UPL Limited's (NSE:UPL) Share Price Is Matching Sentiment Around Its Revenues

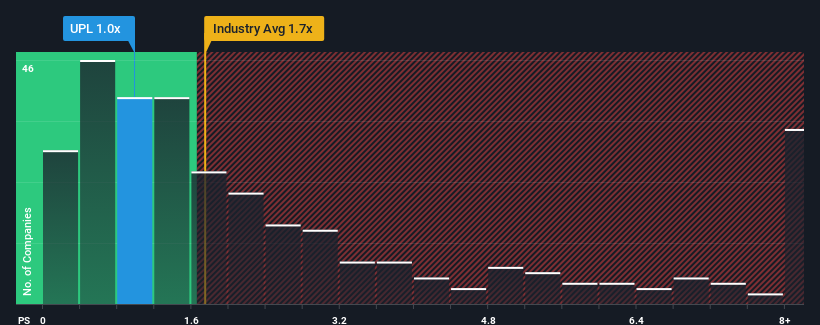

UPL Limited's (NSE:UPL) price-to-sales (or "P/S") ratio of 1x might make it look like a buy right now compared to the Chemicals industry in India, where around half of the companies have P/S ratios above 1.7x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for UPL

What Does UPL's P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, UPL has been very sluggish. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on UPL will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For UPL?

The only time you'd be truly comfortable seeing a P/S as low as UPL's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 11% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 8.8% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 13% per year, which is noticeably more attractive.

In light of this, it's understandable that UPL's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From UPL's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of UPL's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for UPL that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:UPL

UPL

Manufactures and sells pesticides, insecticides, and micronutrients in India, Brazil, the United States, the United Kingdom, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives