- India

- /

- Metals and Mining

- /

- NSEI:TIRUPATIFL

Here's Why We Think Tirupati Forge (NSE:TIRUPATIFL) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Tirupati Forge (NSE:TIRUPATIFL). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Tirupati Forge

How Fast Is Tirupati Forge Growing Its Earnings Per Share?

In the last three years Tirupati Forge's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Tirupati Forge's EPS skyrocketed from ₹0.64 to ₹0.96, in just one year; a result that's bound to bring a smile to shareholders. That's a fantastic gain of 52%.

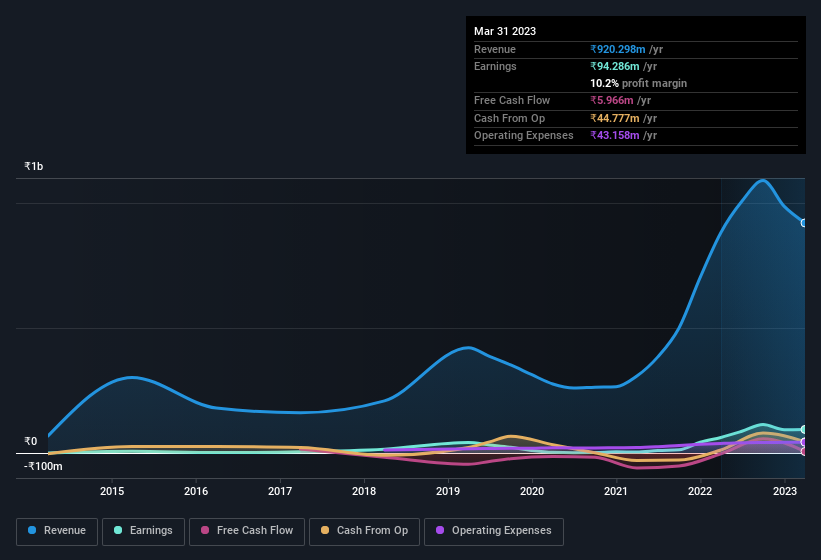

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Tirupati Forge shareholders is that EBIT margins have grown from 9.2% to 13% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Tirupati Forge is no giant, with a market capitalisation of ₹784m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Tirupati Forge Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So those who are interested in Tirupati Forge will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. To be exact, company insiders hold 59% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Although, with Tirupati Forge being valued at ₹784m, this is a small company we're talking about. That means insiders only have ₹465m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations under ₹16b, like Tirupati Forge, the median CEO pay is around ₹3.3m.

The Tirupati Forge CEO received total compensation of only ₹1.8m in the year to March 2022. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Tirupati Forge Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Tirupati Forge's strong EPS growth. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. The overarching message here is that Tirupati Forge has underlying strengths that make it worth a look at. We should say that we've discovered 3 warning signs for Tirupati Forge (2 are a bit unpleasant!) that you should be aware of before investing here.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Tirupati Forge might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TIRUPATIFL

Tirupati Forge

Produces and sells carbon steel forged flanges, forged, and other automotive components in India.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives