Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Rajshree Polypack Limited (NSE:RPPL) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Rajshree Polypack

How Much Debt Does Rajshree Polypack Carry?

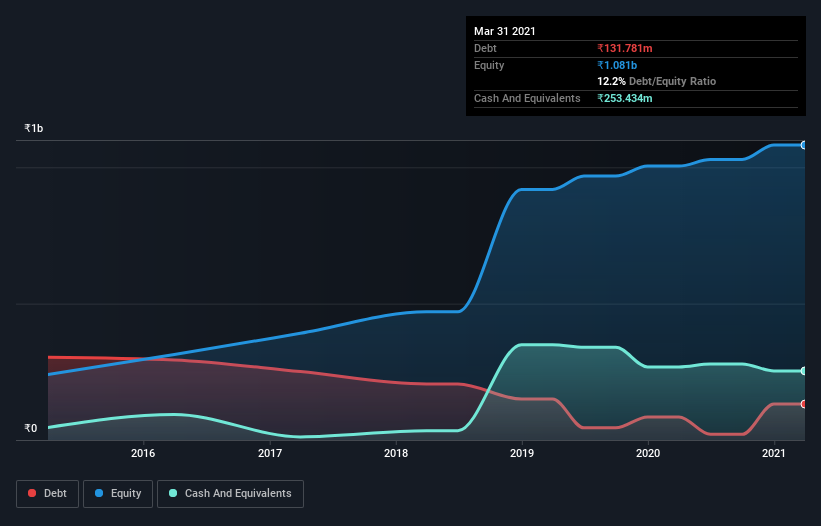

As you can see below, at the end of March 2021, Rajshree Polypack had ₹131.8m of debt, up from ₹84.6m a year ago. Click the image for more detail. However, it does have ₹253.4m in cash offsetting this, leading to net cash of ₹121.7m.

How Strong Is Rajshree Polypack's Balance Sheet?

The latest balance sheet data shows that Rajshree Polypack had liabilities of ₹526.2m due within a year, and liabilities of ₹54.1m falling due after that. Offsetting these obligations, it had cash of ₹253.4m as well as receivables valued at ₹338.4m due within 12 months. So its total liabilities are just about perfectly matched by its shorter-term, liquid assets.

Having regard to Rajshree Polypack's size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the ₹1.81b company is short on cash, but still worth keeping an eye on the balance sheet. Succinctly put, Rajshree Polypack boasts net cash, so it's fair to say it does not have a heavy debt load!

On the other hand, Rajshree Polypack saw its EBIT drop by 4.1% in the last twelve months. That sort of decline, if sustained, will obviously make debt harder to handle. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Rajshree Polypack will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Rajshree Polypack may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Rajshree Polypack saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Rajshree Polypack has net cash of ₹121.7m, as well as more liquid assets than liabilities. So we are not troubled with Rajshree Polypack's debt use. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 4 warning signs with Rajshree Polypack (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Rajshree Polypack, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:RPPL

Rajshree Polypack

Manufactures and sells rigid plastic sheets and thermoformed packaging products in India and internationally.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives