We Wouldn't Be Too Quick To Buy D. B. Corp Limited (NSE:DBCORP) Before It Goes Ex-Dividend

D. B. Corp Limited (NSE:DBCORP) stock is about to trade ex-dividend in three days. The ex-dividend date is usually set to be two business days before the record date, which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Thus, you can purchase D. B's shares before the 23rd of July in order to receive the dividend, which the company will pay on the 14th of August.

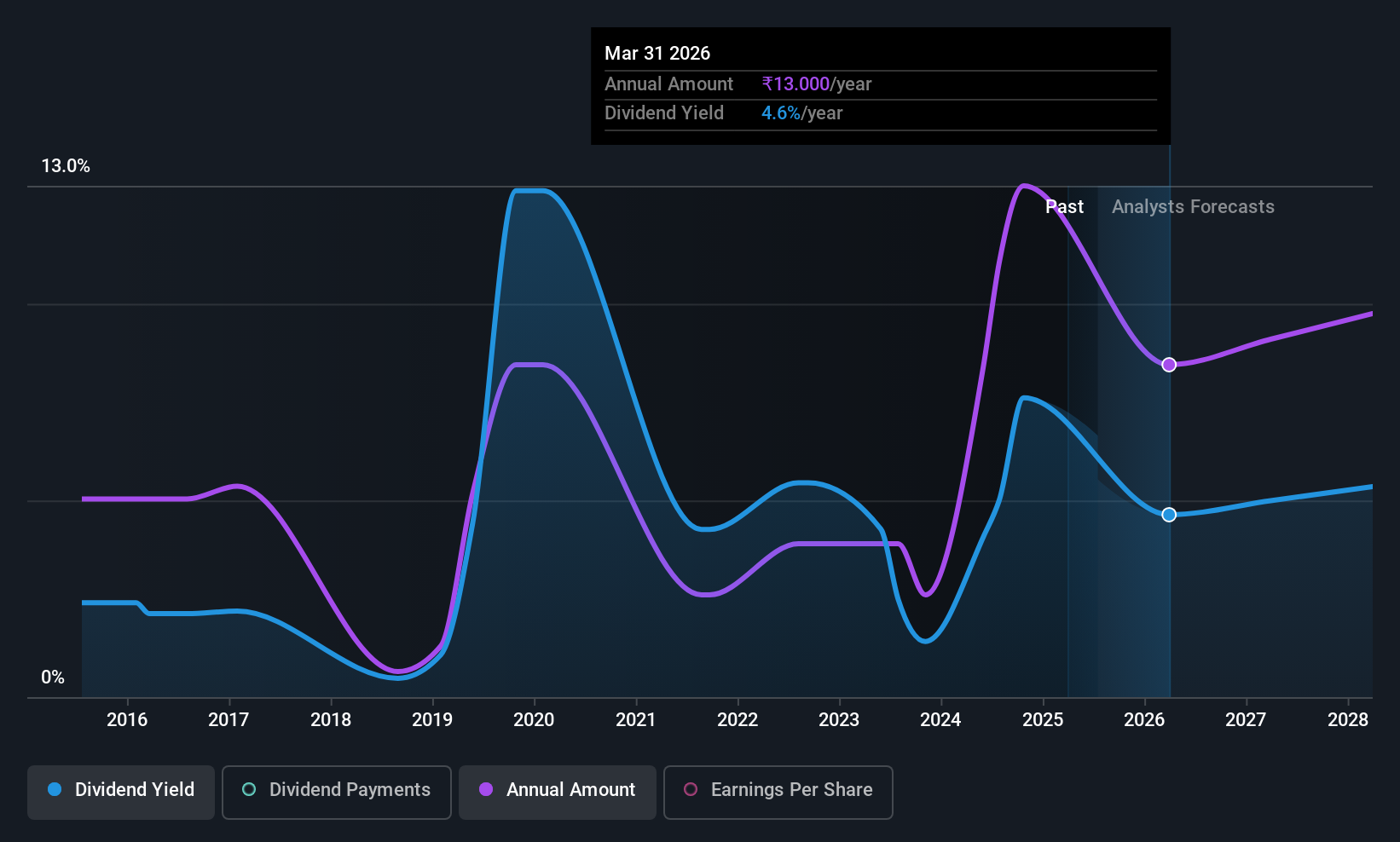

The company's upcoming dividend is ₹5.00 a share, following on from the last 12 months, when the company distributed a total of ₹20.00 per share to shareholders. Based on the last year's worth of payments, D. B has a trailing yield of 7.1% on the current stock price of ₹280.30. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Its dividend payout ratio is 81% of profit, which means the company is paying out a majority of its earnings. The relatively limited profit reinvestment could slow the rate of future earnings growth. We'd be concerned if earnings began to decline. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. The company paid out 98% of its free cash flow over the last year, which we think is outside the ideal range for most businesses. Cash flows are usually much more volatile than earnings, so this could be a temporary effect - but we'd generally want to look more closely here.

D. B paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Cash is king, as they say, and were D. B to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Check out our latest analysis for D. B

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. This is why it's a relief to see D. B earnings per share are up 3.6% per annum over the last five years. Earnings have been growing somewhat, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the last 10 years, D. B has lifted its dividend by approximately 9.9% a year on average. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

Final Takeaway

From a dividend perspective, should investors buy or avoid D. B? D. B is paying out a reasonable percentage of its income and an uncomfortably high 98% of its cash flow as dividends. At least earnings per share have been growing steadily. Bottom line: D. B has some unfortunate characteristics that we think could lead to sub-optimal outcomes for dividend investors.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with D. B. For example - D. B has 1 warning sign we think you should be aware of.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DBCORP

D. B

Engages in the business of publishing newspapers, radio broadcasting, and digital platforms for news and event management in India and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion