- Hong Kong

- /

- Energy Services

- /

- SEHK:3303

Top Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by busy earnings reports and mixed economic signals, investors are seeking stability amid volatility. With major indices experiencing fluctuations and manufacturing activity showing signs of weakness, dividend stocks can offer a reliable income stream in uncertain times. A good dividend stock typically combines consistent payouts with strong fundamentals, making them an attractive option for those looking to balance growth potential with income generation in today's market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.82% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.85% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.52% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.99% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.29% | ★★★★★☆ |

| Premier Financial (NasdaqGS:PFC) | 4.34% | ★★★★★☆ |

Click here to see the full list of 1991 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

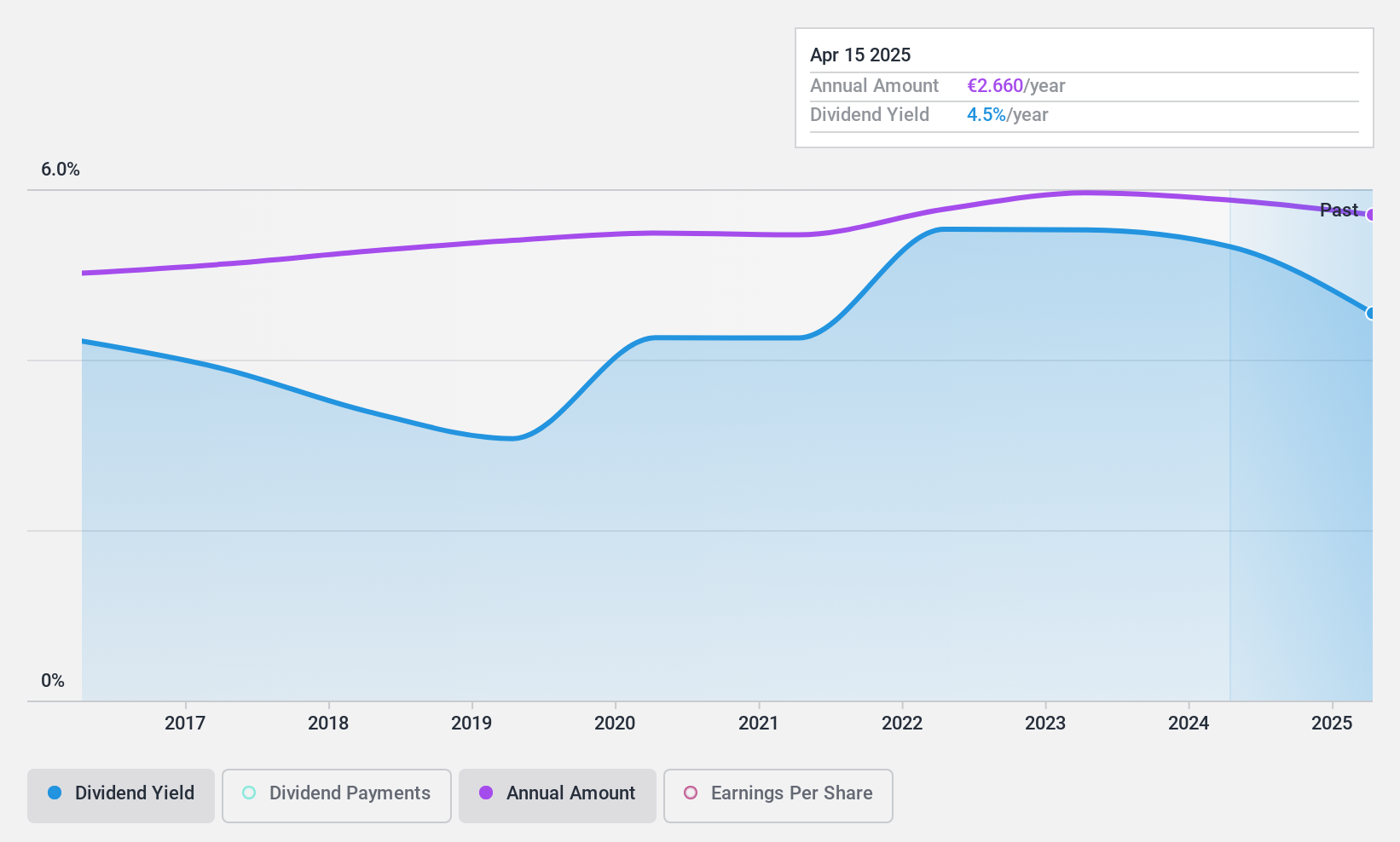

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse client groups in France, with a market cap of €1.05 billion.

Operations: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative generates revenue through its provision of banking products and services to a wide array of clients, including individuals, professionals, associations, farmers, businesses, private banking customers, and public and social housing community clients in France.

Dividend Yield: 5.1%

