- India

- /

- Entertainment

- /

- NSEI:SHEMAROO

Market Cool On Shemaroo Entertainment Limited's (NSE:SHEMAROO) Revenues Pushing Shares 26% Lower

Unfortunately for some shareholders, the Shemaroo Entertainment Limited (NSE:SHEMAROO) share price has dived 26% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 33% share price drop.

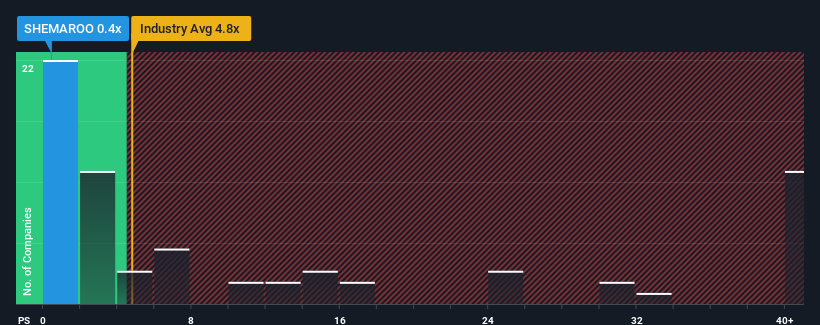

Following the heavy fall in price, Shemaroo Entertainment's price-to-sales (or "P/S") ratio of 0.4x might make it look like a strong buy right now compared to the wider Entertainment industry in India, where around half of the companies have P/S ratios above 4.8x and even P/S above 21x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Shemaroo Entertainment

How Has Shemaroo Entertainment Performed Recently?

It looks like revenue growth has deserted Shemaroo Entertainment recently, which is not something to boast about. One possibility is that the P/S is low because investors think this benign revenue growth rate will likely underperform the broader industry in the near future. Those who are bullish on Shemaroo Entertainment will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Shemaroo Entertainment, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Shemaroo Entertainment's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Shemaroo Entertainment's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period has seen an excellent 86% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Comparing that to the industry, which is predicted to deliver 21% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we find it odd that Shemaroo Entertainment is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On Shemaroo Entertainment's P/S

Having almost fallen off a cliff, Shemaroo Entertainment's share price has pulled its P/S way down as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Shemaroo Entertainment revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Shemaroo Entertainment (2 are potentially serious!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SHEMAROO

Shemaroo Entertainment

Engages in the distribution of content for broadcasting of satellite channels, physical formats and digital technologies in India.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives