This Is The Reason Why We Think Cyber Media (India) Limited's (NSE:CYBERMEDIA) CEO Might Be Underpaid

Shareholders will be pleased by the impressive results for Cyber Media (India) Limited (NSE:CYBERMEDIA) recently and CEO Pradeep Gupta has played a key role. At the upcoming AGM on 30 September 2022, they would be interested to hear about the company strategy going forward and get a chance to cast their votes on resolutions such as executive remuneration and other company matters. Here we will show why we think CEO compensation is appropriate and discuss the case for a pay rise.

Check out our latest analysis for Cyber Media (India)

Comparing Cyber Media (India) Limited's CEO Compensation With The Industry

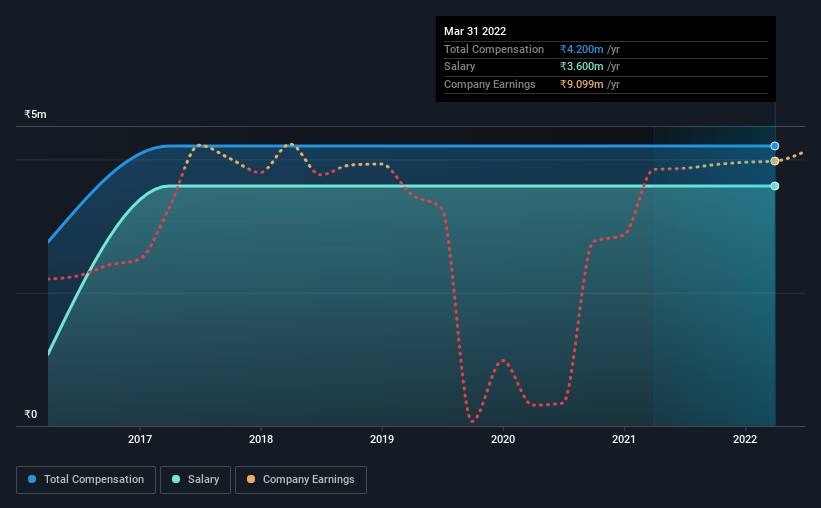

According to our data, Cyber Media (India) Limited has a market capitalization of ₹348m, and paid its CEO total annual compensation worth ₹4.2m over the year to March 2022. There was no change in the compensation compared to last year. Notably, the salary which is ₹3.60m, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under ₹16b, the reported median total CEO compensation was ₹10m. This suggests that Pradeep Gupta is paid below the industry median. Furthermore, Pradeep Gupta directly owns ₹163m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | ₹3.6m | ₹3.6m | 86% |

| Other | ₹600k | ₹600k | 14% |

| Total Compensation | ₹4.2m | ₹4.2m | 100% |

On an industry level, roughly 100% of total compensation represents salary and 0.2491% is other remuneration. Cyber Media (India) pays a modest slice of remuneration through salary, as compared to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Cyber Media (India) Limited's Growth

Cyber Media (India) Limited's earnings per share (EPS) grew 93% per year over the last three years. In the last year, its revenue is up 66%.

This demonstrates that the company has been improving recently and is good news for the shareholders. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Cyber Media (India) Limited Been A Good Investment?

Boasting a total shareholder return of 541% over three years, Cyber Media (India) Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 4 warning signs for Cyber Media (India) (3 are concerning!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CYBERMEDIA

Cyber Media (India)

Engages in the media business in India and internationally.

Medium-low risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.