- India

- /

- Metals and Mining

- /

- NSEI:VEDL

3 Indian Stocks Estimated To Be Up To 46.5% Below Intrinsic Value

Reviewed by Simply Wall St

In the last week, the Indian market is up 1.6%, and over the past 12 months, it has surged by 44%, with earnings forecasted to grow by 17% annually. In this robust environment, identifying stocks that are trading below their intrinsic value can offer significant opportunities for investors seeking to capitalize on potential growth.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹193.03 | ₹306.34 | 37% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2171.75 | ₹4333.04 | 49.9% |

| Apollo Pipes (BSE:531761) | ₹584.60 | ₹1139.07 | 48.7% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1249.00 | ₹2159.67 | 42.2% |

| Vedanta (NSEI:VEDL) | ₹501.75 | ₹938.48 | 46.5% |

| Patel Engineering (BSE:531120) | ₹57.67 | ₹92.88 | 37.9% |

| Orchid Pharma (NSEI:ORCHPHARMA) | ₹1371.25 | ₹2142.32 | 36% |

| IRB Infrastructure Developers (NSEI:IRB) | ₹61.41 | ₹93.23 | 34.1% |

| Tarsons Products (NSEI:TARSONS) | ₹452.15 | ₹710.66 | 36.4% |

| Artemis Medicare Services (NSEI:ARTEMISMED) | ₹289.55 | ₹445.15 | 35% |

Here's a peek at a few of the choices from the screener.

IRB Infrastructure Developers (NSEI:IRB)

Overview: IRB Infrastructure Developers Limited operates in the infrastructure development sector in India with a market cap of ₹370.85 billion.

Operations: The company's revenue segments include Construction generating ₹51.92 billion and BOT/TOT Projects contributing ₹24.16 billion.

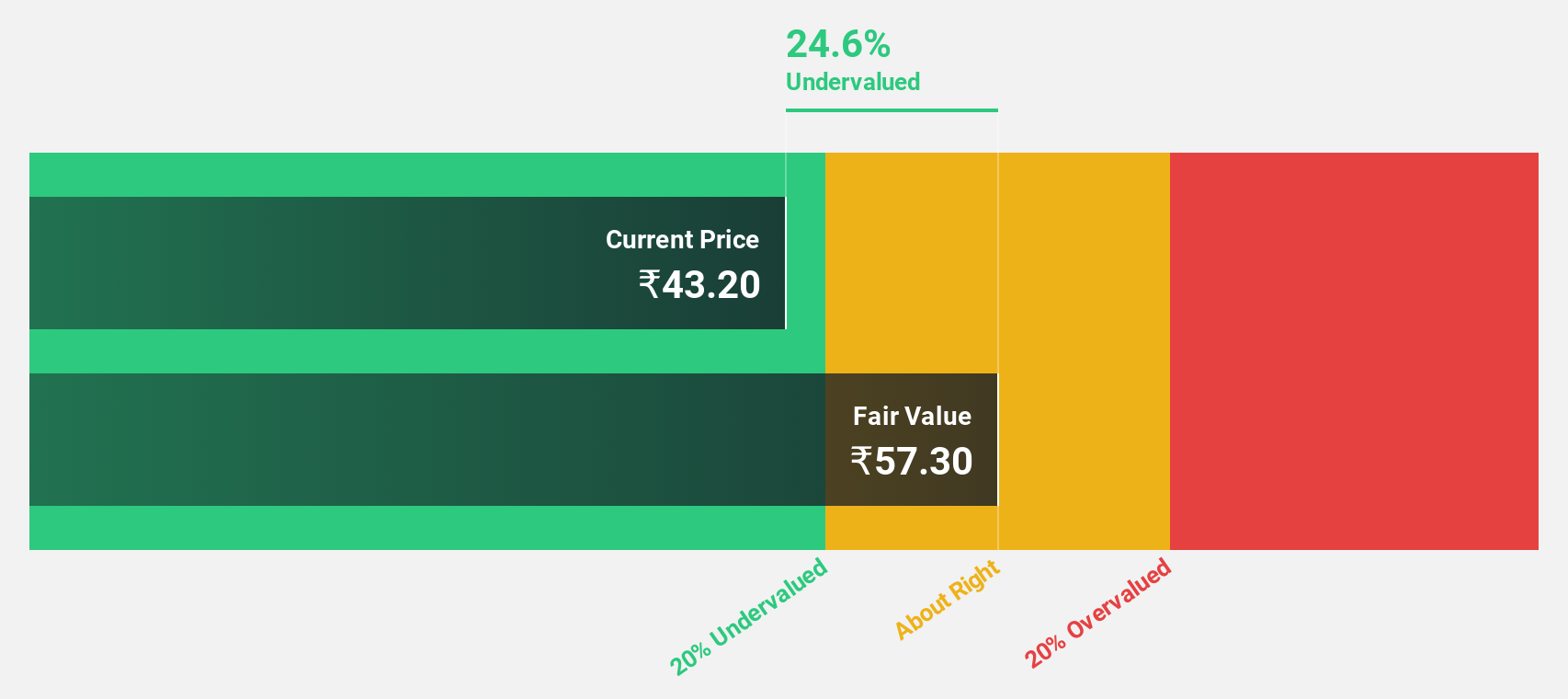

Estimated Discount To Fair Value: 34.1%

IRB Infrastructure Developers is trading at ₹61.41, significantly below its estimated fair value of ₹93.23, indicating it may be undervalued based on cash flows. Despite an unstable dividend track record and low forecasted return on equity (8.3%), IRB's earnings are expected to grow 32% annually over the next three years, outpacing the Indian market's 17.3%. Recent inclusion in the FTSE All-World Index underscores its growing prominence.

- Our earnings growth report unveils the potential for significant increases in IRB Infrastructure Developers' future results.

- Click here to discover the nuances of IRB Infrastructure Developers with our detailed financial health report.

Jindal Steel & Power (NSEI:JINDALSTEL)

Overview: Jindal Steel & Power Limited operates in the steel, mining, and infrastructure sectors in India and internationally, with a market cap of ₹1.05 trillion.

Operations: The company's revenue primarily comes from manufacturing steel products, amounting to ₹510.56 billion.

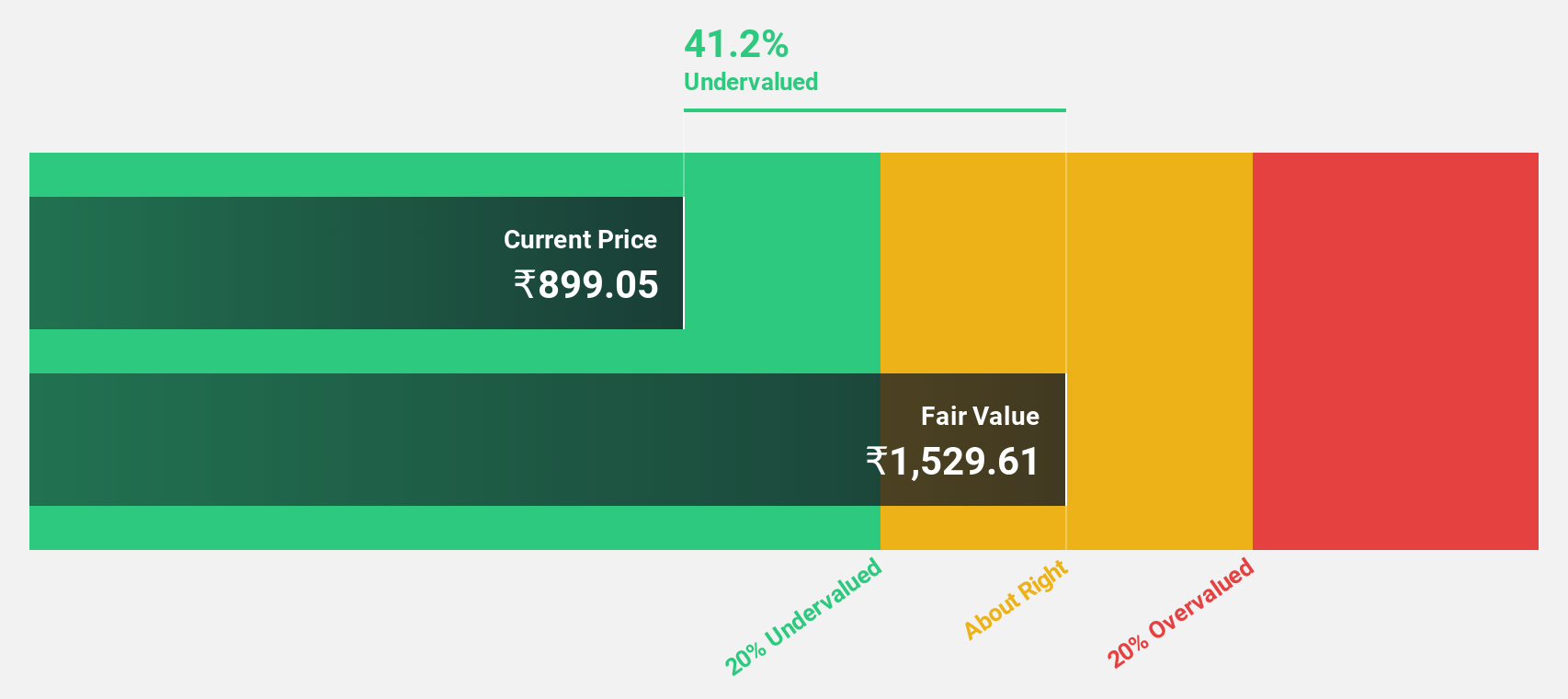

Estimated Discount To Fair Value: 15.1%

Jindal Steel & Power (₹1028.25) is trading below its estimated fair value of ₹1210.73, suggesting it could be undervalued based on cash flows. Recent strategic alliances with Jindal Renewables to integrate green hydrogen and renewable energy into its operations underscore a significant commitment to decarbonization, potentially enhancing long-term sustainability and cost efficiency. Despite a dip in recent quarterly net income, forecasted earnings growth of 24% annually over the next three years indicates strong future prospects.

- Our expertly prepared growth report on Jindal Steel & Power implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Jindal Steel & Power's balance sheet health report.

Vedanta (NSEI:VEDL)

Overview: Vedanta Limited, with a market cap of ₹1.96 trillion, is a diversified natural resources company involved in the exploration, extraction, and processing of minerals and oil and gas across India and internationally.

Operations: Vedanta Limited generates revenue from various segments including Power (₹62.54 billion), Copper (₹197.31 billion), Iron Ore (₹83.51 billion), Aluminium (₹499.81 billion), Oil and Gas (₹179.05 billion), and Zinc - International (₹32.06 billion).

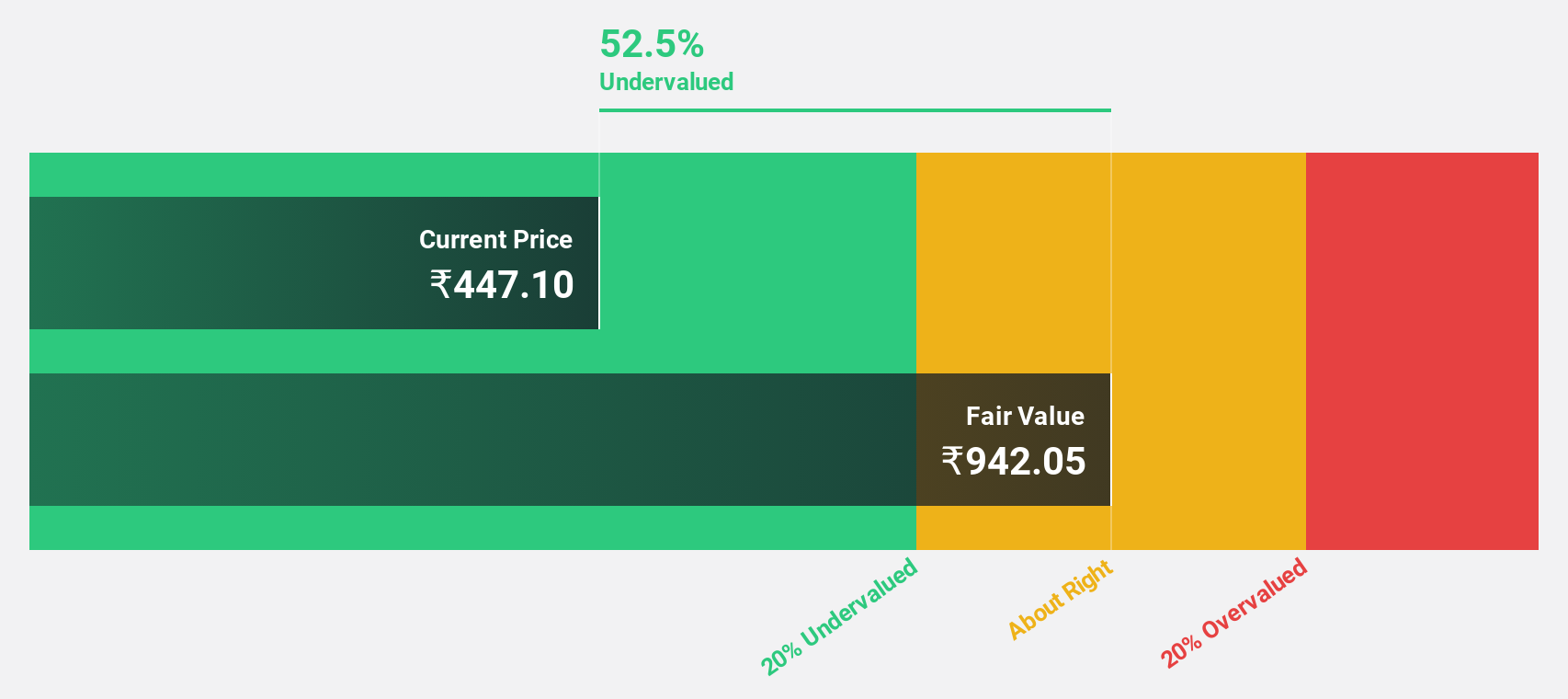

Estimated Discount To Fair Value: 46.5%

Vedanta (₹501.75) is trading below its estimated fair value of ₹938.48, highlighting potential undervaluation based on cash flows. The proposed demerger into separate listed entities could simplify its corporate structure and attract direct investment in pure-play companies. Despite recent executive changes and regulatory challenges, Vedanta's earnings are forecasted to grow significantly at 41.8% annually, though it carries a high level of debt and lower profit margins compared to last year.

- Our comprehensive growth report raises the possibility that Vedanta is poised for substantial financial growth.

- Navigate through the intricacies of Vedanta with our comprehensive financial health report here.

Key Takeaways

- Investigate our full lineup of 25 Undervalued Indian Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:VEDL

Vedanta

A diversified natural resources company, explores, extracts, and processes minerals, and oil and gas in India, Europe, China, the United States, Mexico, and internationally.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success