Caisse Régionale de Crédit Agricole Mutuel du Languedoc offers a reliable dividend yield of 5.14%, with payments growing consistently over the past decade and showing stability with minimal volatility. The payout ratio is a manageable 29.8%, suggesting dividends are well covered by earnings, though future coverage remains uncertain due to insufficient data. Trading significantly below estimated fair value, it presents potential value for investors despite its yield being slightly lower than top-tier French dividend payers.

- Take a closer look at Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative's potential here in our dividend report.

- According our valuation report, there's an indication that Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative's share price might be on the cheaper side.

D. B (NSEI:DBCORP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: D. B. Corp Limited operates in newspaper printing and publishing, radio broadcasting, and digital news platforms for news and event management in India and internationally, with a market cap of ₹57.48 billion.

Operations: D. B. Corp Limited generates revenue primarily from its printing, publishing, and allied business segment, which accounts for ₹22.44 billion, and its radio segment, contributing ₹1.67 billion.

Dividend Yield: 6.2%

D. B. Corp Limited's dividend yield of 6.2% ranks it among the top 25% in India, though its dividend history is marked by volatility and unreliability over the past decade. The company recently declared a second interim dividend of INR 5 per share for FY2024-25, with a payout ratio of 79.7%, indicating coverage by earnings and cash flows (63.6%). Despite fluctuating dividends, its P/E ratio of 12.9x suggests potential value compared to the Indian market average.

- Delve into the full analysis dividend report here for a deeper understanding of D. B.

- Insights from our recent valuation report point to the potential overvaluation of D. B shares in the market.

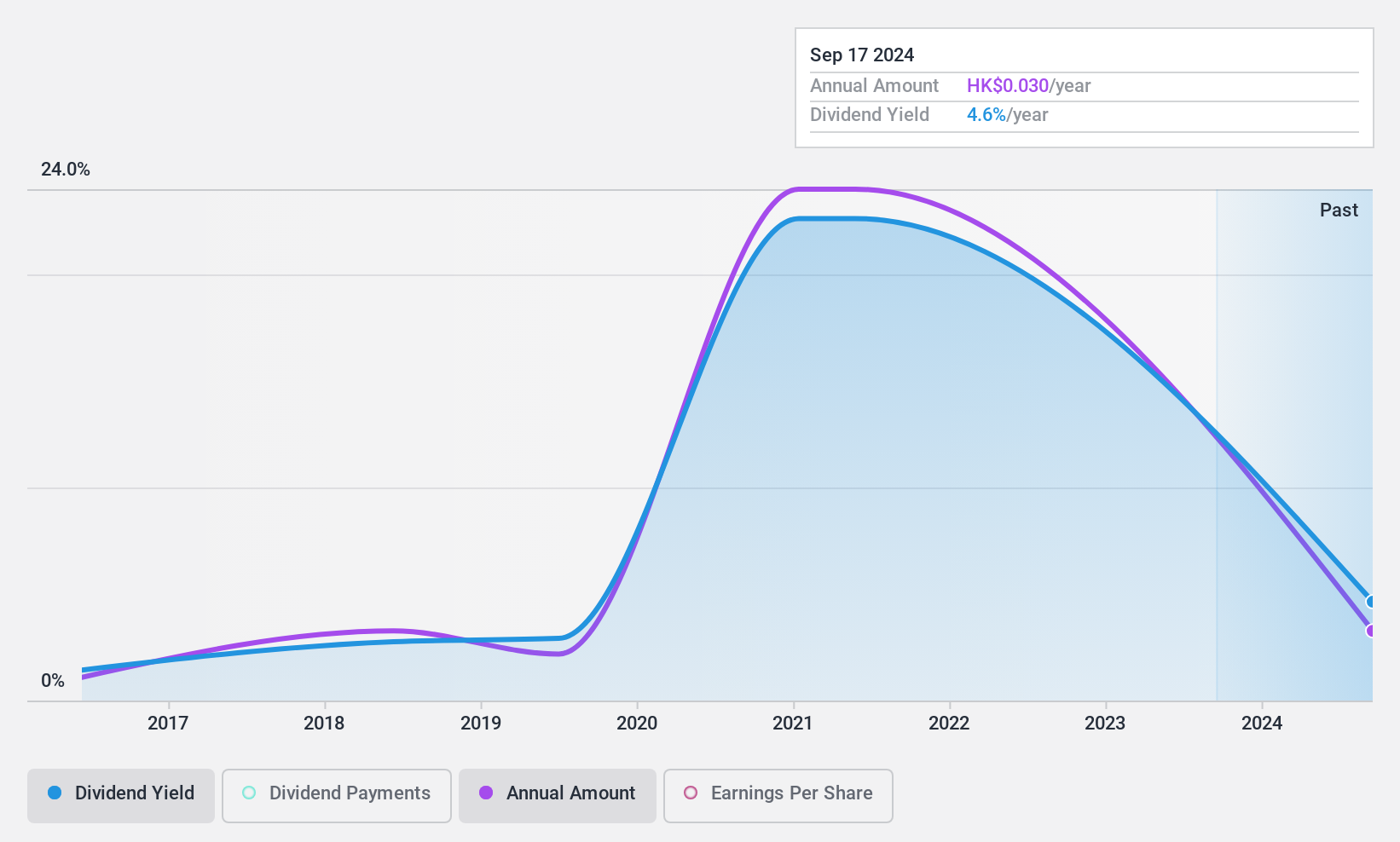

Jutal Offshore Oil Services (SEHK:3303)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jutal Offshore Oil Services Limited is an investment holding company involved in the fabrication of facilities and provision of integrated services for the oil and gas, new energy, and refining and chemical industries, with a market cap of HK$1.68 billion.

Operations: Jutal Offshore Oil Services Limited generates revenue primarily from its oil and gas segment, amounting to CN¥2.98 billion, with additional contributions from the new energy and refinery and chemical segment totaling CN¥64.13 million.

Dividend Yield: 7.4%

Jutal Offshore Oil Services' dividend yield of 7.41% is slightly below the top 25% in Hong Kong, with a history of volatility and unreliability over the past decade. Despite this, dividends are well covered by earnings (15.5%) and cash flows (24.1%). Recent earnings showed significant growth, with net income rising to CNY 177.31 million for H1 2024 from CNY 68.84 million a year ago, supporting its interim dividend of HKD 0.03 per share declared in August 2024.

- Dive into the specifics of Jutal Offshore Oil Services here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Jutal Offshore Oil Services is priced lower than what may be justified by its financials.

Key Takeaways

- Take a closer look at our Top Dividend Stocks list of 1991 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3303

Jutal Offshore Oil Services

An investment holding company, engages in the fabrication of facilities and provision of integrated services for oil and gas, new energy, and refining and chemical industries.

Flawless balance sheet with solid track record and pays a dividend.