Stock Analysis

Exploring Three Indian Exchange Growth Companies With Substantial Insider Ownership

Reviewed by Simply Wall St

Despite a flat performance over the last week, the Indian market has shown robust growth, soaring by 42% over the past year with earnings expected to grow by 17% annually. In such an optimistic environment, companies with high insider ownership can be particularly compelling as this often reflects confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Pitti Engineering (BSE:513519) | 33.6% | 36.5% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 36.5% |

| Triveni Turbine (BSE:533655) | 28.6% | 21.1% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Dixon Technologies (India) (NSEI:DIXON) | 25% | 27.7% |

| Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 27.8% |

| MTAR Technologies (NSEI:MTARTECH) | 38.4% | 41.7% |

| Steel Strips Wheels (BSE:513262) | 35.9% | 26.5% |

| Aether Industries (NSEI:AETHER) | 31.1% | 40.5% |

Let's explore several standout options from the results in the screener.

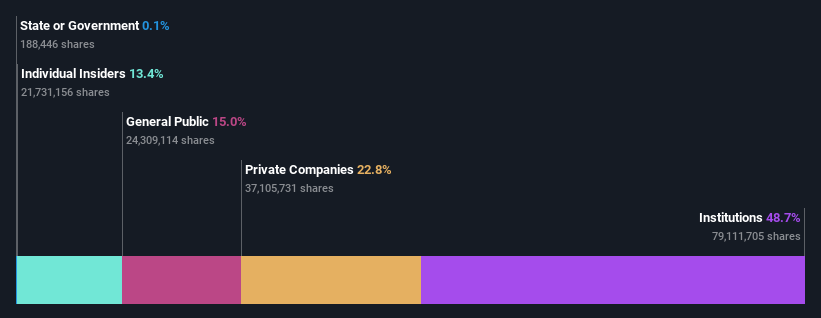

Kalpataru Projects International (NSEI:KPIL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kalpataru Projects International Limited specializes in engineering, procurement, and construction (EPC) services for various sectors including buildings, infrastructure, and energy in India and globally, with a market capitalization of approximately ₹194.81 billion.

Operations: Kalpataru Projects International generates revenue primarily from its Engineering, Procurement, and Construction (EPC) services, which contributed ₹191.48 billion, and from development projects amounting to ₹2.80 billion.

Insider Ownership: 12.4%

Kalpataru Projects International has demonstrated a robust financial performance with year-on-year growth in sales and net income, reporting INR 196.26 billion in sales and INR 5.1 billion in net income for the fiscal year ending March 2024. Despite facing regulatory challenges, including multiple GST demands which were largely resolved favorably, the company maintains its growth trajectory. The recent recommendation of a substantial dividend underscores confidence in its financial health, although it's noted that interest payments are not well covered by earnings, indicating potential financial stress points.

- Navigate through the intricacies of Kalpataru Projects International with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Kalpataru Projects International is trading beyond its estimated value.

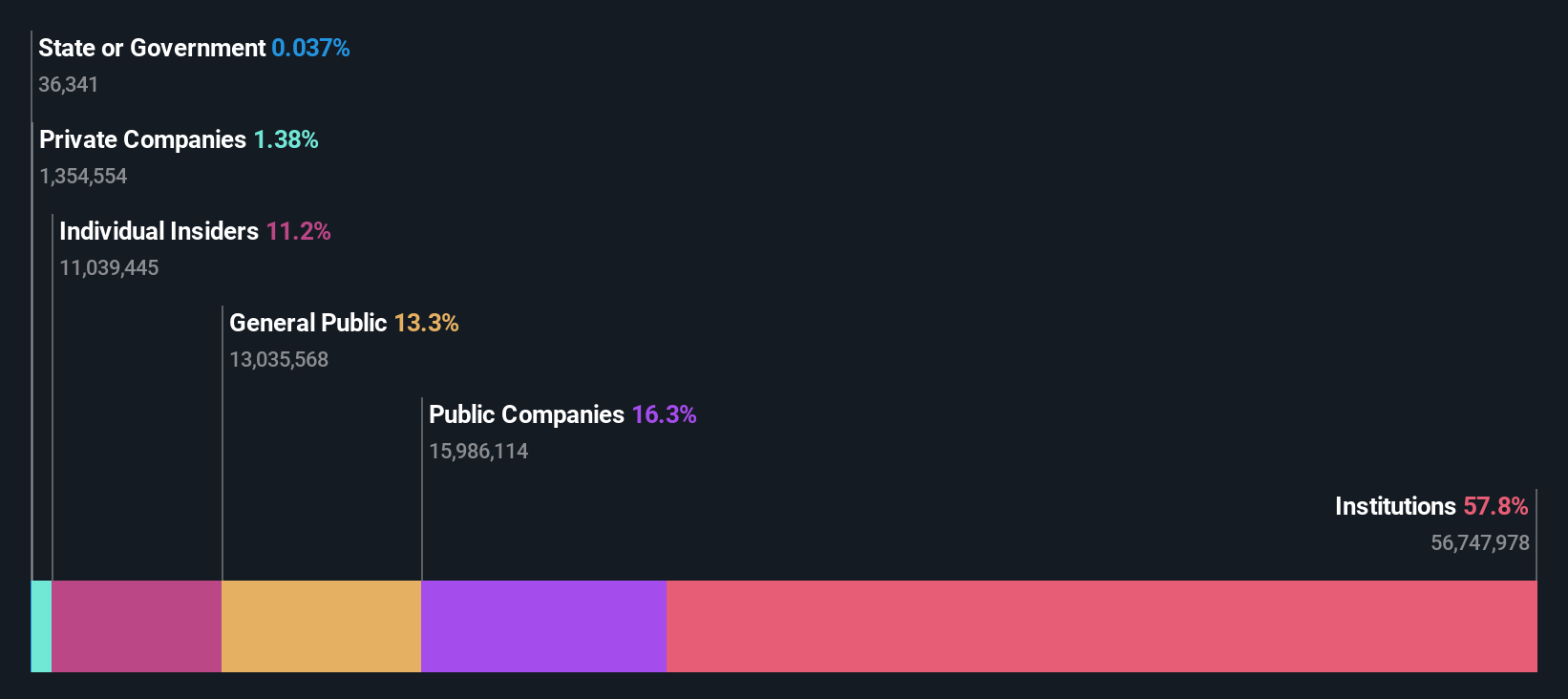

PVR INOX (NSEI:PVRINOX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PVR INOX Limited operates in India and Sri Lanka, focusing on the exhibition, distribution, and production of movies with a market capitalization of approximately ₹129.77 billion.

Operations: The company primarily generates revenue through the exhibition, distribution, and production of movies across India and Sri Lanka.

Insider Ownership: 11.6%

PVR INOX has shown a sharp rebound in revenue, reaching INR 62.64 billion for FY 2024, up from INR 38.30 billion the previous year, despite reporting a net loss of INR 320 million. The company's expansion strategy is evident with new cinemas across India, including innovative theme-based auditoriums and luxury formats such as Director’s Cut and ICE Theatres®, enhancing its experiential entertainment offerings. This growth trajectory aligns with market forecasts predicting revenue growth faster than the Indian market average, although profitability is expected to materialize only in the next three years.

- Click here and access our complete growth analysis report to understand the dynamics of PVR INOX.

- The analysis detailed in our PVR INOX valuation report hints at an deflated share price compared to its estimated value.

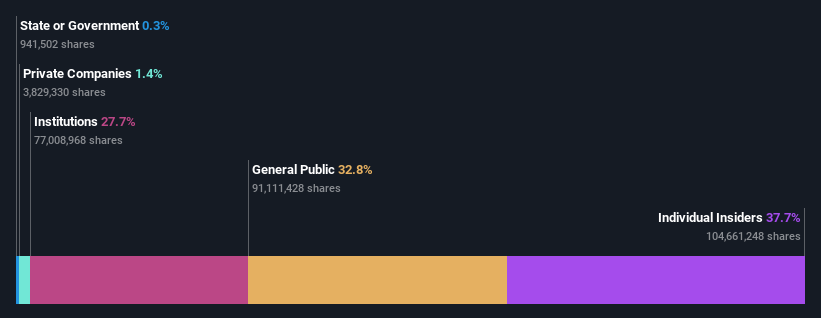

Sonata Software (NSEI:SONATSOFTW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sonata Software Limited offers information technology services and solutions across India, the United States, Europe, the Middle East, and Australia, with a market capitalization of approximately ₹147.55 billion.

Operations: The company generates its revenue from providing IT services and solutions across various regions including India, the US, Europe, the Middle East, and Australia.

Insider Ownership: 37.9%

Sonata Software, despite a dip in net income to INR 3.09 billion from INR 4.52 billion year-over-year, has maintained a growth trajectory with annual sales rising to INR 87.39 billion from INR 75.20 billion. The company's insider transactions aren't substantial but show more buying than selling recently, reflecting some confidence by insiders in the firm's prospects. Additionally, its strategic partnership with Zones LLC and the expansion into Poland emphasize its commitment to leveraging cloud technology and generative AI for business transformation, aiming at enhanced operational efficiency and market differentiation.

- Click to explore a detailed breakdown of our findings in Sonata Software's earnings growth report.

- The valuation report we've compiled suggests that Sonata Software's current price could be inflated.

Where To Now?

- Click this link to deep-dive into the 86 companies within our Fast Growing Indian Companies With High Insider Ownership screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Sonata Software is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SONATSOFTW

Sonata Software

Provides information technology services and solutions in India, the United States, Europe, the Middle East, and Australia.

High growth potential established dividend payer.