- India

- /

- Paper and Forestry Products

- /

- NSEI:TNPL

Market Might Still Lack Some Conviction On Tamil Nadu Newsprint and Papers Limited (NSE:TNPL) Even After 29% Share Price Boost

Tamil Nadu Newsprint and Papers Limited (NSE:TNPL) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 38% over that time.

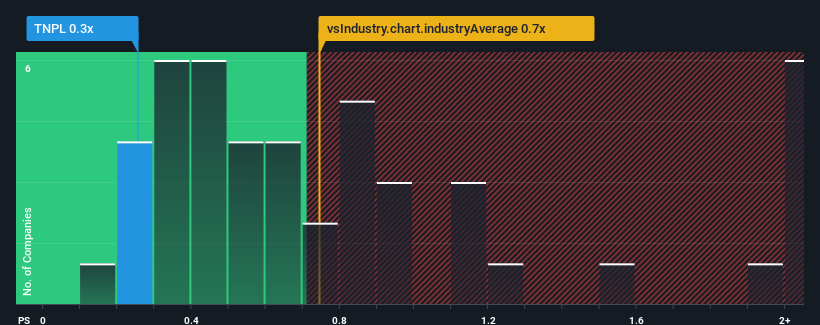

Even after such a large jump in price, there still wouldn't be many who think Tamil Nadu Newsprint and Papers' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in India's Forestry industry is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Tamil Nadu Newsprint and Papers

How Tamil Nadu Newsprint and Papers Has Been Performing

For example, consider that Tamil Nadu Newsprint and Papers' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Tamil Nadu Newsprint and Papers will help you shine a light on its historical performance.How Is Tamil Nadu Newsprint and Papers' Revenue Growth Trending?

Tamil Nadu Newsprint and Papers' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.2%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 14% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

In contrast to the company, the rest of the industry is expected to decline by 0.4% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this in mind, we find it intriguing that Tamil Nadu Newsprint and Papers' P/S matches its industry peers. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Key Takeaway

Its shares have lifted substantially and now Tamil Nadu Newsprint and Papers' P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Tamil Nadu Newsprint and Papers revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

You need to take note of risks, for example - Tamil Nadu Newsprint and Papers has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Tamil Nadu Newsprint and Papers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TNPL

Tamil Nadu Newsprint and Papers

Manufactures and markets paper and paperboards in India and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives