It's A Story Of Risk Vs Reward With Entertainment Network (India) Limited (NSE:ENIL)

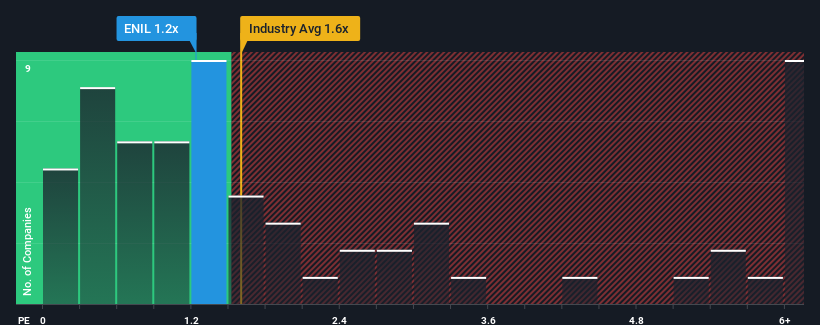

There wouldn't be many who think Entertainment Network (India) Limited's (NSE:ENIL) price-to-sales (or "P/S") ratio of 1.2x is worth a mention when the median P/S for the Media industry in India is similar at about 1.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Entertainment Network (India)

How Has Entertainment Network (India) Performed Recently?

Revenue has risen firmly for Entertainment Network (India) recently, which is pleasing to see. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Entertainment Network (India) will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Entertainment Network (India), take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Entertainment Network (India)'s Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Entertainment Network (India)'s to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. The strong recent performance means it was also able to grow revenue by 71% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 12% shows it's noticeably more attractive.

With this information, we find it interesting that Entertainment Network (India) is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What Does Entertainment Network (India)'s P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To our surprise, Entertainment Network (India) revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

You should always think about risks. Case in point, we've spotted 3 warning signs for Entertainment Network (India) you should be aware of.

If these risks are making you reconsider your opinion on Entertainment Network (India), explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Entertainment Network (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ENIL

Entertainment Network (India)

Together with its subsidiary, operates FM radio broadcasting stations in India and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026