Sadhana Nitro Chem Limited's (NSE:SADHNANIQ) 27% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

The Sadhana Nitro Chem Limited (NSE:SADHNANIQ) share price has fared very poorly over the last month, falling by a substantial 27%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 59% loss during that time.

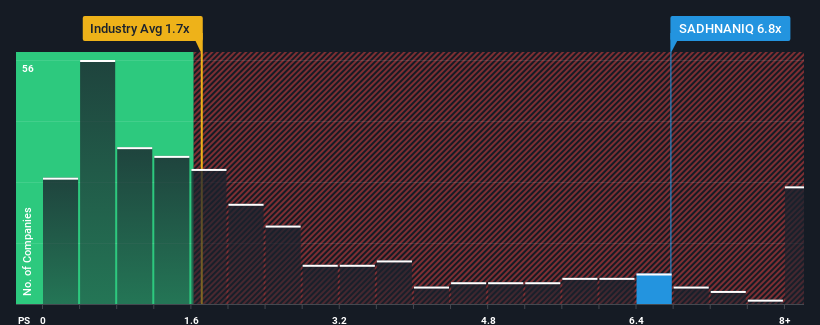

In spite of the heavy fall in price, you could still be forgiven for thinking Sadhana Nitro Chem is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6.8x, considering almost half the companies in India's Chemicals industry have P/S ratios below 1.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Sadhana Nitro Chem

How Sadhana Nitro Chem Has Been Performing

Sadhana Nitro Chem has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Sadhana Nitro Chem will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Sadhana Nitro Chem?

Sadhana Nitro Chem's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. The latest three year period has also seen an excellent 49% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

It's interesting to note that the rest of the industry is similarly expected to grow by 16% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's curious that Sadhana Nitro Chem's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

What We Can Learn From Sadhana Nitro Chem's P/S?

A significant share price dive has done very little to deflate Sadhana Nitro Chem's very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Sadhana Nitro Chem has shown that it currently trades on a higher than expected P/S since its recent three-year growth is only in line with the wider industry forecast. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. Unless there is a significant improvement in the company's medium-term trends, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Plus, you should also learn about these 7 warning signs we've spotted with Sadhana Nitro Chem (including 4 which shouldn't be ignored).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SADHNANIQ

Sadhana Nitro Chem

Engages in the manufacture and sale of chemical intermediates, organic chemicals, and performance chemicals in India and internationally.

Medium-low with proven track record.

Market Insights

Community Narratives