- India

- /

- Entertainment

- /

- NSEI:TIPSMUSIC

Does Tips Industries (NSE:TIPSINDLTD) Deserve A Spot On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Tips Industries (NSE:TIPSINDLTD). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Tips Industries

How Fast Is Tips Industries Growing Its Earnings Per Share?

In the last three years Tips Industries's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, Tips Industries's EPS shot from ₹5.53 to ₹13.03, over the last year. Year on year growth of 136% is certainly a sight to behold.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Unfortunately, Tips Industries's revenue dropped 15% last year, but the silver lining is that EBIT margins improved from -2.7% to 33%. That's not ideal.

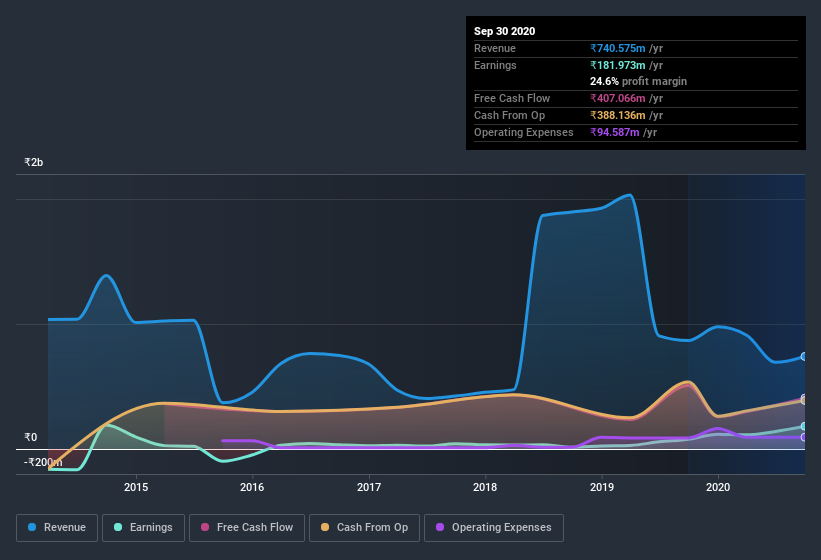

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Tips Industries isn't a huge company, given its market capitalization of ₹4.9b. That makes it extra important to check on its balance sheet strength.

Are Tips Industries Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Tips Industries insiders own a significant number of shares certainly appeals to me. Indeed, with a collective holding of 81%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about ₹4.0b riding on the stock, at current prices. That's nothing to sneeze at!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations under ₹15b, like Tips Industries, the median CEO pay is around ₹3.2m.

The CEO of Tips Industries was paid just ₹1.4m in total compensation for the year ending . You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Tips Industries Worth Keeping An Eye On?

Tips Industries's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The sharp increase in earnings could signal good business momentum. Big growth can make big winners, so I do think Tips Industries is worth considering carefully. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Tips Industries , and understanding these should be part of your investment process.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Tips Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tips Music might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:TIPSMUSIC

Tips Music

Engages in the acquisition and exploitation of music rights in India and internationally.

Exceptional growth potential with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives