Market Participants Recognise Tatva Chintan Pharma Chem Limited's (NSE:TATVA) Revenues Pushing Shares 34% Higher

Tatva Chintan Pharma Chem Limited (NSE:TATVA) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 66%.

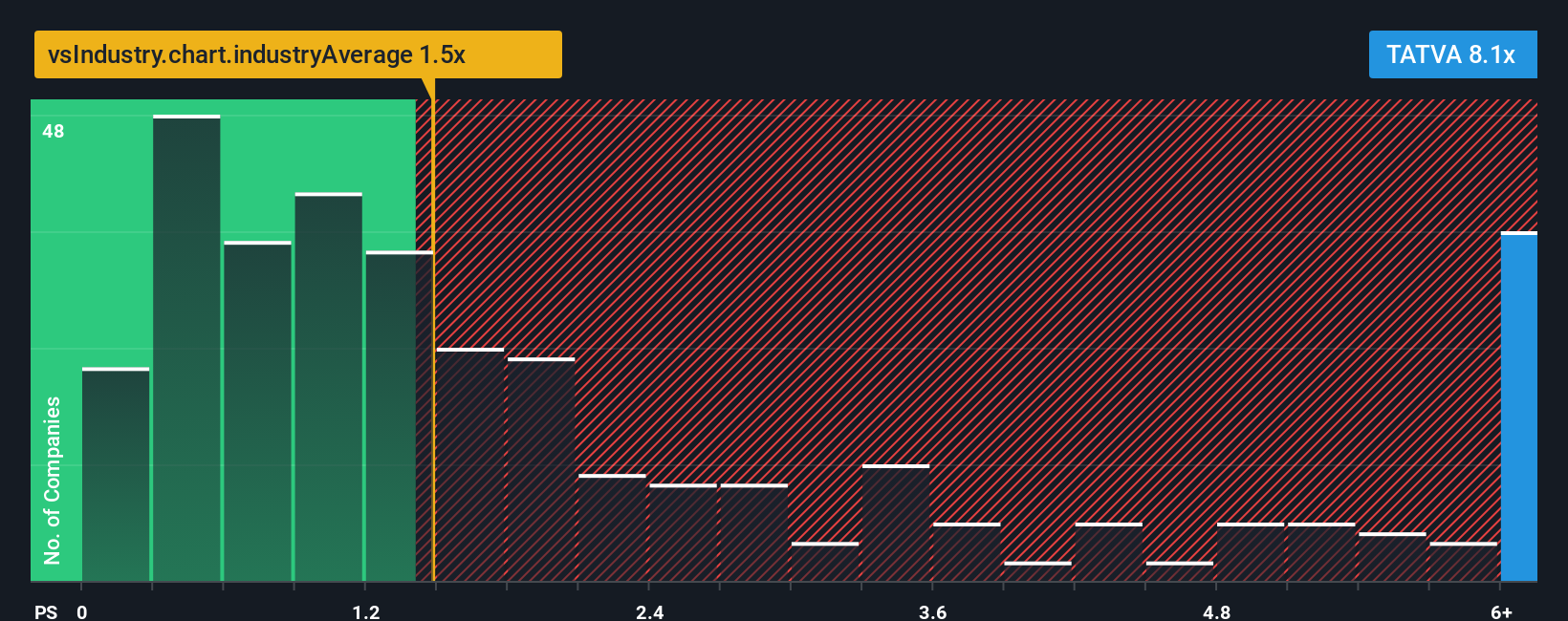

Since its price has surged higher, given around half the companies in India's Chemicals industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider Tatva Chintan Pharma Chem as a stock to avoid entirely with its 8.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Tatva Chintan Pharma Chem

How Tatva Chintan Pharma Chem Has Been Performing

Recent times haven't been great for Tatva Chintan Pharma Chem as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Tatva Chintan Pharma Chem's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Tatva Chintan Pharma Chem would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 5.1% drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 33% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 15% growth forecast for the broader industry.

In light of this, it's understandable that Tatva Chintan Pharma Chem's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The strong share price surge has lead to Tatva Chintan Pharma Chem's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Tatva Chintan Pharma Chem's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Tatva Chintan Pharma Chem that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Tatva Chintan Pharma Chem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TATVA

Tatva Chintan Pharma Chem

Engages in the manufacture and sale of specialty chemicals in India, Germany, the United States of America, China, Singapore, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives