Exploring Undervalued Stocks On The Indian Exchange With Delhivery And Two Others

Reviewed by Simply Wall St

Despite a flat performance over the last week, the Indian market has shown robust growth, rising 45% in the past 12 months with earnings expected to grow by 16% annually. In this context, identifying undervalued stocks like Delhivery can offer investors potential opportunities for growth in line with these encouraging market trends.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HEG (NSEI:HEG) | ₹2096.15 | ₹3275.02 | 36% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹417.60 | ₹636.71 | 34.4% |

| Updater Services (NSEI:UDS) | ₹324.25 | ₹538.60 | 39.8% |

| Vedanta (NSEI:VEDL) | ₹455.50 | ₹747.19 | 39% |

| Rajesh Exports (NSEI:RAJESHEXPO) | ₹309.50 | ₹506.27 | 38.9% |

| Strides Pharma Science (NSEI:STAR) | ₹942.55 | ₹1664.05 | 43.4% |

| Mahindra Logistics (NSEI:MAHLOG) | ₹534.50 | ₹902.60 | 40.8% |

| Delhivery (NSEI:DELHIVERY) | ₹382.70 | ₹738.18 | 48.2% |

| PVR INOX (NSEI:PVRINOX) | ₹1438.30 | ₹2547.94 | 43.6% |

| Godrej Properties (NSEI:GODREJPROP) | ₹3381.40 | ₹5564.57 | 39.2% |

Let's explore several standout options from the results in the screener.

Delhivery (NSEI:DELHIVERY)

Overview: Delhivery Limited offers supply chain solutions across various sectors including e-commerce, FMCG, and manufacturing in India, with a market capitalization of approximately ₹282.89 billion.

Operations: The company's revenue from logistics services totals ₹81.42 billion.

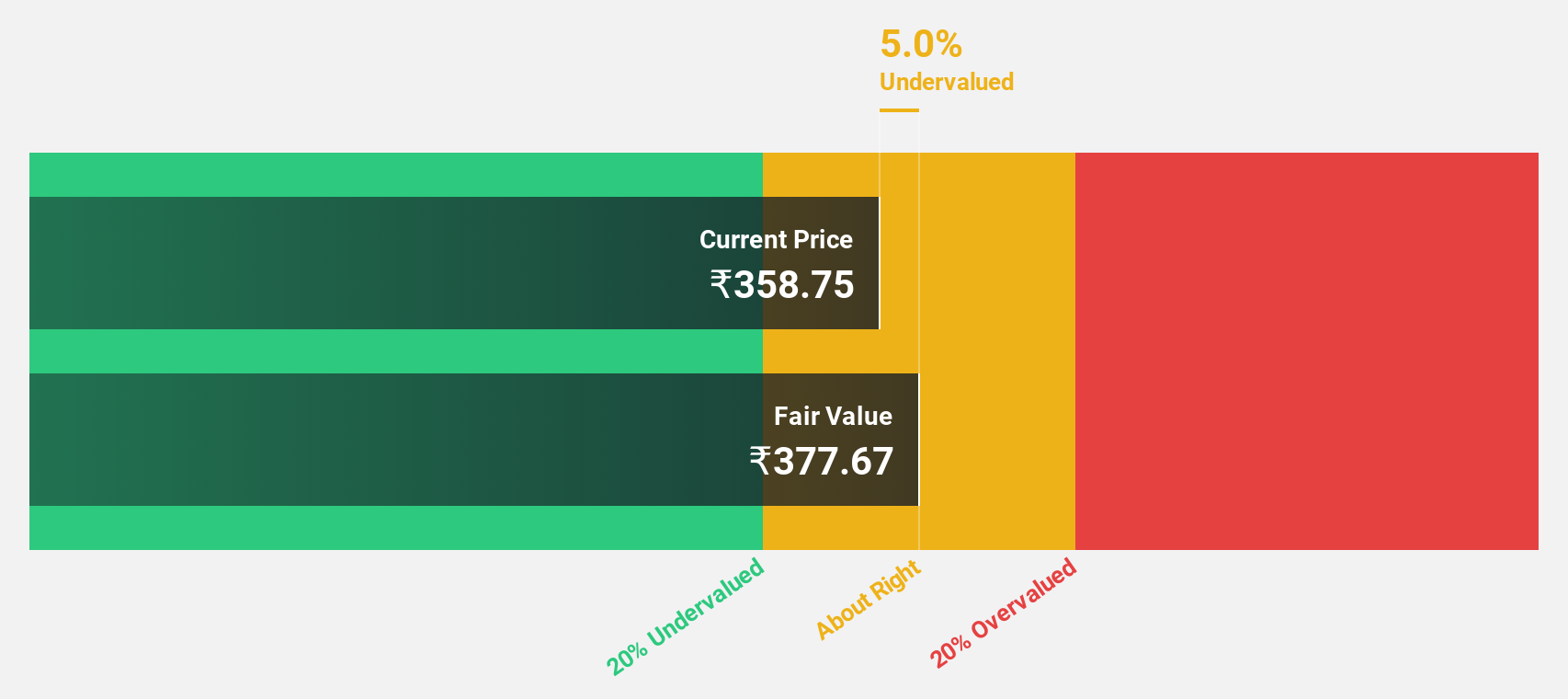

Estimated Discount To Fair Value: 48.2%

Delhivery, priced at ₹382.7, trades significantly below its estimated fair value of ₹738.18, reflecting a potential undervaluation based on cash flow analysis. Despite a forecasted low return on equity of 7% in three years, the company is expected to grow earnings by 61.67% annually and become profitable within the same period. Recent strategic moves include reclassifying share capital and expanding into drone technology which could impact future cash flows and valuation positively.

- Our growth report here indicates Delhivery may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Delhivery.

Godrej Properties (NSEI:GODREJPROP)

Overview: Godrej Properties Limited, operating in India, focuses on real estate construction and development with a market capitalization of approximately ₹94.02 billion.

Operations: The company generates revenue primarily from real estate development, totaling ₹29.95 billion, with a smaller segment in hospitality bringing in ₹0.41 billion.

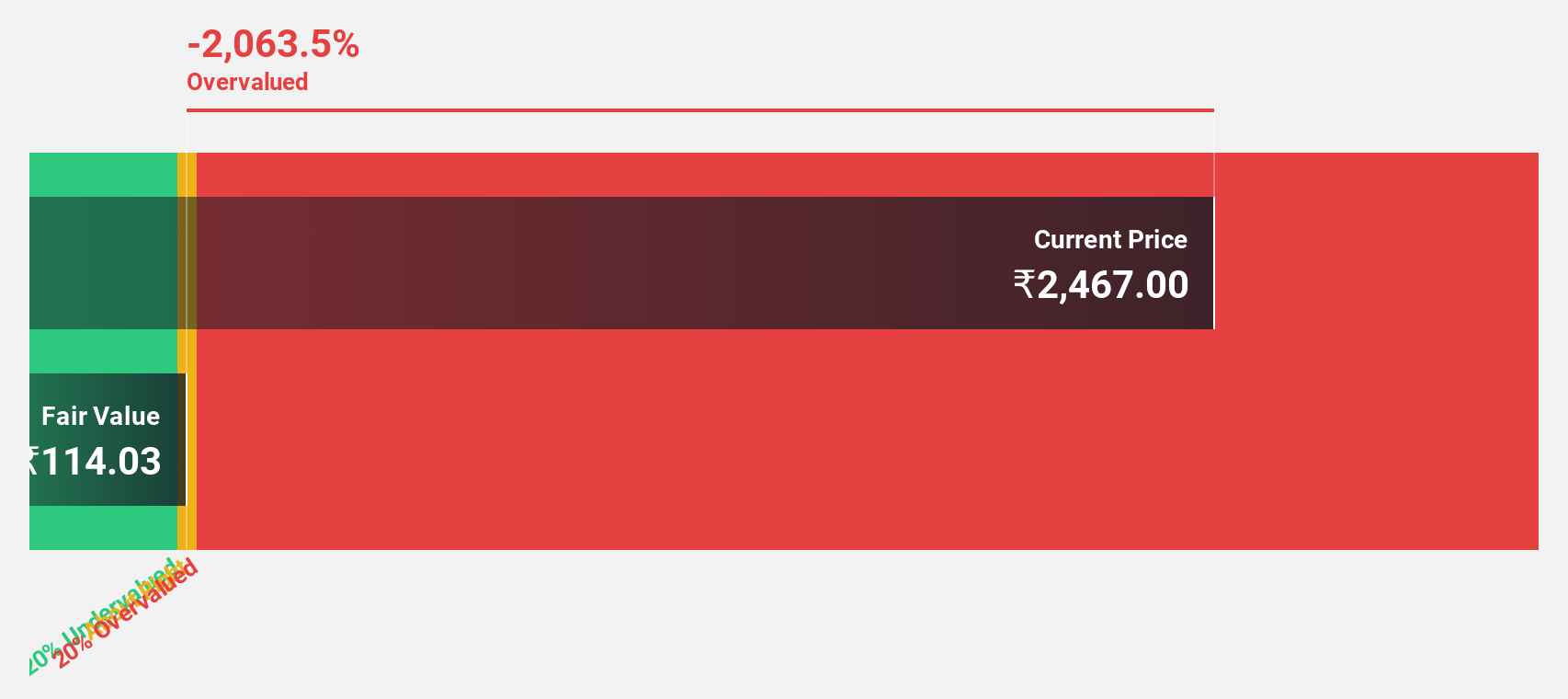

Estimated Discount To Fair Value: 39.2%

Godrej Properties, valued at ₹3381.4, is significantly undervalued with a fair value estimate of ₹5564.57, indicating strong potential based on cash flow analysis. Despite concerns over debt coverage by operating cash flow and a modest forecasted Return on Equity of 14.4%, the company's earnings and revenue growth projections are robust at 36.22% and 31.7% annually respectively, outpacing the Indian market averages substantially. Recent acquisitions in Bengaluru and Pune underline aggressive expansion strategies, enhancing its future revenue streams estimated at billions in INR.

- In light of our recent growth report, it seems possible that Godrej Properties' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Godrej Properties' balance sheet health report.

Shyam Metalics and Energy (NSEI:SHYAMMETL)

Overview: Shyam Metalics and Energy Limited is an integrated metal company based in India, specializing in the production and sale of long steel products and ferro alloys, with a market capitalization of approximately ₹193.28 billion.

Operations: The company generates ₹131.95 billion from its iron and steel segment.

Estimated Discount To Fair Value: 32.4%

Shyam Metalics and Energy, priced at ₹694.25, is well below its estimated fair value of ₹1027.63, reflecting a significant undervaluation based on discounted cash flows. The company's earnings are projected to grow by 28.7% annually, outstripping the Indian market's average. Despite a dividend coverage issue with free cash flows only supporting 0.78%, recent strategic board appointments and consistent sales growth in key product segments like stainless steel and sponge iron suggest operational strengthening which could enhance future financial performance.

- Our comprehensive growth report raises the possibility that Shyam Metalics and Energy is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Shyam Metalics and Energy.

Next Steps

- Click through to start exploring the rest of the 17 Undervalued Indian Stocks Based On Cash Flows now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:DELHIVERY

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives