- India

- /

- Metals and Mining

- /

- NSEI:VENUSPIPES

Investors Still Aren't Entirely Convinced By Venus Pipes and Tubes Limited's (NSE:VENUSPIPES) Earnings Despite 27% Price Jump

Venus Pipes and Tubes Limited (NSE:VENUSPIPES) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 31% in the last twelve months.

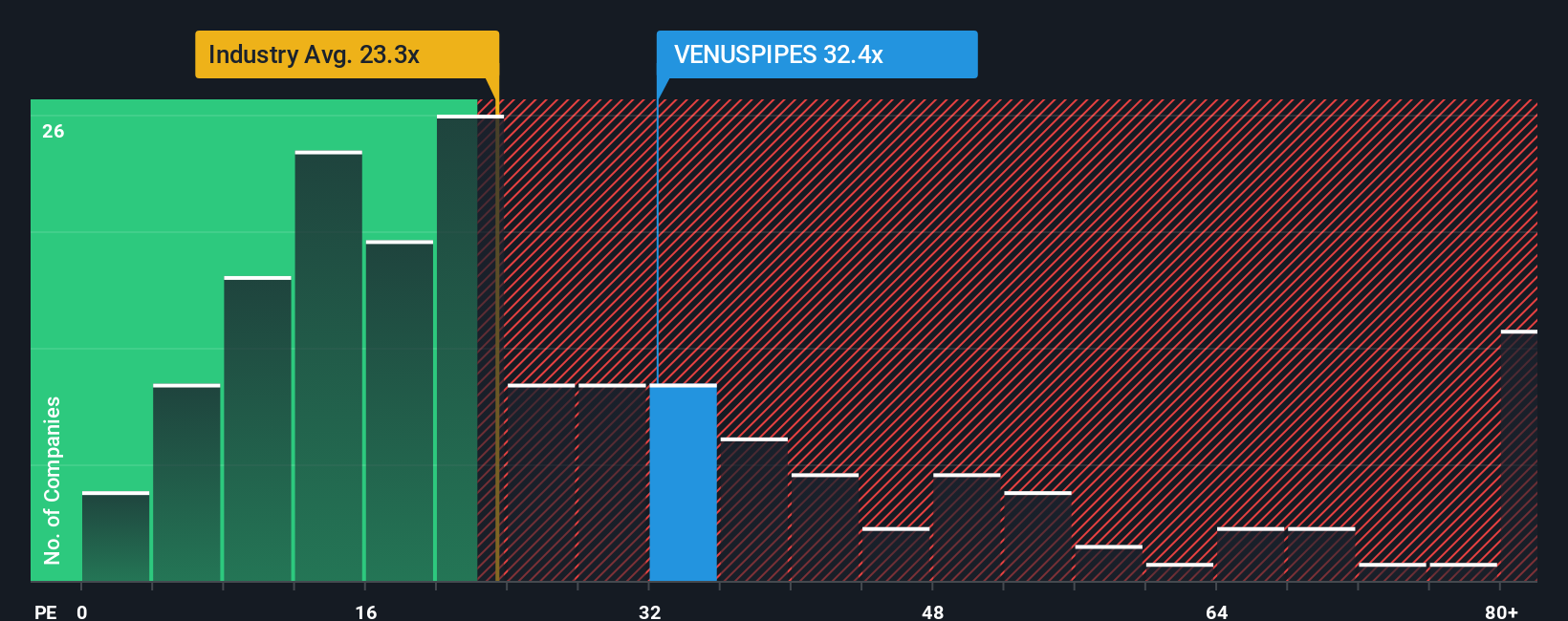

In spite of the firm bounce in price, it's still not a stretch to say that Venus Pipes and Tubes' price-to-earnings (or "P/E") ratio of 32.4x right now seems quite "middle-of-the-road" compared to the market in India, where the median P/E ratio is around 29x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's inferior to most other companies of late, Venus Pipes and Tubes has been relatively sluggish. One possibility is that the P/E is moderate because investors think this lacklustre earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Venus Pipes and Tubes

Does Growth Match The P/E?

In order to justify its P/E ratio, Venus Pipes and Tubes would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a worthy increase of 7.8%. Pleasingly, EPS has also lifted 102% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 32% per annum as estimated by the six analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 22% per annum, which is noticeably less attractive.

With this information, we find it interesting that Venus Pipes and Tubes is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Venus Pipes and Tubes' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Venus Pipes and Tubes' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Venus Pipes and Tubes (1 is a bit unpleasant!) that you should be aware of before investing here.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:VENUSPIPES

Venus Pipes and Tubes

Manufactures and sells stainless-steel pipes and tubes worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success