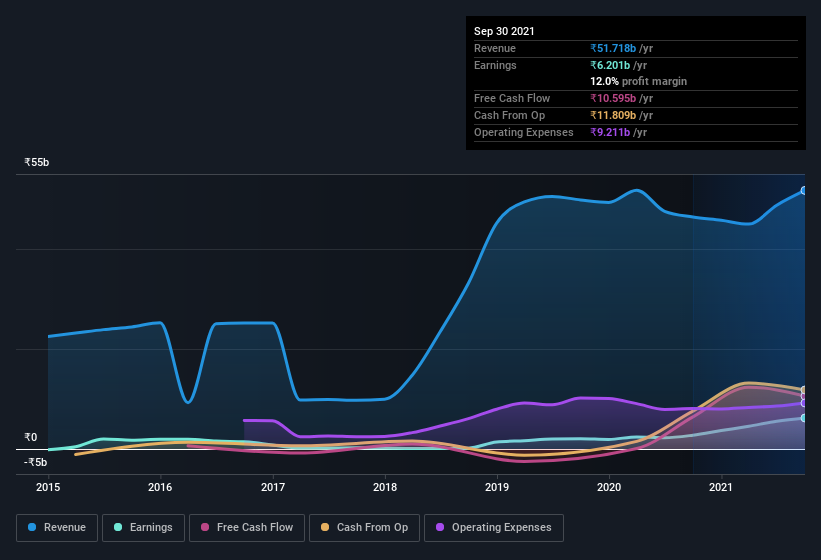

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that TV18 Broadcast is growing revenues, and EBIT margins improved by 5.3 percentage points to 18%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check TV18 Broadcast's balance sheet strength, before getting too excited.

Are TV18 Broadcast Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own TV18 Broadcast shares worth a considerable sum. To be specific, they have ₹1.6b worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 2.0% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is TV18 Broadcast Worth Keeping An Eye On?

TV18 Broadcast's earnings have taken off like any random crypto-currency did, back in 2017. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So to my mind TV18 Broadcast is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. What about risks? Every company has them, and we've spotted 1 warning sign for TV18 Broadcast you should know about.

Although TV18 Broadcast certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if TV18 Broadcast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TV18BRDCST

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives