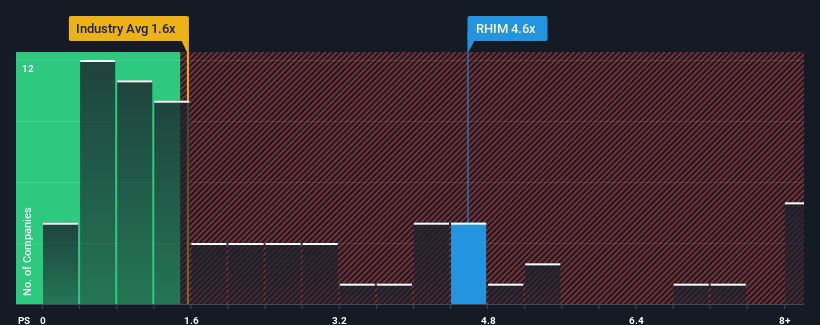

When you see that almost half of the companies in the Basic Materials industry in India have price-to-sales ratios (or "P/S") below 1.6x, RHI Magnesita India Limited (NSE:RHIM) looks to be giving off strong sell signals with its 4.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for RHI Magnesita India

What Does RHI Magnesita India's P/S Mean For Shareholders?

RHI Magnesita India certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on RHI Magnesita India.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, RHI Magnesita India would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 47% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 31% as estimated by the three analysts watching the company. Meanwhile, the broader industry is forecast to contract by 8.4%, which would indicate the company is doing very well.

With this information, we can see why RHI Magnesita India is trading at such a high P/S compared to the industry. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of RHI Magnesita India's analyst forecasts revealed that its superior revenue outlook against a shaky industry is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenue is remote enough to justify paying a premium in the form of a high P/S. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Assuming the company's outlook remains unchanged, the share price is likely to be supported by prospective buyers.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with RHI Magnesita India, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RHIM

RHI Magnesita India

Engages in the manufacture and trading of refractories, monolithics, bricks, and ceramic paper in India and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives