- India

- /

- Basic Materials

- /

- NSEI:SAURASHCEM

Even With A 26% Surge, Cautious Investors Are Not Rewarding Saurashtra Cement Limited's (NSE:SAURASHCEM) Performance Completely

Saurashtra Cement Limited (NSE:SAURASHCEM) shares have continued their recent momentum with a 26% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

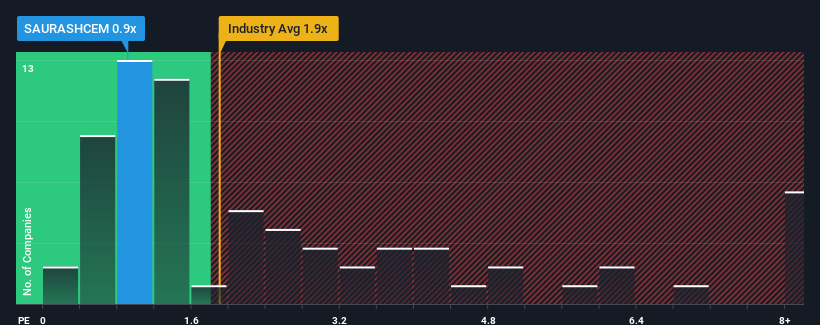

In spite of the firm bounce in price, Saurashtra Cement's price-to-sales (or "P/S") ratio of 0.9x might still make it look like a buy right now compared to the Basic Materials industry in India, where around half of the companies have P/S ratios above 1.9x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Saurashtra Cement

How Has Saurashtra Cement Performed Recently?

Saurashtra Cement has been doing a decent job lately as it's been growing revenue at a reasonable pace. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for Saurashtra Cement, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Saurashtra Cement?

In order to justify its P/S ratio, Saurashtra Cement would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.3%. The latest three year period has also seen an excellent 162% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 14% shows it's a great look while it lasts.

With this information, we find it very odd that Saurashtra Cement is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What We Can Learn From Saurashtra Cement's P/S?

Saurashtra Cement's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Upon analysing the past data, we see it is unexpected that Saurashtra Cement is currently trading at a lower P/S than the rest of the industry given that its revenue growth in the past three-year years is exceeding expectations in a challenging industry. We think potential risks might be placing significant pressure on the P/S ratio and share price. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors think future revenue could see a lot of volatility.

You need to take note of risks, for example - Saurashtra Cement has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SAURASHCEM

Saurashtra Cement

Engages in the manufacture and sale of cement and paints in India and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives