- India

- /

- Metals and Mining

- /

- NSEI:SOUTHWEST

Some Confidence Is Lacking In South West Pinnacle Exploration Limited (NSE:SOUTHWEST) As Shares Slide 26%

South West Pinnacle Exploration Limited (NSE:SOUTHWEST) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Longer-term, the stock has been solid despite a difficult 30 days, gaining 20% in the last year.

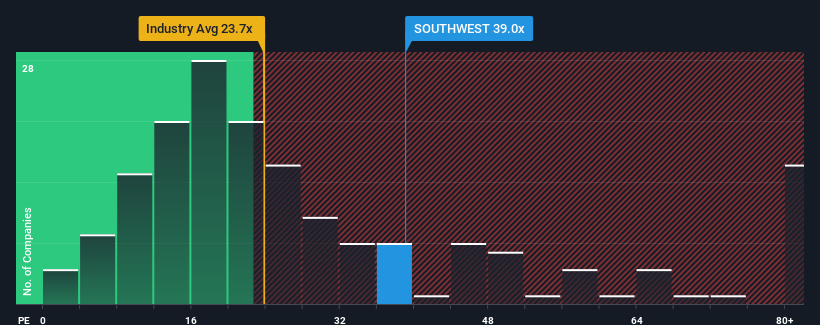

Although its price has dipped substantially, South West Pinnacle Exploration's price-to-earnings (or "P/E") ratio of 39x might still make it look like a sell right now compared to the market in India, where around half of the companies have P/E ratios below 31x and even P/E's below 17x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

For example, consider that South West Pinnacle Exploration's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for South West Pinnacle Exploration

How Is South West Pinnacle Exploration's Growth Trending?

In order to justify its P/E ratio, South West Pinnacle Exploration would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 4.7% decrease to the company's bottom line. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 19% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's noticeably less attractive on an annualised basis.

With this information, we find it concerning that South West Pinnacle Exploration is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From South West Pinnacle Exploration's P/E?

South West Pinnacle Exploration's P/E hasn't come down all the way after its stock plunged. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that South West Pinnacle Exploration currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 3 warning signs for South West Pinnacle Exploration (1 shouldn't be ignored!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SOUTHWEST

South West Pinnacle Exploration

Provides drilling, exploration, and allied services to coal, ferrous, nonferrous, atomic, and base metal mining; and water and unconventional energy industries in India and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives