Revenues Not Telling The Story For Sharda Cropchem Limited (NSE:SHARDACROP) After Shares Rise 34%

Despite an already strong run, Sharda Cropchem Limited (NSE:SHARDACROP) shares have been powering on, with a gain of 34% in the last thirty days. The last 30 days bring the annual gain to a very sharp 94%.

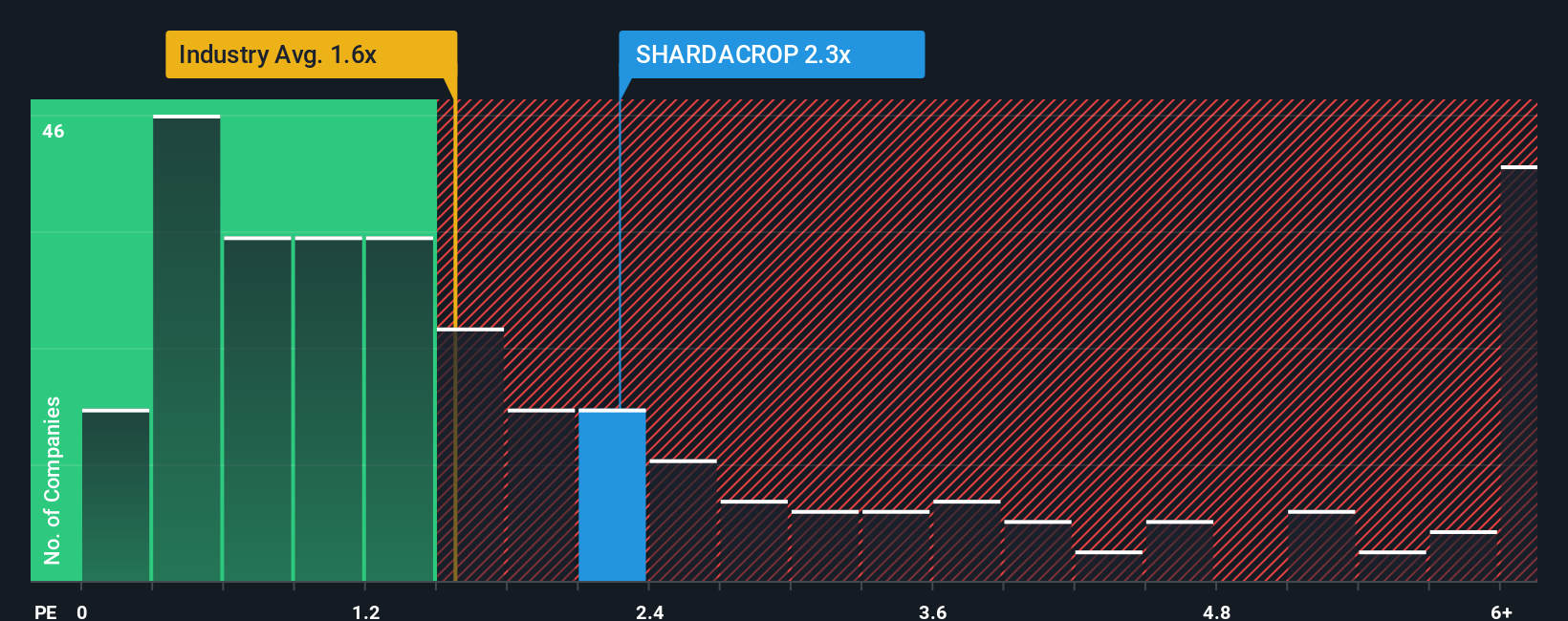

After such a large jump in price, given close to half the companies operating in India's Chemicals industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider Sharda Cropchem as a stock to potentially avoid with its 2.3x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Sharda Cropchem

How Has Sharda Cropchem Performed Recently?

With revenue growth that's superior to most other companies of late, Sharda Cropchem has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sharda Cropchem.How Is Sharda Cropchem's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Sharda Cropchem's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 37% gain to the company's top line. The latest three year period has also seen a 21% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 14% over the next year. That's shaping up to be similar to the 14% growth forecast for the broader industry.

With this information, we find it interesting that Sharda Cropchem is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Sharda Cropchem's P/S

Sharda Cropchem's P/S is on the rise since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Sharda Cropchem currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Sharda Cropchem (at least 1 which is a bit concerning), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Sharda Cropchem, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SHARDACROP

Sharda Cropchem

A crop protection chemical company, provides various formulations and generic active ingredients worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives